Answered step by step

Verified Expert Solution

Question

1 Approved Answer

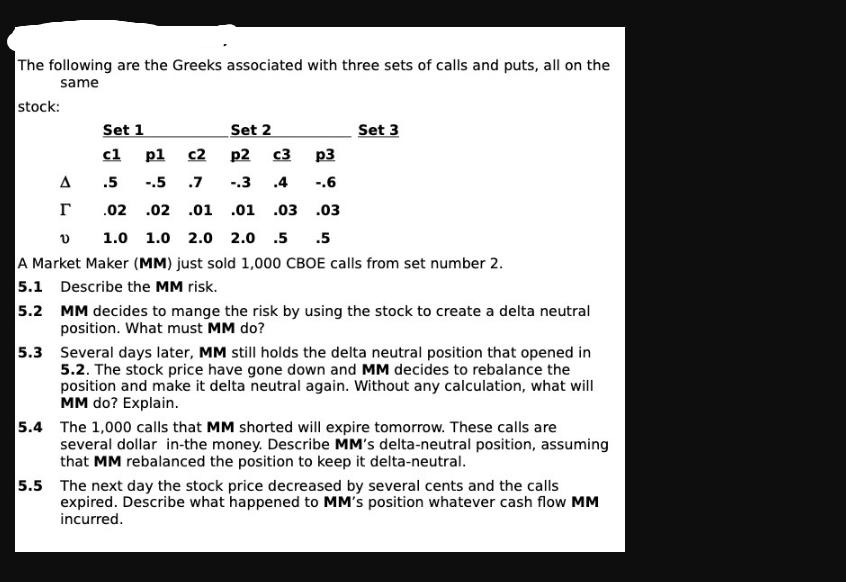

The following are the Greeks associated with three sets of calls and puts, all on the same stock: Set 3 Set 1 Set 2

The following are the Greeks associated with three sets of calls and puts, all on the same stock: Set 3 Set 1 Set 2 c1 p1 c2 p2 c3 p3 A .5 -.5 .7 -.3 .4 -.6 r .02 .02 .01 .01 .03 .03 0 1.0 1.0 2.0 2.0 .5 .5 A Market Maker (MM) just sold 1,000 CBOE calls from set number 2. 5.1 Describe the MM risk. 5.2 5.3 MM decides to mange the risk by using the stock to create a delta neutral position. What must MM do? Several days later, MM still holds the delta neutral position that opened in 5.2. The stock price have gone down and MM decides to rebalance the position and make it delta neutral again. Without any calculation, what will MM do? Explain. 5.4 The 1,000 calls that MM shorted will expire tomorrow. These calls are several dollar in-the money. Describe MM's delta-neutral position, assuming that MM rebalanced the position to keep it delta-neutral. 5.5 The next day the stock price decreased by several cents and the calls expired. Describe what happened to MM's position whatever cash flow MM incurred.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

51 Describe the MM risk The MMs risk arises from being short 1000 CBOE calls from set number 2 The risk is primarily associated with the price movement of the underlying stock and the potential for si...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started