Answered step by step

Verified Expert Solution

Question

1 Approved Answer

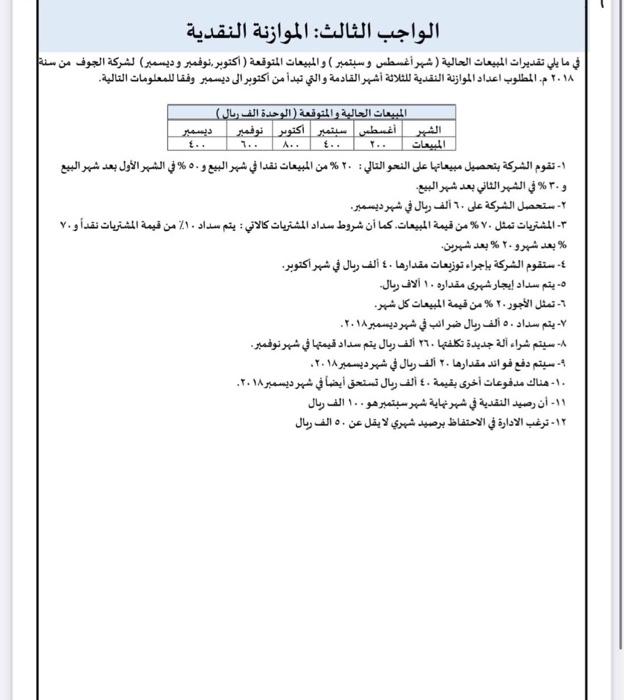

The following are the sales estimates for August and September The expected sales are October, November and December for Gibran Company from the year 2018

The following are the sales estimates for August and September

The expected sales are October, November and December for Gibran Company from the year 2018

Required: Prepare the cash budget for the next three months, which start from October to December, as shown in the following table:

Current and projected sales

Month:

August | 200

September 400

| October 800

| November 600

| December 400

1- The company collects its sales on the following converter 20% of sales in cash in the month of sale, 50% in the first month after the month of sale, and 30% in the second month after the month of sale

2- The company will receive $ 60,000 in the month of September.

3- Purchases represent 70% of the sales value

Also, the terms of payment of purchases are as follows: 10% of the value of purchases shall be paid in cash, 70% after a month, and 20% after two months.

4- The company will distribute 40,000 in the month of October

5- A monthly rent is paid in the amount of 10,000

6- Wages represent 20% of the value of sales every month.

7- 50,000 taxes are paid in the month of December 2018

8- A new machine will be purchased at a cost of 260,000, and its value will be paid in November

9-An interest amounting to 20,000 will be paid in December 2018

10-Another 40,000 payments are due in December

11- The cash balance at the end of September is 100,000

12- The administration wishes to maintain a monthly balance of not less than 50,000

sorry its in arabic but that is the sales prices

august: 200$

septemper: 400$

october: 800$

november:600$

december: 400$

number unit: in thousand

: ( ) ( ) . . ( ) 1- : % % % - 60 - % . : % % - 40 5- 10 - % - 50 - - - 40 11- - 50 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started