Answered step by step

Verified Expert Solution

Question

1 Approved Answer

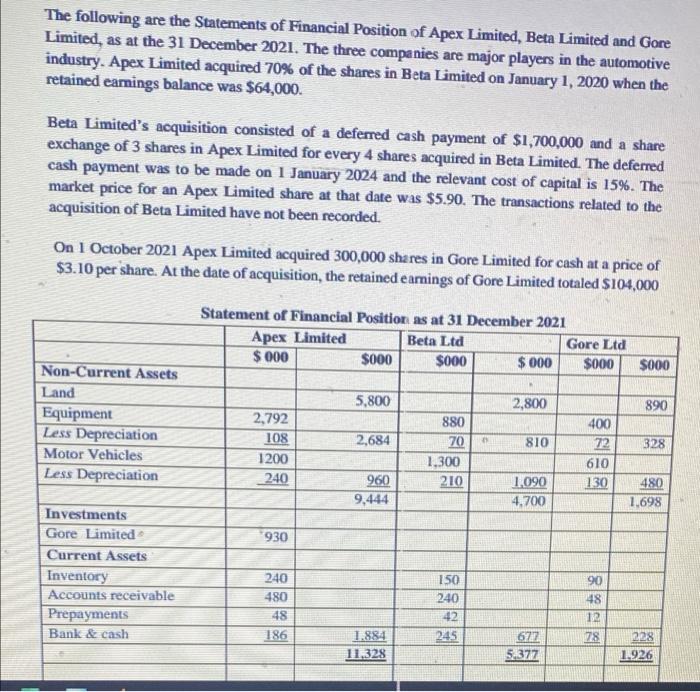

The following are the Statements of Financial Position of Apex Limited, Beta Limited and Gore Limited, as at the 31 December 2021. The three

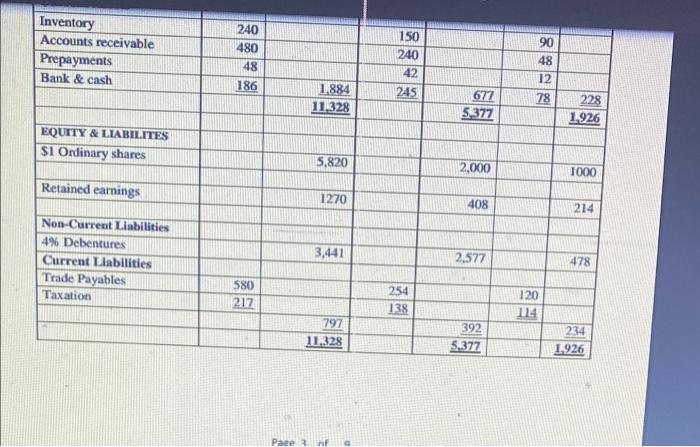

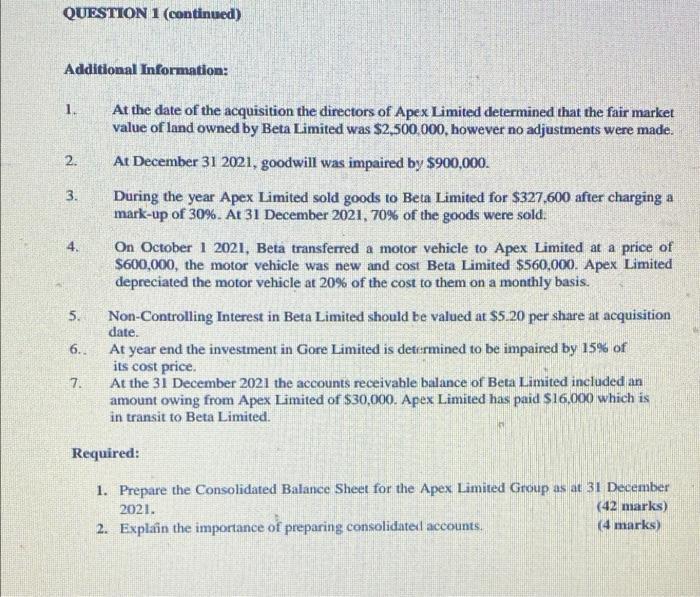

The following are the Statements of Financial Position of Apex Limited, Beta Limited and Gore Limited, as at the 31 December 2021. The three companies are major players in the automotive industry. Apex Limited acquired 70% of the shares in Beta Limited on January 1, 2020 when the retained earnings balance was $64,000. Beta Limited's acquisition consisted of a deferred cash payment of $1,700,000 and a share exchange of 3 shares in Apex Limited for every 4 shares acquired in Beta Limited. The deferred cash payment was to be made on 1 January 2024 and the relevant cost of capital is 15%. The market price for an Apex Limited share at that date was $5.90. The transactions related to the acquisition of Beta Limited have not been recorded. On 1 October 2021 Apex Limited acquired 300,000 shares in Gore Limited for cash at a price of $3.10 per share. At the date of acquisition, the retained earnings of Gore Limited totaled $104,000 Non-Current Assets Land Equipment Less Depreciation Motor Vehicles Less Depreciation Investments Gore Limited Current Assets Inventory Accounts receivable Prepayments Bank & cash Statement of Financial Position as at 31 December 2021 Apex Limited Beta Ltd $000 $000 2,792 108 1200 240 930 240 480 48 186 $000 5,800 2,684 960 9,444 1,884 11,328 880 70 B 1,300 210 150 240 42 245 $000 2,800 810 1,090 4,700 677 5.377 Gore Ltd $000 400 72 610 130 90 48 12 78 $000 890 328 480 1,698 228 1.926 Inventory Accounts receivable Prepayments Bank & cash EQUITY & LIABILITES $1 Ordinary shares Retained earnings Non-Current Liabilities 4% Debentures Current Liabilities Trade Payables Taxation 240 480 48 186 580 217 Page 1,884 11,328 5,820 1270 3,441 797 11,328 150 240 42 245 254 138 677 5.377 2,000 408 2,577 392 5.377 90 48 12 78 120 114 228 1.926 1000 214 478 234 1.926 QUESTION 1 (continued) Additional Information: 1. 2. 3. 5. 6.. 7. At the date of the acquisition the directors of Apex Limited determined that the fair market value of land owned by Beta Limited was $2,500,000, however no adjustments were made. At December 31 2021, goodwill was impaired by $900,000. During the year Apex Limited sold goods to Beta Limited for $327,600 after charging a mark-up of 30%. At 31 December 2021, 70% of the goods were sold. On October 1 2021, Beta transferred a motor vehicle to Apex Limited at a price of $600,000, the motor vehicle was new and cost Beta Limited $560,000. Apex Limited depreciated the motor vehicle at 20% of the cost to them on a monthly basis. Non-Controlling Interest in Beta Limited should be valued at $5.20 per share at acquisition date. At year end the investment in Gore Limited is determined to be impaired by 15% of its cost price. At the 31 December 2021 the accounts receivable balance of Beta Limited included an amount owing from Apex Limited of $30,000. Apex Limited has paid $16,000 which is in transit to Beta Limited. Required: 1. Prepare the Consolidated Balance Sheet for the Apex Limited Group as at 31 December 2021. (42 marks) 2. Explain the importance of preparing consolidated accounts. (4 marks)

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Prepare the Consolidated balance shee for Apex limit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started