Question

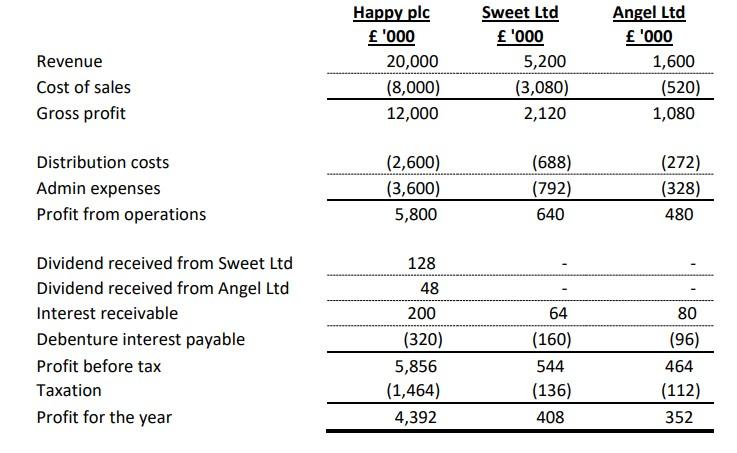

The following are the summarised income statements of three companies, Happy plc, Sweet Ltd, and Angel Ltd for the financial year ended 31 December 2021:

The following are the summarised income statements of three companies, Happy plc, Sweet Ltd, and Angel Ltd for the financial year ended 31 December 2021:

Additional information:

(i) On 1 August 2018 Happy plc purchased 1,200,000 ordinary shares in Sweet Ltd. At that date Sweet Ltd had in issue a total of 1,600,000 ordinary shares. Each ordinary share in Sweet Ltd carries one vote and there are no voting rights other than those attached to the ordinary shares. Sweet Ltd has not issued any ordinary shares since this date. The purchase was funded through Happy plc issuing 1 ordinary share for every 5 shares acquired in Sweet Ltd. On 1 August 2018 the fair value of 1 share in Happy plc was 15.00. Shares in Happy plc and Sweet Ltd have a nominal value of 1.

(ii) At the date of acquisition, Sweet Ltd had retained earnings of 480,000, a share premium account of 800,000, and the fair value of non-current assets in Sweet Ltd was 720,000 more than book value. Non-current assets in Sweet Ltd have since been adjusted to reflect this. Sweet Ltd has not re-valued any non-current assets since this date. All shares in Sweet Ltd were originally issued at their nominal value of 1.

(iii) During the year, Happy plc had sold goods to Sweet Ltd for 800,000. These had been marked up by 25%. On 31 December 2021, Sweet Ltd still had 20% of these goods in closing inventory.

(iv) During the year Happy plc paid dividends of 1,600,000.

(v) Sweet Ltd has in issue 2,000,000 8% debentures. Happy plc owns 15% of these debentures.

(vi) Happy plc has held an investment of 40% of the equity shares in Angel Ltd for several years. No fair value adjustments were required on the acquisition of these shares. At the date of acquisition Angel Ltd had retained earnings of 640,000.

(vii) Retained earnings at 1 January 2021 were: Happy plc - 7,600,000 Sweet Ltd - 1,600,000 Angel Ltd - 1,440,000

(viii) A review on 31 December 2021 established that for the current reporting year, goodwill in the investment in Sweet Ltd should be written off at 15% on the original amount. There was no impairment of goodwill for previous years.

Required

(a) Calculate the goodwill arising on the acquisition of Sweet Ltd at 1 August 2018.

(b) Prepare a consolidated income statement for the year ended 31 December 2021. Your answer should distinguish between profit for the year attributable to the non-controlling interest and that attributable to the group.

(c) Calculate consolidated retained earnings for the year ended 31 December 2021.

(d) Calculate the amount of the non-controlling interest that would appear in the consolidated statement of financial position at 31 December 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started