Question

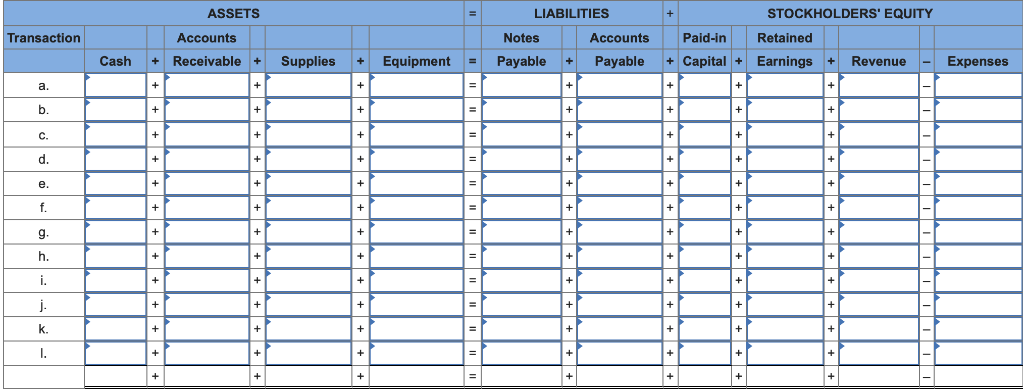

The following are the transactions relating to the formation of Cardinal Mowing Services, Inc., and its first month of operations. a. The firm was organized

| The following are the transactions relating to the formation of Cardinal Mowing Services, Inc., and its first month of operations. |

| a. | The firm was organized and the initial stockholders invested cash of $600. |

| b. | The company borrowed $900 from a relative of one of the initial stockholders; a short-term note was signed. |

| c. | Two zero-turn lawn mowers costing $480 each and a professional trimmer costing $130 were purchased for cash. The original list price of each mower was $610, but a discount was received because the seller was having a sale. |

| d. | Gasoline, oil, and several packages of trash bags were purchased for cash of $90. |

| e. | Advertising flyers announcing the formation of the business and a newspaper ad were purchased. The cost of these items, $170, will be paid in 30 days. |

| f. | During the first two weeks of operations, 47 lawns were mowed. The total revenue for this work was $705; $465 was collected in cash, and the balance will be received within 30 days. |

| g. | Employees were paid $420 for their work during the first two weeks. |

| h. | Additional gasoline, oil, and trash bags costing $110 were purchased for cash. |

| i. | In the last two weeks of the first month, revenues totaled $920, of which $375 was collected. |

| j. | `Employee wages for the last two weeks totaled $510; these will be paid during the first week of the next month. |

| k. | It was determined that at the end of the month the cost of the gasoline, oil, and trash bags still on hand was $30. |

| l. | Customers paid a total of $150 due from mowing services provided during the first two weeks. The revenue for these services was recognized in transaction f. |

| Required: |

| a. | Record each transaction in the appropriate columns. (Enter decreases to account balances as a negative.) |

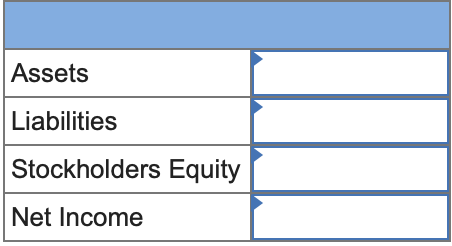

| b. | Calculate the total assets, liabilities, and stockholders equity at the end of the month and calculate the amount of net income for the month. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started