Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following are transactions of Albert Sing, an interior design consultant, for the month of September 2023 Sept. 1-Albert Sing began business as an interior

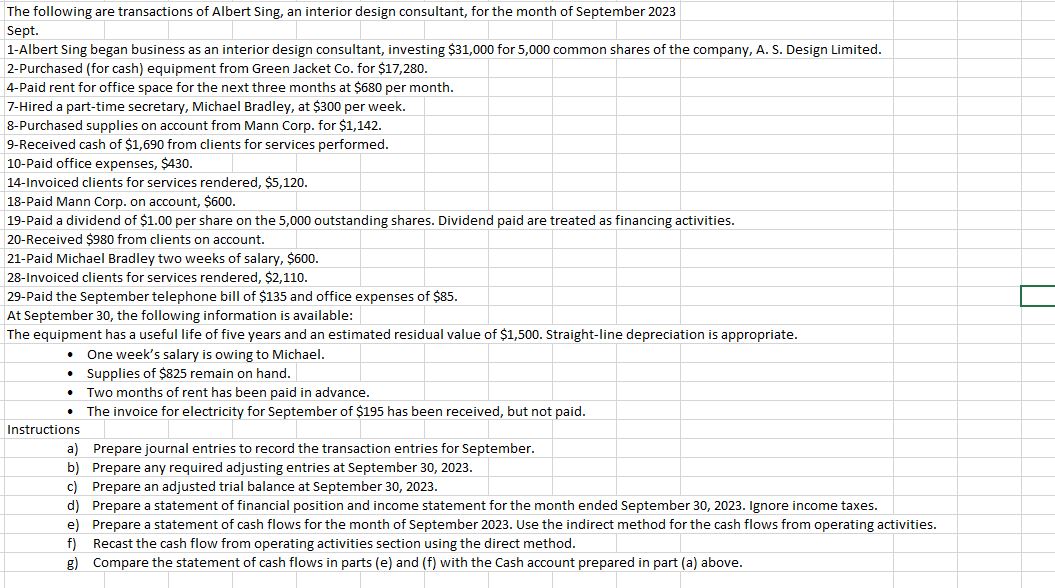

The following are transactions of Albert Sing, an interior design consultant, for the month of September 2023 Sept. 1-Albert Sing began business as an interior design consultant, investing $31,000 for 5,000 common shares of the company, A. S. Design Limited. 2-Purchased (for cash) equipment from Green Jacket Co. for $17,280. 4-Paid rent for office space for the next three months at $680 per month. 7-Hired a part-time secretary, Michael Bradley, at $300 per week. 8-Purchased supplies on account from Mann Corp. for $1,142. 9-Received cash of $1,690 from clients for services performed. 10 -Paid office expenses, $430. 14 Invoiced clients for services rendered, $5,120. 18-Paid Mann Corp. on account, $600. 19 -Paid a dividend of $1.00 per share on the 5,000 outstanding shares. Dividend paid are treated as financing activities. 20-Received \$980 from clients on account. 21-Paid Michael Bradley two weeks of salary, $600. 28-Invoiced clients for services rendered, $2,110. 29 -Paid the September telephone bill of $135 and office expenses of $85. At September 30, the following information is available: The equipment has a useful life of five years and an estimated residual value of $1,500. Straight-line depreciation is appropriate. - One week's salary is owing to Michael. - Supplies of $825 remain on hand. - Two months of rent has been paid in advance. - The invoice for electricity for September of $195 has been received, but not paid. Instructions a) Prepare journal entries to record the transaction entries for September. b) Prepare any required adjusting entries at September 30, 2023. c) Prepare an adjusted trial balance at September 30,2023. d) Prepare a statement of financial position and income statement for the month ended September 30, 2023. Ignore income taxes. e) Prepare a statement of cash flows for the month of September 2023. Use the indirect method for the cash flows from operating activities. f) Recast the cash flow from operating activities section using the direct method. g) Compare the statement of cash flows in parts (e) and (f) with the Cash account prepared in part (a) above

The following are transactions of Albert Sing, an interior design consultant, for the month of September 2023 Sept. 1-Albert Sing began business as an interior design consultant, investing $31,000 for 5,000 common shares of the company, A. S. Design Limited. 2-Purchased (for cash) equipment from Green Jacket Co. for $17,280. 4-Paid rent for office space for the next three months at $680 per month. 7-Hired a part-time secretary, Michael Bradley, at $300 per week. 8-Purchased supplies on account from Mann Corp. for $1,142. 9-Received cash of $1,690 from clients for services performed. 10 -Paid office expenses, $430. 14 Invoiced clients for services rendered, $5,120. 18-Paid Mann Corp. on account, $600. 19 -Paid a dividend of $1.00 per share on the 5,000 outstanding shares. Dividend paid are treated as financing activities. 20-Received \$980 from clients on account. 21-Paid Michael Bradley two weeks of salary, $600. 28-Invoiced clients for services rendered, $2,110. 29 -Paid the September telephone bill of $135 and office expenses of $85. At September 30, the following information is available: The equipment has a useful life of five years and an estimated residual value of $1,500. Straight-line depreciation is appropriate. - One week's salary is owing to Michael. - Supplies of $825 remain on hand. - Two months of rent has been paid in advance. - The invoice for electricity for September of $195 has been received, but not paid. Instructions a) Prepare journal entries to record the transaction entries for September. b) Prepare any required adjusting entries at September 30, 2023. c) Prepare an adjusted trial balance at September 30,2023. d) Prepare a statement of financial position and income statement for the month ended September 30, 2023. Ignore income taxes. e) Prepare a statement of cash flows for the month of September 2023. Use the indirect method for the cash flows from operating activities. f) Recast the cash flow from operating activities section using the direct method. g) Compare the statement of cash flows in parts (e) and (f) with the Cash account prepared in part (a) above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started