Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following are transactions pertaining to KFM furniture for the month of June 2020 . June 1 Kamal commenced business as a furniture dealer by

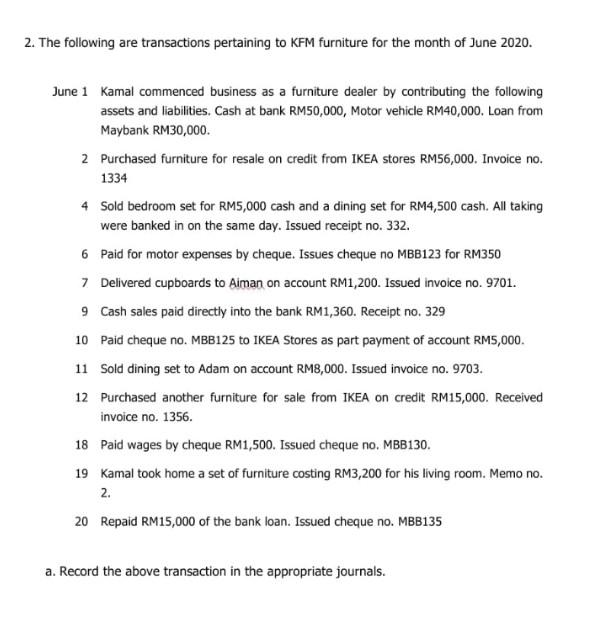

The following are transactions pertaining to KFM furniture for the month of June 2020 . June 1 Kamal commenced business as a furniture dealer by contributing the following assets and liabilities. Cash at bank RM50,000, Motor vehicle RM40,000. Loan from Maybank RM30,000. 2 Purchased furniture for resale on credit from IKEA stores RM56,000. Invoice no. 1334 4 Sold bedroom set for RM5,000 cash and a dining set for RM4,500 cash. All taking were banked in on the same day. Issued receipt no. 332. 6 Paid for motor expenses by cheque. Issues cheque no MBB123 for RM350 7 Delivered cupboards to Aiman on account RM1,200. Issued invoice no. 9701. 9 Cash sales paid directly into the bank RM1,360. Receipt no. 329 10 Paid cheque no. MBB125 to IKEA Stores as part payment of account RM5,000. 11 Sold dining set to Adam on account RM8,000. Issued invoice no. 9703. 12 Purchased another furniture for sale from IKEA on credit RM15,000. Received invoice no. 1356. 18 Paid wages by cheque RM1,500. Issued cheque no, MBB130. 19 Kamal took home a set of furniture costing RM3,200 for his living room. Memo no. 2. 20 Repaid RM15,000 of the bank loan. Issued cheque no. MBB135 a. Record the above transaction in the appropriate journals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started