Answered step by step

Verified Expert Solution

Question

1 Approved Answer

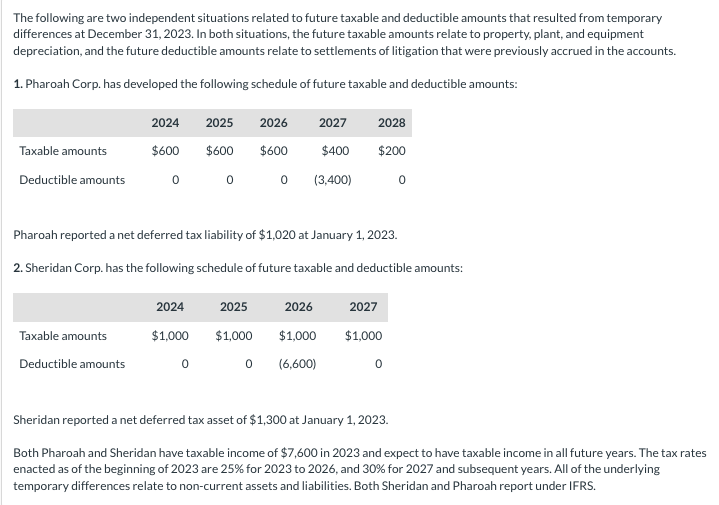

The following are two independent situations related to The following are two independent situations related to future taxable and deductible amounts that resulted from temporary

The following are two independent situations related to The following are two independent situations related to future taxable and deductible amounts that resulted from temporary

differences at December In both situations, the future taxable amounts relate to property, plant, and equipment

depreciation, and the future deductible amounts relate to settlements of litigation that were previously accrued in the accounts.

Pharoah Corp. has developed the following schedule of future taxable and deductible amounts:

Pharoah reported a net deferred tax liability of $ at January

Sheridan Corp. has the following schedule of future taxable and deductible amounts:

Sheridan reported a net deferred tax asset of $ at January

Both Pharoah and Sheridan have taxable income of $ in and expect to have taxable income in all future years. The tax rates

enacted as of the beginning of are for to and for and subsequent years. All of the underlying

temporary differences relate to noncurrent assets and liabilities. Both Sheridan and Pharoah report under IFRS.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started