Answered step by step

Verified Expert Solution

Question

1 Approved Answer

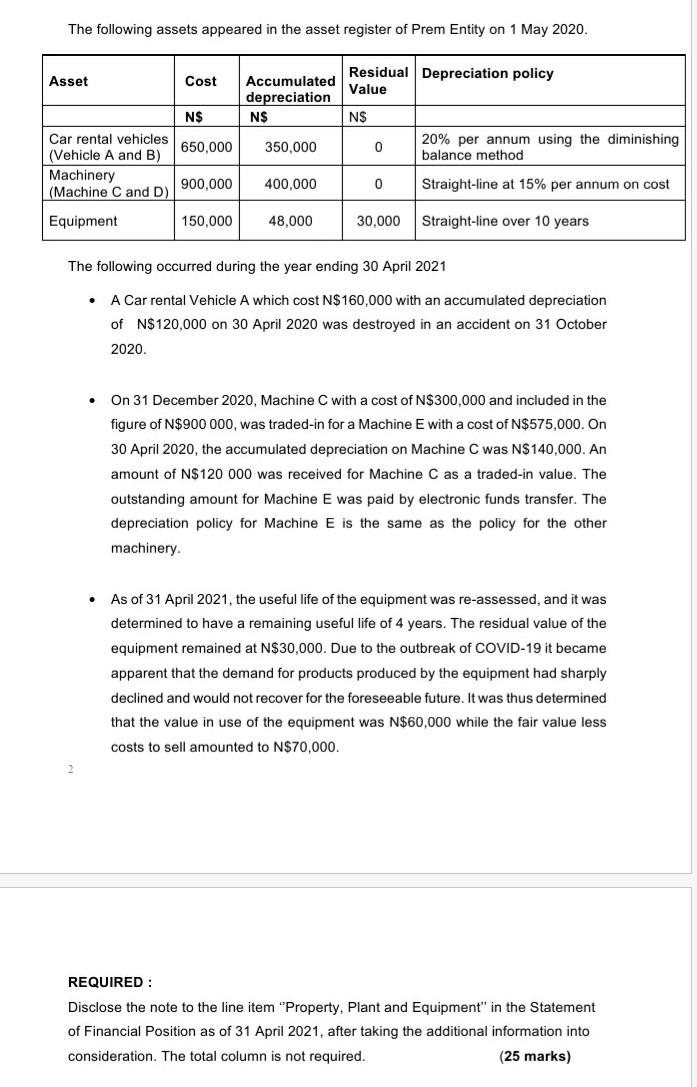

The following assets appeared in the asset register of Prem Entity on 1 May 2020. Asset Cost Residual Depreciation policy Value Accumulated depreciation N$ NS

The following assets appeared in the asset register of Prem Entity on 1 May 2020. Asset Cost Residual Depreciation policy Value Accumulated depreciation N$ NS NS 650,000 350.000 0 20% per annum using the diminishing balance method Car rental vehicles (Vehicle A and B) Machinery (Machine C and D) 900,000 400,000 0 Straight-line at 15% per annum on cost Equipment 150,000 48,000 30,000 Straight-line over 10 years The following occurred during the year ending 30 April 2021 . A Car rental Vehicle A which cost N$160,000 with an accumulated depreciation of N$120,000 on 30 April 2020 was destroyed in an accident on 31 October 2020. On 31 December 2020, Machine C with a cost of N$300,000 and included in the figure of N$900 000, was traded-in for a Machine E with a cost of N$575,000. On 30 April 2020, the accumulated depreciation on Machine C was N$ 140,000. An amount of N$120 000 was received for Machine C as a traded-in value. The outstanding amount for Machine E was paid by electronic funds transfer. The depreciation policy for Machine E is the same as the policy for the other machinery . As of 31 April 2021, the useful life of the equipment was re-assessed, and it was determined to have a remaining useful life of 4 years. The residual value of the equipment remained at N$30,000. Due to the outbreak of COVID-19 it became apparent that the demand for products produced by the equipment had sharply declined and would not recover for the foreseeable future. It was thus determined that the value in use of the equipment was N$60,000 while the fair value less costs to sell amounted to N$70,000. REQUIRED: Disclose the note to the line item "Property, Plant and Equipment" in the Statement of Financial Position as of 31 April 2021, after taking the additional information into consideration. The total column is not required. (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started