Answered step by step

Verified Expert Solution

Question

1 Approved Answer

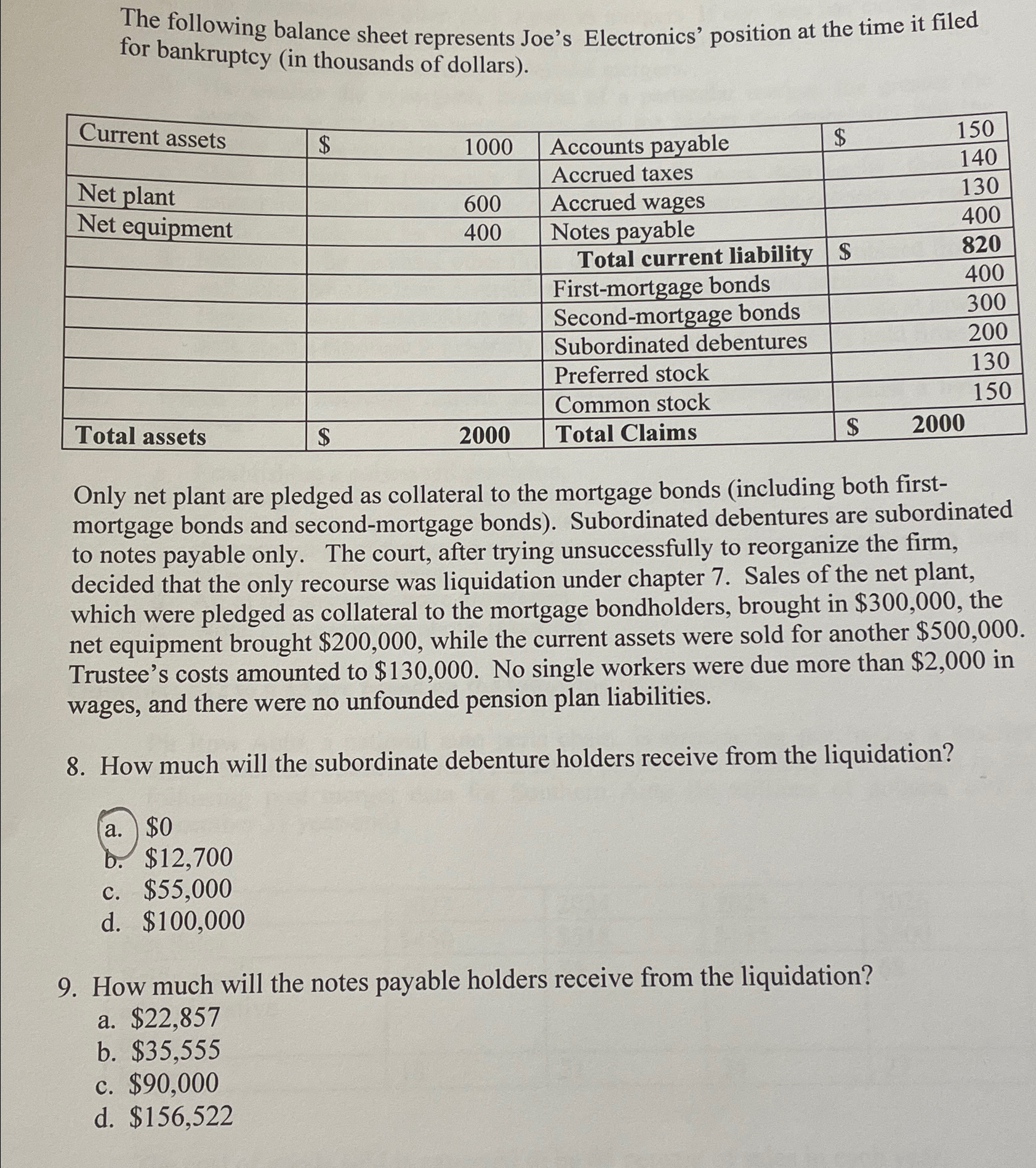

The following balance sheet represents Joe's Electronics' position at the time it filed for bankruptcy ( in thousands of dollars ) . table [

The following balance sheet represents Joe's Electronics' position at the time it filed for bankruptcy in thousands of dollars

tableCurrent assets,$Accounts payable,$tableAccounts payaoleAccrued taxesNet plant,,Accrued wages,,Net equipment,,Notes payable,,Total current liability,$Firstmortgage bonds,,Secondmortgage bonds,,Subordinated debentures,,Preferred stock,,Common stock,,Total assets,$Total Claims,$

Only net plant are pledged as collateral to the mortgage bonds including both firstmortgage bonds and secondmortgage bonds Subordinated debentures are subordinated to notes payable only. The court, after trying unsuccessfully to reorganize the firm, decided that the only recourse was liquidation under chapter Sales of the net plant, which were pledged as collateral to the mortgage bondholders, brought in $ the net equipment brought $ while the current assets were sold for another $ Trustee's costs amounted to $ No single workers were due more than $ in wages, and there were no unfounded pension plan liabilities.

How much will the subordinate debenture holders receive from the liquidation?

a $

b $

c $

d $

How much will the notes payable holders receive from the liquidation?

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started