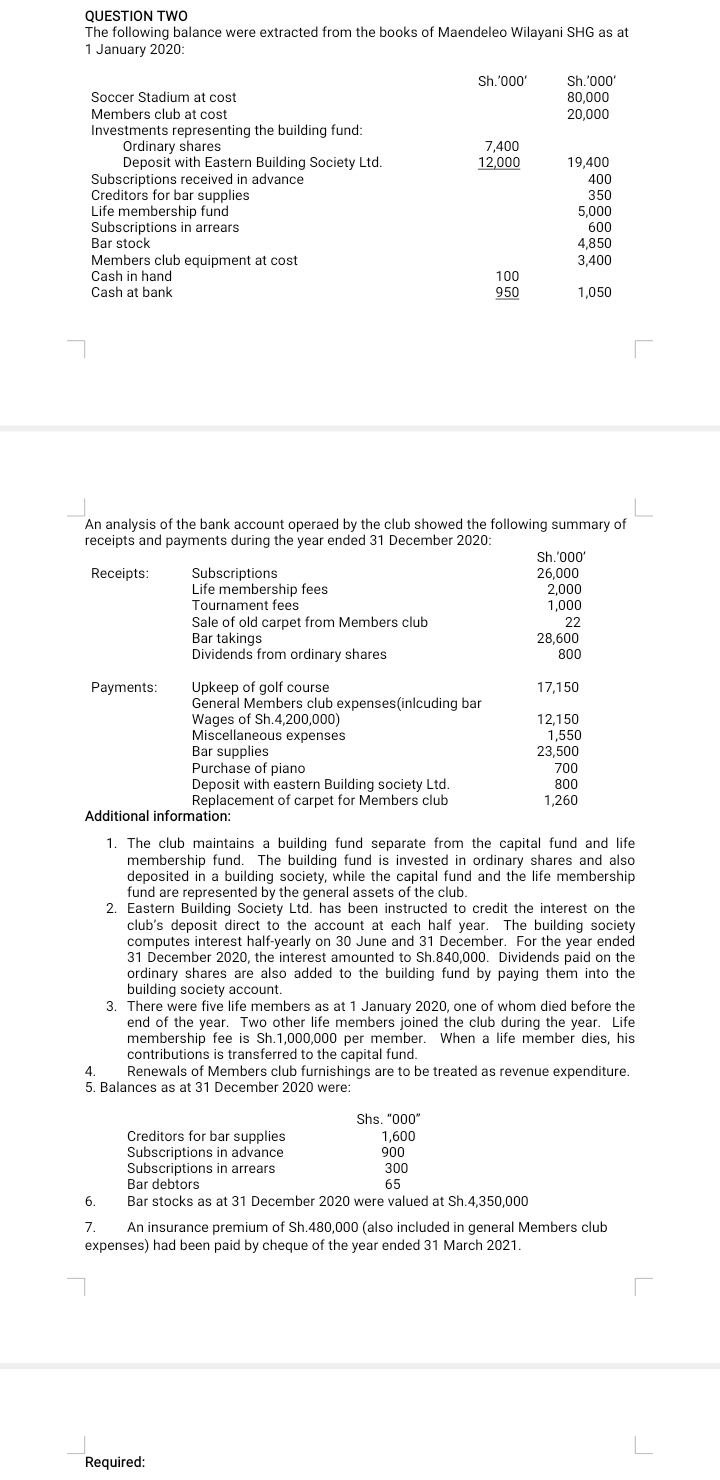

- The following balance were extracted from the books of Maendeleo Wilayani SHG as at 1 January 2020:

Required

Determine

(a)Income and expenditure account for the year ended 31 |December 2020.(10 marks)

(b)Statement of financial position as at 31 December 2020. (10 marks)

_| J QUESTION TWO The following balance were extracted from the books of Maendeleo Wilayani SHG as at 1 January 2020: Sh.'DDD' Sh.'DDD' Soccer Stadium at cost 80000 Members club at cost 20.000 Investments representing the building fund: Ordinary shares 2,400 Deposit with Eastern Building Society Ltd. 12 000 19.400 Subscriptions received in advance 400 Creditors for bar supplies 350 Life membership fund 5.000 Subscriptions in arrears 500 Bar stock 4.350 Members club equipment at cost 3,400 Cash in hand 100 Cash at bank m 1,050 An analysis of the bank account operaed by the club showed the following summary of receipts and payments during the year ended 31 December 2020: Sh.'DDD' Receipts: Subscriptions 26.000 Life membership fees 2,0 00 Toumament fees 1,000 Sale of old carpet from Members club 22 Bar takings 23.600 Dividends from ordinary shares 800 Payments: Upkeep of golf course 12,150 General Members club expensesnlcuding bar Wages of $14,200,000} 12.150 Miscellaneous expenses 1550 Bar supplies 23.500 Purchase of piano 2'00 Deposit with eastern Building society Ltd. 300 Rep lacem ent of carpet for Mem bers club 1,260 Additional information: 4 1. The club maintains a building fund separate from the capital fund and life membership fund. The building fund is invested in ordinary shares and also deposited in a building society, while the capital fund and the life membership fund are represented by the general assets of the club. . Eastern Building Society Ltd. has been instructed to credit the interest on the club's deposit direct to the account at each half year. The building society computes interest half-yearly on 30 June and 31 December. For the year ended 31 December 2020, the interest amounted to Sh.340,000. Dividends paid on the ordinary shares are also added to the building fund by paying them into the building society account. . There were five life members as at 1 January 2020, one of whom died before the end of the year. Two other life members joined the club during the year. Life membership fee is Sh.1,000,000 per member. when a life member dies, his contributions is transferred to the capital fund Renewals of Members club furnishings are to be treated as revenue expenditure 5. Balances as at 31 December 2020 were: 6. TI" Shs. \"000' Creditors for bar supplies 1,600 Subscriptions in advance 900 Subscriptions in arrears 300 Bar debtors 65 Bar stocks as at 31 December 2020 were valued at Sh.4.350,000 An insurance premium of Sh. 430 000 {also included in general Members club expenses} had been paid by cheque of the year ended 31 March 2021. Required