Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following balances appeared in the accounting records of Hunt Ltd for the year ended 31 December 2020: 2020 2019 Accounts receivable Allowance for

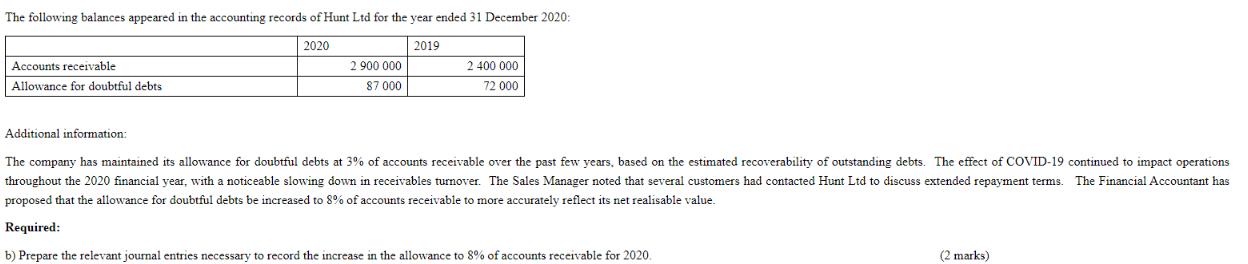

The following balances appeared in the accounting records of Hunt Ltd for the year ended 31 December 2020: 2020 2019 Accounts receivable Allowance for doubtful debts. 2 900 000 87 000 2 400 000 72 000 Additional information: The company has maintained its allowance for doubtful debts at 3% of accounts receivable over the past few years, based on the estimated recoverability of outstanding debts. The effect of COVID-19 continued to impact operations throughout the 2020 financial year, with a noticeable slowing down in receivables turnover. The Sales Manager noted that several customers had contacted Hunt Ltd to discuss extended repayment terms. The Financial Accountant has proposed that the allowance for doubtful debts be increased to 8% of accounts receivable to more accurately reflect its net realisable value. Required: b) Prepare the relevant journal entries necessary to record the increase in the allowance to 8% of accounts receivable for 2020. (2 marks)

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION The journal entry to record the increase in the allowance for doubtful debts to 8 of accounts receivable for 2020 would be Debit Bad Debt Exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started