Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Poppy Company uses a perpetual inventory system. It reported the following data related to beginning inventory and inventory purchases and sales for the month

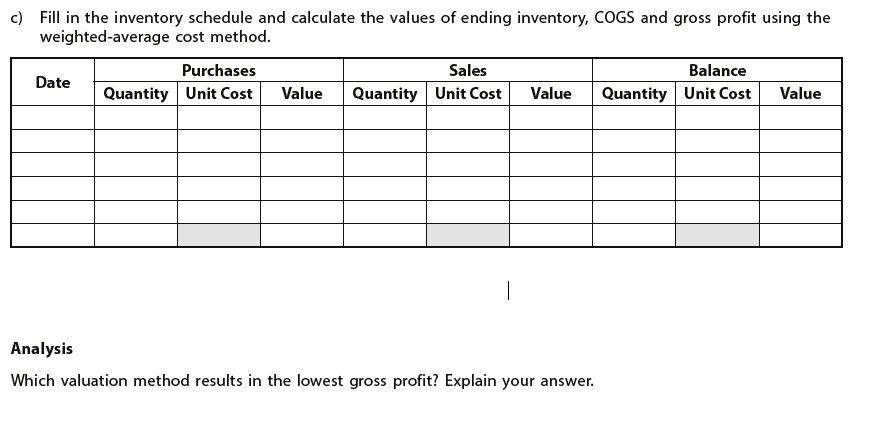

Poppy Company uses a perpetual inventory system. It reported the following data related to beginning inventory and inventory purchases and sales for the month of July 2019. Jul 1 Jul 9 Jul 16 Jul 18 Jul 30 Beginning inventory consisted of 300 units at $13 per unit Sold 200 units at $20 per unit Date Purchased 120 units at $12 per unit Purchased 300 units at $10 per unit Sold 150 units at $20 per unit Required a) Fill in the inventory schedule and calculate the values of ending inventory, COGS and gross profit using the specific identification method. Assume that the 150 units sold on July 30 consist of 15 units from the beginning inventory, 35 units from the July 16 purchase and 100 units from the July 18 purchase. Sales Balance Value Quantity Unit Cost Value Quantity Unit Cost Purchases Quantity Unit Cost Value b) Fill in the inventory schedule and calculate the values of ending inventory, COGS and gross profit using the FIFO cost method. Date Purchases Sales Quantity Unit Cost Value Quantity Unit Cost Balance Value Quantity Unit Cost Value c) Fill in the inventory schedule and calculate the values of ending inventory, COGS and gross profit using the cost method. weighted-average Date Purchases Sales Quantity Unit Cost Value Quantity Unit Cost | Value Analysis Which valuation method results in the lowest gross profit? Explain your answer. Balance Quantity Unit Cost Value

Step by Step Solution

★★★★★

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started