Answered step by step

Verified Expert Solution

Question

1 Approved Answer

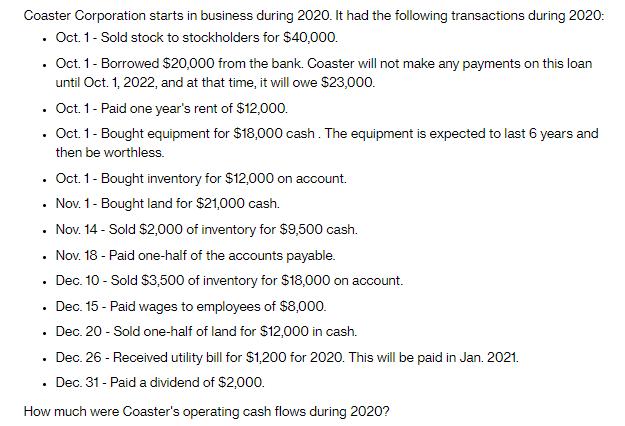

Coaster Corporation starts in business during 2020. It had the following transactions during 2020: Oct. 1- Sold stock to stockholders for $40,000. . .

Coaster Corporation starts in business during 2020. It had the following transactions during 2020: Oct. 1- Sold stock to stockholders for $40,000. . . . . Oct. 1- Bought inventory for $12,000 on account. Nov. 1- Bought land for $21,000 cash. Nov. 14 - Sold $2,000 of inventory for $9,500 cash. Nov. 18 - Paid one-half of the accounts payable. Dec. 10 - Sold $3,500 of inventory for $18,000 on account. Dec. 15 - Paid wages to employees of $8,000. Dec. 20 - Sold one-half of land for $12,000 in cash. . . . . Oct. 1- Borrowed $20,000 from the bank. Coaster will not make any payments on this loan until Oct. 1, 2022, and at that time, it will owe $23,000. . Oct. 1- Paid one year's rent of $12,000. Oct. 1 - Bought equipment for $18,000 cash. The equipment is expected to last 6 years and then be worthless. Dec. 26 - Received utility bill for $1,200 for 2020. This will be paid in Jan. 2021. Dec. 31 - Paid a dividend of $2,000. How much were Coaster's operating cash flows during 2020? .

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To determine Coaster Corporations operating cash flows during 2020 we need to calculate the net cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started