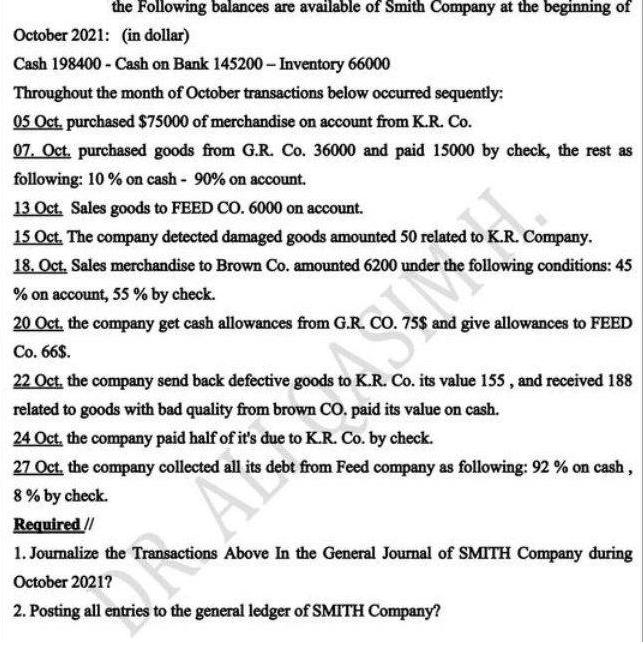

the Following balances are available of Smith Company at the beginning of October 2021: (in dollar) Cash 198400 - Cash on Bank 145200-Inventory 66000

the Following balances are available of Smith Company at the beginning of October 2021: (in dollar) Cash 198400 - Cash on Bank 145200-Inventory 66000 Throughout the month of October transactions below occurred sequently: 05 Oct. purchased $75000 of merchandise on account from K.R. Co. 07. Oct. purchased goods from G.R. Co. 36000 and paid 15000 by check, the rest as following: 10% on cash - 90% on account. 13 Oct. Sales goods to FEED CO. 6000 on account. 15 Oct. The company detected damaged goods amounted 50 related to K.R. Company. 18. Oct. Sales merchandise to Brown Co. amounted 6200 under the following conditions: 45 % on account, 55 % by check. 20 Oct, the company get cash allowances from G.R. CO. 75$ and give allowances to FEED Co. 66$. 22 Oct, the company send back defective goods to K.R. Co. its value 155, and received 188 related to goods with bad quality from brown CO. paid its value on cash. 24 Oct, the company paid half of it's due to K.R. Co. by check. 27 Oct, the company collected all its debt from Feed company as following: 92 % on cash, 8% by check. Required // 1. Journalize the Transactions Above In the General Journal of SMITH Company during October 2021? 2. Posting all entries to the general ledger of SMITH Company?

Step by Step Solution

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries Formula Tables General Ledger 1 2 Date Particuars 3 1012021 Balance BF 4 5 6 7 8 Dat...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started