Answered step by step

Verified Expert Solution

Question

1 Approved Answer

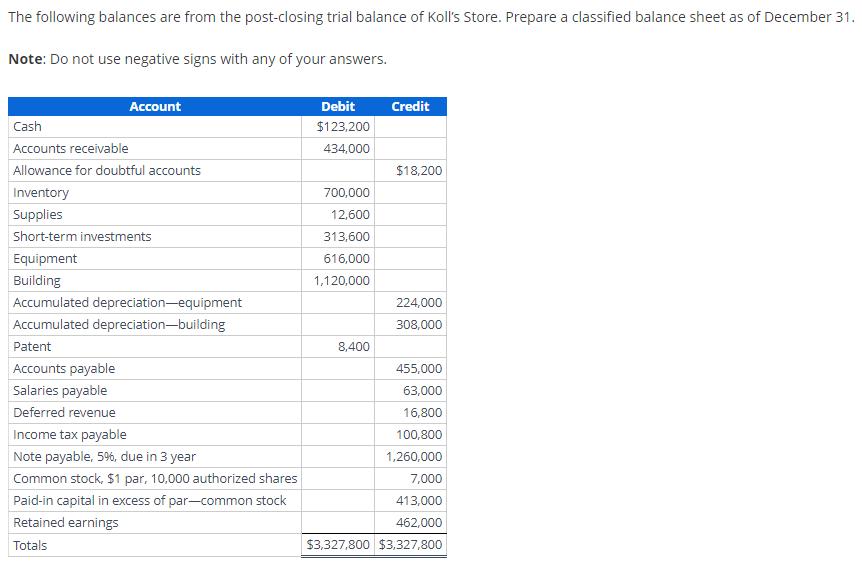

The following balances are from the post-closing trial balance of Koll's Store. Prepare a classified balance sheet as of December 31. Note: Do not

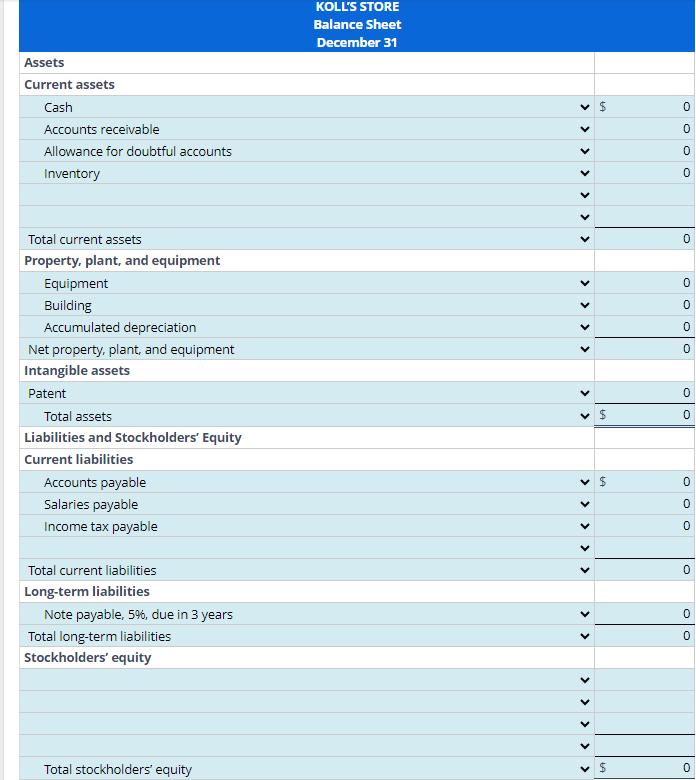

The following balances are from the post-closing trial balance of Koll's Store. Prepare a classified balance sheet as of December 31. Note: Do not use negative signs with any of your answers. Account Cash Accounts receivable Allowance for doubtful accounts Inventory Supplies Short-term investments Equipment Building Accumulated depreciation-equipment Accumulated depreciation-building Patent Accounts payable Salaries payable Deferred revenue Income tax payable Note payable, 5%, due in 3 year Common stock, $1 par, 10,000 authorized shares Paid-in capital in excess of par-common stock Retained earnings Totals Debit $123,200 434,000 700,000 12,600 313,600 616,000 1,120,000 8,400 Credit $18,200 224,000 308,000 455,000 63,000 16,800 100,800 1,260,000 7,000 413,000 462,000 $3,327,800 $3,327,800 Assets Current assets Cash Accounts receivable Allowance for doubtful accounts Inventory Total current assets Property, plant, and equipment Equipment Building Accumulated depreciation Net property, plant, and equipment Intangible assets Patent Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Salaries payable Income tax payable Total current liabilities Long-term liabilities Note payable, 5%, due in 3 years Total long-term liabilities Stockholders' equity Total stockholders' equity KOLL'S STORE Balance Sheet December 31 < < < < < < < > > > > < < < < < < < > > > > < $ $ LA $ OOO 0 0 O 0 0 O a O 0 0 0 0 O 0

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Financial Statements These are written records that convey the business activities and financial per...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started