Question

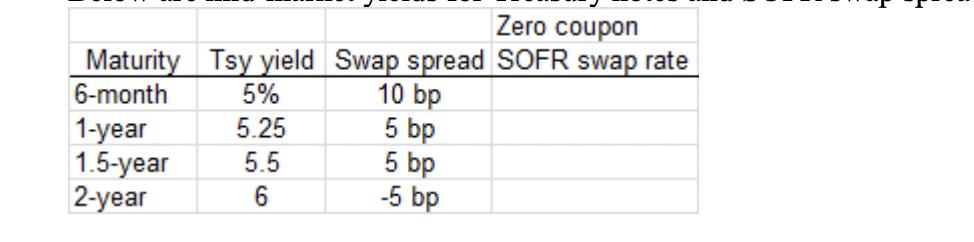

Below are mid-market yields for Treasury notes and SOFR swap spreads 1. Use bootstrapping to build a zero curve for SOFR swaps. 2. Consider

1. Use bootstrapping to build a zero curve for SOFR swaps.

2. Consider a company that can borrow money at SOFR. The company issues a new security that pays no interest but matures in 2 years and pays $1 million. How much would you be willing to pay for this bond?

Zero coupon Maturity Tsy yield Swap spread SOFR swap rate 6-month 1-year 1.5-year 2-year 5% 55 5.25 5.5 6 10 bp 5 bp 5 bp -5 bp

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 To build a zero curve for SOFR swaps using the provided information we can use bootstrapping Boots...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: David Spiceland

11th Edition

1264134525, 9781264134526

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App