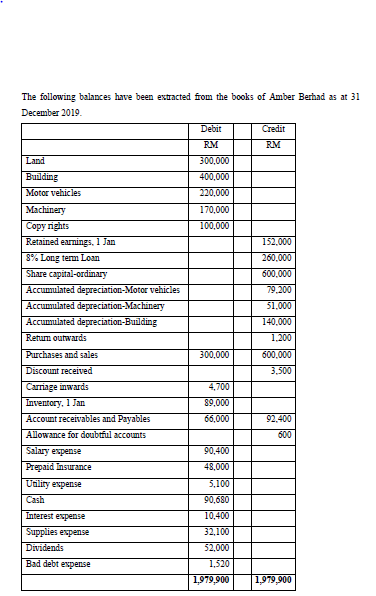

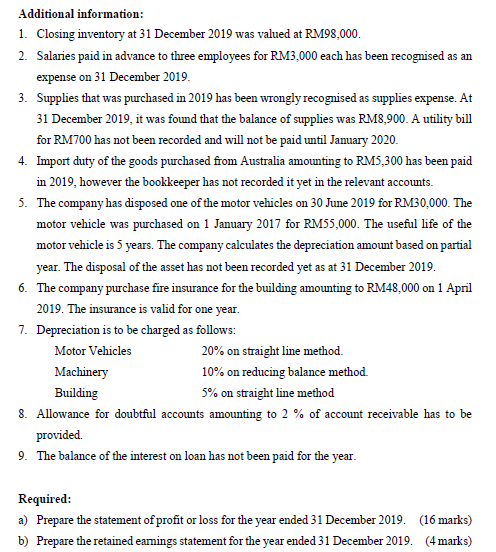

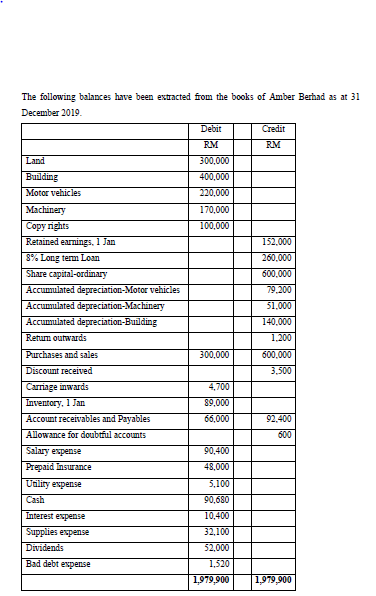

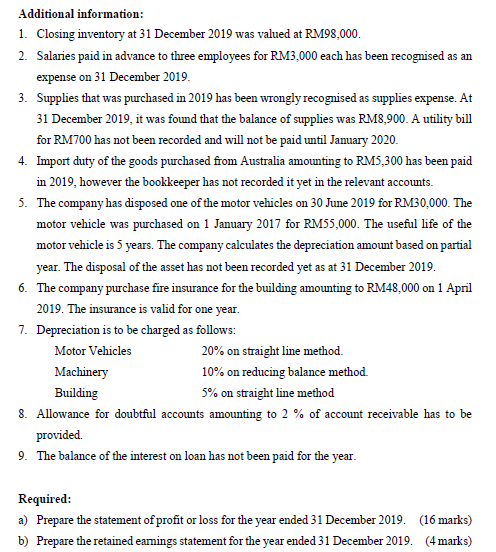

The following balances have been extracted from the books of Amber Berhad as at 31 December 2019 Debit Credit RM RM Land 300,000 Building 400,000 Motor vehicles 220.000 Machinery 170,000 Copyrights 100,000 Retained earnings, 1 Jan 152.000 8% Long term Loan 260.000 Share capital-ordinary 600.000 Accumulated depreciation-Motor vehicles 79.200 Accumulated depreciation Machinery 51.000 Accumulated depreciation-Bulding 140.000 Retum outwards 1.200 Purchases and sales 300,000 600.000 Discount received 3,500 Carriage inwards 4,700 Inventory, 1 Jan 89,000 Account receivables and Payables 66,000 92.400 Alowance for doubtral accounts 600 Salary expense 90,400 Prepaid Insurance 48.000 Utility expense 5.100 Cash 90,680 Interest expense 10,400 Supplies expense 32,100 Dividends 52,000 Bad debt expense 1,520 1,979,900 1,979.900 Additional information: 1. Closing inventory at 31 December 2019 was valued at RM98.000. 2. Salaries paid in advance to three employees for RM3,000 each has been recognised as an expense on 31 December 2019. 3. Supplies that was purchased in 2019 has been wrongly recognised as supplies expense. At 31 December 2019, it was found that the balance of supplies was RM8,900. A utility bill for RM700 has not been recorded and will not be paid until January 2020. 4. Import duty of the goods purchased from Australia amounting to RM5,300 has been paid in 2019, however the bookkeeper has not recorded it yet in the relevant accounts. 5. The company has disposed one of the motor vehicles on 30 June 2019 for RM30,000. The motor vehicle was purchased on 1 January 2017 for RM55,000. The useful life of the motor vehicle is 5 years. The company calculates the depreciation amount based on partial year. The disposal of the asset has not been recorded yet as at 31 December 2019. 6. The company purchase fire insurance for the building amounting to RM48,000 on 1 April 2019. The insurance is valid for one year. 7. Depreciation is to be charged as follows: Motor Vehicles 20% on straight line method. Machinery 10% on reducing balance method. Building 5% on straight line method 8. Allowance for doubtful accounts amounting to 2 % of account receivable has to be provided 9. The balance of the interest on loan has not been paid for the year. Required: a) Prepare the statement of profit or loss for the year ended 31 December 2019. (16 marks) b) Prepare the retained eamings statement for the year ended 31 December 2019. (4 marks)