Answered step by step

Verified Expert Solution

Question

1 Approved Answer

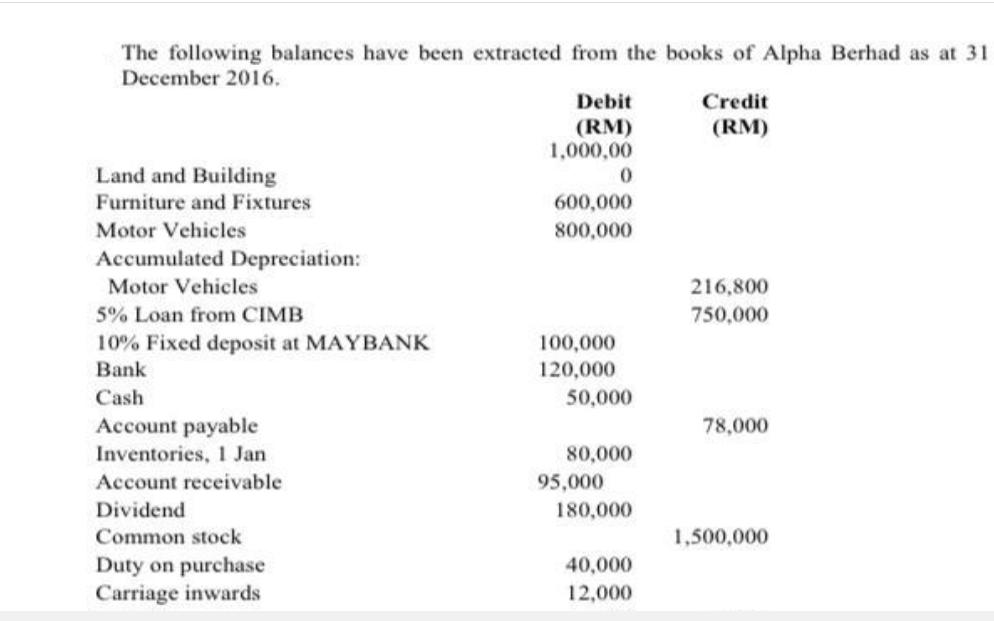

The following balances have been extracted from the books of Alpha Berhad as at 31 December 2016. Land and Building Furniture and Fixtures Motor

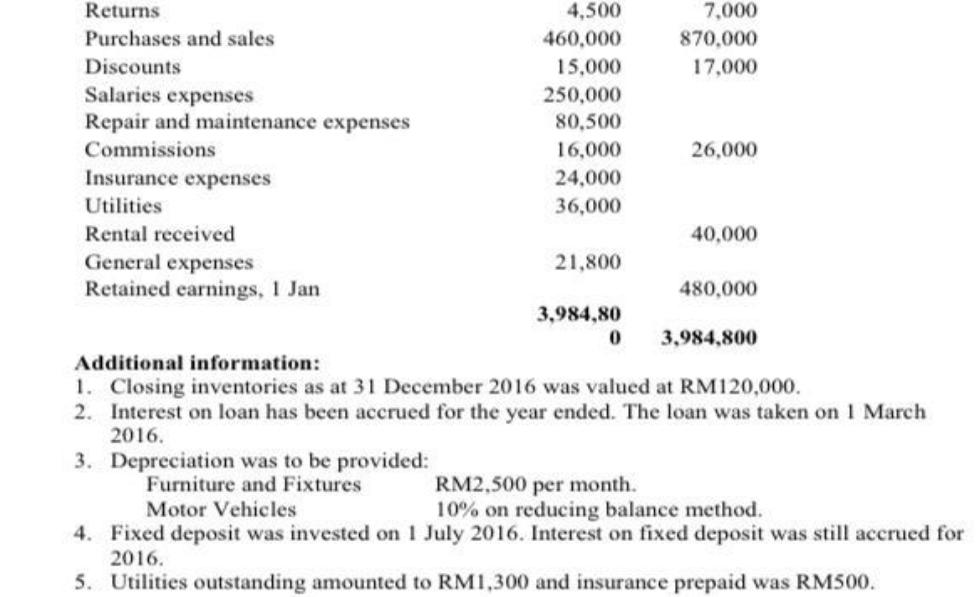

The following balances have been extracted from the books of Alpha Berhad as at 31 December 2016. Land and Building Furniture and Fixtures Motor Vehicles Accumulated Depreciation: Motor Vehicles 5% Loan from CIMB 10% Fixed deposit at MAYBANK Bank Cash Account payable Inventories, 1 Jan Account receivable Dividend Common stock Duty on purchase Carriage inwards Debit (RM) 1,000,00 600,000 800,000 100,000 120,000 0 50,000 80,000 95,000 180,000 40,000 12,000 Credit (RM) 216,800 750,000 78,000 1,500,000 Returns Purchases and sales Discounts Salaries expenses Repair and maintenance expenses Commissions Insurance expenses Utilities Rental received General expenses Retained earnings, 1 Jan 4,500 460,000 15,000 250,000 80,500 16,000 24,000 36,000 21,800 3,984,80 0 7,000 870,000 17,000 26,000 40,000 480,000 3,984,800 Additional information: 1. Closing inventories as at 31 December 2016 was valued at RM120,000. 2. Interest on loan has been accrued for the year ended. The loan was taken on 1 March 2016. 3. Depreciation was to be provided: Furniture and Fixtures RM2,500 per month. Motor Vehicles 10% on reducing balance method. 4. Fixed deposit was invested on 1 July 2016. Interest on fixed deposit was still accrued for 2016. 5. Utilities outstanding amounted to RM1,300 and insurance prepaid was RM500. 6. The company collected a receivable from customer, RM15,200, however the bookkeeper recorded it at RM12,500. This transaction has not been adjusted in the books of Alpha Berhad. Required: a) Prepare the income statement for the year ended 31 December 2016. b) Prepare the retained earnings statement for the year ended 31 December 2016. c) Prepare the balance sheet as at 31 December 2016.

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started