Answered step by step

Verified Expert Solution

Question

1 Approved Answer

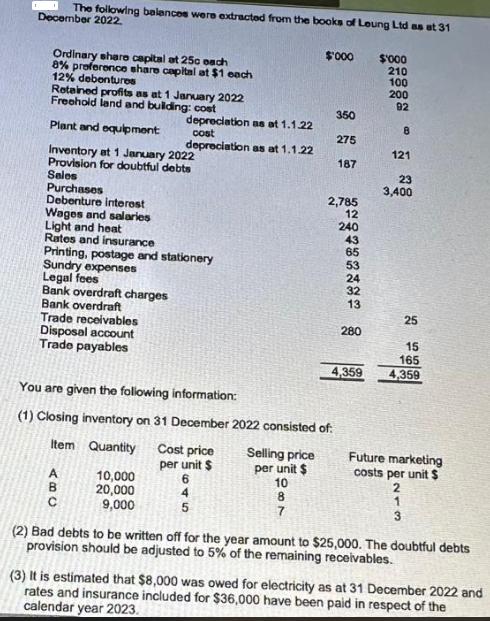

The following balances were extracted from the books of Leung Ltd as at 31 December 2022. Ordinary share capital at 250 each 8% preference

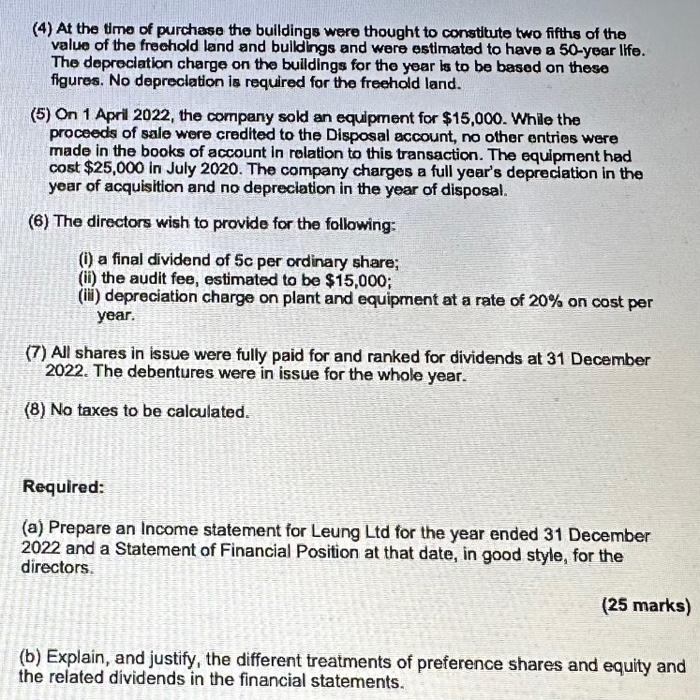

The following balances were extracted from the books of Leung Ltd as at 31 December 2022. Ordinary share capital at 250 each 8% preference share capital at $1 each 12% debentures Retained profits as at 1 January 2022 Freehold land and building: cost Plant and equipment Inventory at 1 January 2022 Provision for doubtful debts Sales Purchases Debenture interest Wages and salaries Light and heat Rates and insurance Printing, postage and stationery Sundry expenses Legal fees Bank overdraft charges Bank overdraft Trade receivables Disposal account Trade payables depreciation as at 1.1.22 cost depreciation as at 1.1.22 A 10,000 20,000 9,000 You are given the following information: (1) Closing inventory on 31 December 2022 consisted of. Item Quantity Cost price per unit $ 6 Selling price per unit $ $'000 10 8 7 350 275 187 2,785 12 240 43 65 53 24 32 13 280 4,359 $'000 210 100 200 92 8 121 23 3,400 25 15 165 4,359 2 1 3 Future marketing costs per unit $ 5 (2) Bad debts to be written off for the year amount to $25,000. The doubtful debts provision should be adjusted to 5% of the remaining receivables. (3) It is estimated that $8,000 was owed for electricity as at 31 December 2022 and rates and insurance included for $36,000 have been paid in respect of the calendar year 2023. (4) At the time of purchase the buildings were thought to constitute two fifths of the value of the freehold land and buildings and were estimated to have a 50-year life. The depreciation charge on the buildings for the year is to be based on these figures. No depreciation is required for the freehold land. (5) On 1 April 2022, the company sold an equipment for $15,000. While the proceeds of sale were credited to the Disposal account, no other entries were made in the books of account in relation to this transaction. The equipment had cost $25,000 in July 2020. The company charges a full year's depreciation in the year of acquisition and no depreciation in the year of disposal. (6) The directors wish to provide for the following: (i) a final dividend of 5c per ordinary share; (ii) the audit fee, estimated to be $15,000; (iii) depreciation charge on plant and equipment at a rate of 20% on cost per year. (7) All shares in issue were fully paid for and ranked for dividends at 31 December 2022. The debentures were in issue for the whole year. (8) No taxes to be calculated. Required: (a) Prepare an Income statement for Leung Ltd for the year ended 31 December 2022 and a Statement of Financial Position at that date, in good style, for the directors. (25 marks) (b) Explain, and justify, the different treatments of preference shares and equity and the related dividends in the financial statements.

Step by Step Solution

★★★★★

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the financial statements for Leung Ltd for the year ended 31 December 2022 Leung Ltd Income Statement for the year ended 31 December 2022 Sales 4359 Less Cost of Sales Opening Inventory 121 P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started