Question

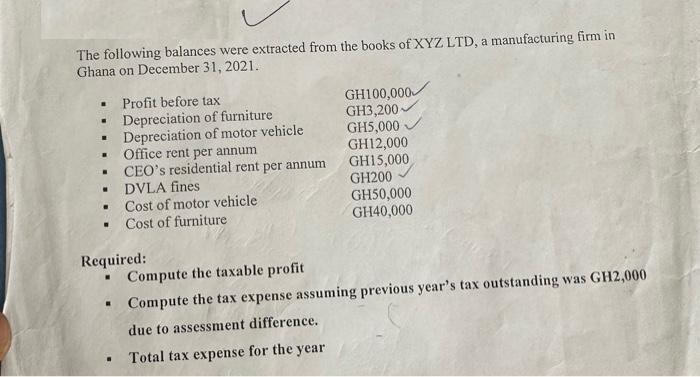

The following balances were extracted from the books of XYZ LTD, a manufacturing firm in Ghana on December 31, 2021. Profit before tax .

The following balances were extracted from the books of XYZ LTD, a manufacturing firm in Ghana on December 31, 2021. Profit before tax . Depreciation of furniture . . . . . Depreciation of motor vehicle Office rent per annum CEO's residential rent per annum DVLA fines . Cost of motor vehicle Cost of furniture Required: GH100,000 GH3,200- GH5,000 GH12,000 GH15,000 GH200 GH50,000 GH40,000 Compute the taxable profit Compute the tax expense assuming previous year's tax outstanding was GH2,000 due to assessment difference. Total tax expense for the year

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

I To compute the taxable profit we need to add back the nontaxable expenses to the p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald Kieso, Jerry Weygandt, Terry Warfield, Nicola Young,

10th Canadian Edition, Volume 1

978-1118735329, 9781118726327, 1118735323, 1118726324, 978-0176509736

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App