Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4.Unfortunately, following a few very profitable months, the Covid-19 pandemic struck and Sienna had to shut down the store for 3 moths, But she

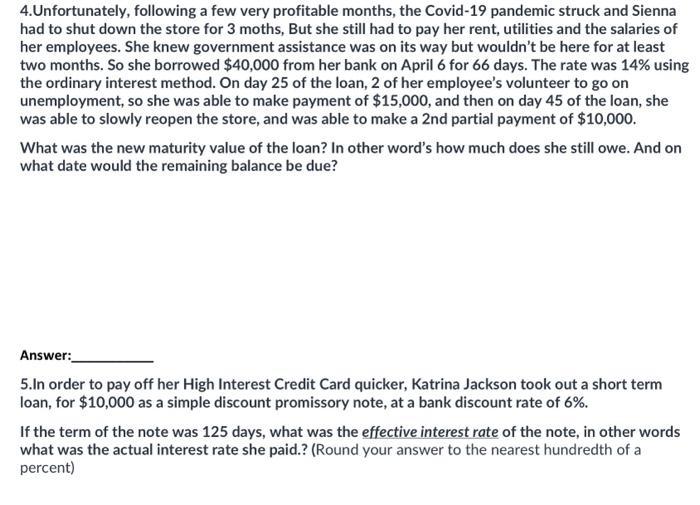

4.Unfortunately, following a few very profitable months, the Covid-19 pandemic struck and Sienna had to shut down the store for 3 moths, But she still had to pay her rent, utilities and the salaries of her employees. She knew government assistance was on its way but wouldn't be here for at least two months. So she borrowed $40,000 from her bank on April 6 for 66 days. The rate was 14% using the ordinary interest method. On day 25 of the loan, 2 of her employee's volunteer to go on unemployment, so she was able to make payment of $15,000, and then on day 45 of the loan, she was able to slowly reopen the store, and was able to make a 2nd partial payment of $10,000. What was the new maturity value of the loan? In other word's how much does she still owe. And on what date would the remaining balance be due? Answer: 5.In order to pay off her High Interest Credit Card quicker, Katrina Jackson took out a short term loan, for $10,000 as a simple discount promissory note, at a bank discount rate of 6%. If the term of the note was 125 days, what was the effective interest rate of the note, in other words what was the actual interest rate she paid.? (Round your answer to the nearest hundredth of a percent)

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The remaining debt owed by Sienna would be 15000 which is the loans maturity am...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started