Question

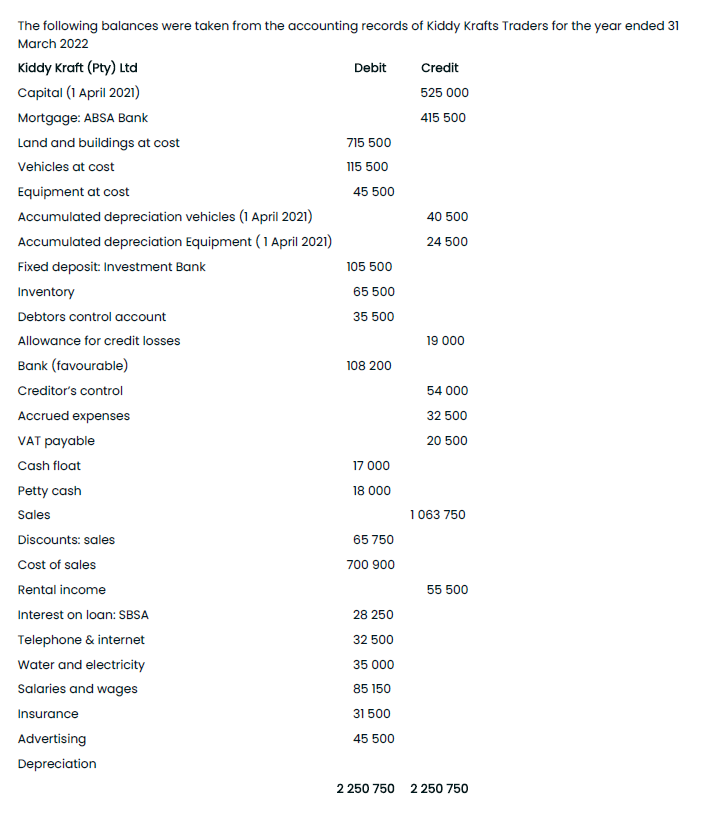

The following balances were taken from the accounting records of Kiddy Krafts Traders for the year ended 31March 2022 The following transactions have not been

The following balances were taken from the accounting records of Kiddy Krafts Traders for the year ended 31March 2022

The following transactions have not been accounted for in the above trial balance at 31 March 2022 (a) Depreciation on both vehicles and equipment for the year has not yet been accounted for. - Vehicles are depreciated at 15% per annum according to the straight-line method. - Equipment is depreciated at 20% per annum on reducing balance method. (b) Kiddy Kraft Traders received an invoice for water and electricity for an amount of R2 500 relating to March2021, which has not been paid yet. (c) R15 000 was received from Fancy Nancy for inventory to be delivered in April 2022. (d) PJ Mask, a debtor of Kiddy Kraft Traders, went into liquidation. His account of R2 500 was written off as a baddebt. No specific allowance for credit losses was previously recognised. (e) It is the policy of Kiddy Kraft to adjust their allowance for credit losses to 20% of outstanding debtors at yearend. The adjustment is yet to be processed. (f) Kiddy Kraft Traders has an insurance policy that it pays annually in advance. The insurance premiums forJanuary 2022 to December 2022 were paid during the month of January. The insurance premiums are R1 500 permonth. There were no drawings made by the owner during the year. Assume a net profit for the year of R79 075 after all adjustments have been processed. REQUIRED: Using the information above prepare the adjusting journal entries.

The following transactions have not been accounted for in the above trial balance at 31 March 2022 (a) Depreciation on both vehicles and equipment for the year has not yet been accounted for. - Vehicles are depreciated at 15% per annum according to the straight-line method. - Equipment is depreciated at 20% per annum on reducing balance method. (b) Kiddy Kraft Traders received an invoice for water and electricity for an amount of R2 500 relating to March2021, which has not been paid yet. (c) R15 000 was received from Fancy Nancy for inventory to be delivered in April 2022. (d) PJ Mask, a debtor of Kiddy Kraft Traders, went into liquidation. His account of R2 500 was written off as a baddebt. No specific allowance for credit losses was previously recognised. (e) It is the policy of Kiddy Kraft to adjust their allowance for credit losses to 20% of outstanding debtors at yearend. The adjustment is yet to be processed. (f) Kiddy Kraft Traders has an insurance policy that it pays annually in advance. The insurance premiums forJanuary 2022 to December 2022 were paid during the month of January. The insurance premiums are R1 500 permonth. There were no drawings made by the owner during the year. Assume a net profit for the year of R79 075 after all adjustments have been processed. REQUIRED: Using the information above prepare the adjusting journal entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started