Answered step by step

Verified Expert Solution

Question

1 Approved Answer

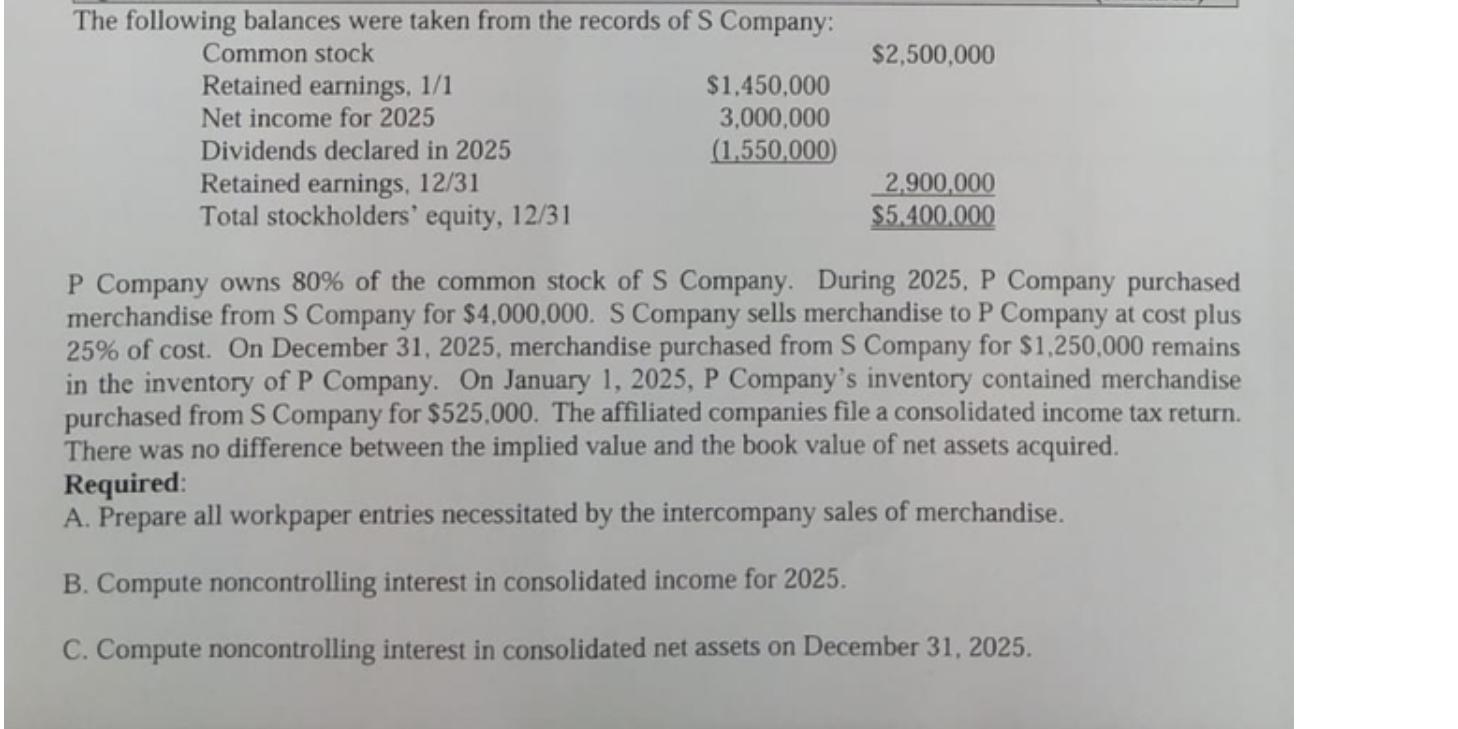

The following balances were taken from the records of S Company: Common stock Retained earnings, 1/1 Net income for 2025 Dividends declared in 2025

The following balances were taken from the records of S Company: Common stock Retained earnings, 1/1 Net income for 2025 Dividends declared in 2025 Retained earnings, 12/31 Total stockholders' equity, 12/31 $1,450,000 3,000,000 (1,550,000) $2,500,000 2,900,000 $5.400.000 P Company owns 80% of the common stock of S Company. During 2025, P Company purchased merchandise from S Company for $4,000,000. S Company sells merchandise to P Company at cost plus 25% of cost. On December 31, 2025, merchandise purchased from S Company for $1,250,000 remains in the inventory of P Company. On January 1, 2025, P Company's inventory contained merchandise purchased from S Company for $525.000. The affiliated companies file a consolidated income tax return. There was no difference between the implied value and the book value of net assets acquired. Required: A. Prepare all workpaper entries necessitated by the intercompany sales of merchandise. B. Compute noncontrolling interest in consolidated income for 2025. C. Compute noncontrolling interest in consolidated net assets on December 31, 2025.

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The image contains an accounting exercise that provides balance sheet information for S Company and details about transactions between P Company and S Company The image asks to prepare workpaper entri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started