Answered step by step

Verified Expert Solution

Question

1 Approved Answer

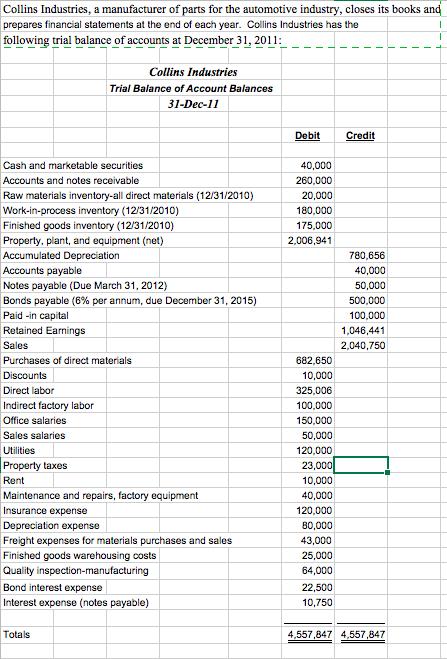

Collins Industries, a manufacturer of parts for the automotive industry, closes its books and prepares financial statements at the end of each year. Collins

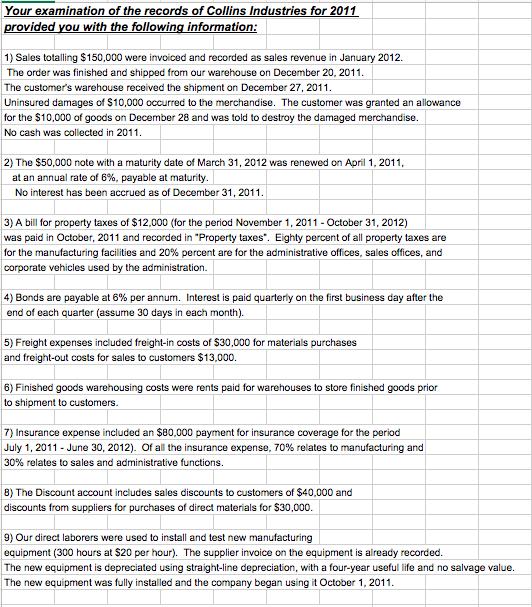

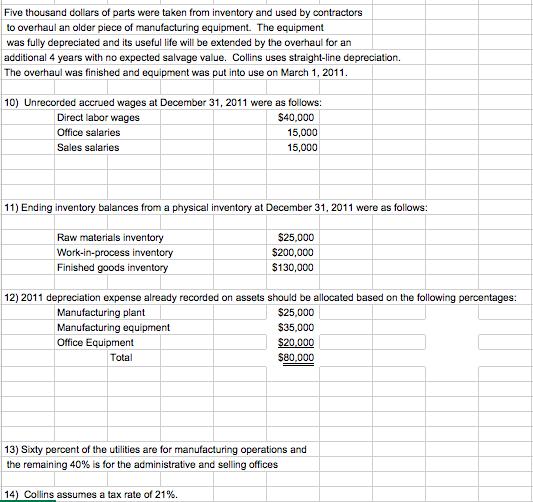

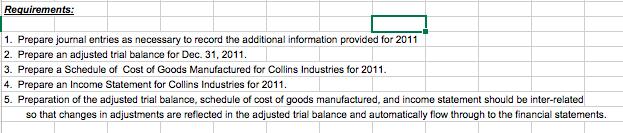

Collins Industries, a manufacturer of parts for the automotive industry, closes its books and prepares financial statements at the end of each year. Collins Industries has the following trial balance of accounts at December 31, 2011: Cash and marketable securities Accounts and notes receivable Raw materials inventory-all direct materials (12/31/2010) Work-in-process inventory (12/31/2010) Finished goods inventory (12/31/2010) Property, plant, and equipment (net) Accumulated Depreciation Accounts payable Notes payable (Due March 31, 2012) Bonds payable (6% per annum, due December 31, 2015) Paid -in capital Retained Earnings Sales Collins Industries Trial Balance of Account Balances 31-Dec-11 Purchases of direct materials Discounts Direct labor Indirect factory labor Office salaries Sales salaries Utilities Property taxes Rent Maintenance and repairs, factory equipment Insurance expense Depreciation expense Freight expenses for materials purchases and sales Finished goods warehousing costs Quality inspection-manufacturing Bond interest expense Interest expense (notes payable) Totals Debit 40,000 260,000 20,000 180,000 175,000 2,006,941 682,650 10,000 325,006 100,000 150,000 50,000 120,000 23,000 10,000 40,000 120,000 80,000 43,000 25,000 64,000 22,500 10,750 Credit 780,656 40,000 50,000 500,000 100,000 1,046,441 2,040,750 4,557,847 4,557,847 Your examination of the records of Collins Industries for 2011 provided you with the following information: 1) Sales totalling $150,000 were invoiced and recorded as sales revenue in January 2012. The order was finished and shipped from our warehouse on December 20, 2011. The customer's warehouse received the shipment on December 27, 2011. Uninsured damages of $10,000 occurred to the merchandise. The customer was granted an allowance for the $10,000 of goods on December 28 and was told to destroy the damaged merchandise. No cash was collected in 2011. 2) The $50,000 note with a maturity date of March 31, 2012 was renewed on April 1, 2011, at an annual rate of 6%, payable at maturity. No interest has been accrued as of December 31, 2011. 3) A bill for property taxes of $12,000 (for the period November 1, 2011 - October 31, 2012) was paid in October, 2011 and recorded in "Property taxes". Eighty percent of all property taxes are for the manufacturing facilities and 20% percent are for the administrative offices, sales offices, and corporate vehicles used by the administration. 4) Bonds are payable at 6% per annum. Interest is paid quarterly on the first business day after the end of each quarter (assume 30 days in each month). 5) Freight expenses included freight-in costs of $30,000 for materials purchases and freight-out costs for sales to customers $13,000. 6) Finished goods warehousing costs were rents paid for warehouses to store finished goods prior to shipment to customers. 7) Insurance expense included an $80,000 payment for insurance coverage for the period July 1, 2011 - June 30, 2012). Of all the insurance expense, 70% relates to manufacturing and 30% relates to sales and administrative functions. 8) The Discount account includes sales discounts to customers of $40,000 and discounts from suppliers for purchases of direct materials for $30,000. 9) Our direct laborers were used to install and test new manufacturing equipment (300 hours at $20 per hour). The supplier invoice on the equipment is already recorded. The new equipment is depreciated using straight-line depreciation, with a four-year useful life and no salvage value. The new equipment was fully installed and the company began using it October 1, 2011. Five thousand dollars of parts were taken from inventory and used by contractors to overhaul an older piece of manufacturing equipment. The equipment was fully depreciated and its useful life will be extended by the overhaul for an additional 4 years with no expected salvage value. Collins uses straight-line depreciation. The overhaul was finished and equipment was put into use on March 1, 2011. 10) Unrecorded accrued wages at December 31, 2011 were as follows: Direct labor wages $40,000 15,000 15,000 Office salaries Sales salaries 11) Ending inventory balances from a physical inventory at December 31, 2011 were as follows: Raw materials inventory $25,000 $200,000 Work-in-process inventory Finished goods inventory $130,000 12) 2011 depreciation expense already recorded on assets should be allocated based on the following percentages: $25,000 $35,000 $20,000 $80,000 Manufacturing plant Manufacturing equipment Office Equipment Total 13) Sixty percent of the utilities are for manufacturing operations and the remaining 40% is for the administrative and selling offices 14) Collins assumes a tax rate of 21%. Requirements: 1. Prepare journal entries as necessary to record the additional information provided for 2011 2. Prepare an adjusted trial balance for Dec. 31, 2011. 3. Prepare a Schedule of Cost of Goods Manufactured for Collins Industries for 2011. 4. Prepare an Income Statement for Collins Industries for 2011. 5. Preparation of the adjusted trial balance, schedule of cost of goods manufactured, and income statement should be inter-related so that changes in adjustments are reflected in the adjusted trial balance and automatically flow through to the financial statements.

Step by Step Solution

★★★★★

3.58 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started