Answered step by step

Verified Expert Solution

Question

1 Approved Answer

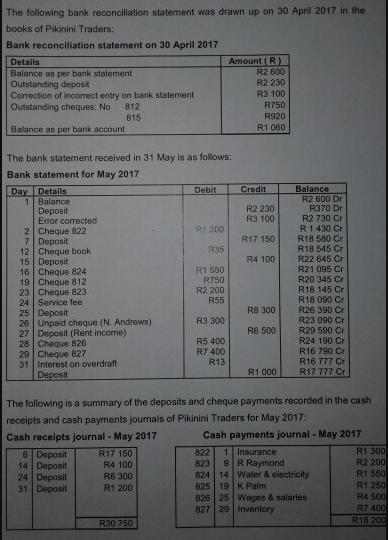

The following bank reconciliation statement was drawn up on 30 April 2017 in the books of Pikinini Traders: Bank reconciliation statement on 30 April

The following bank reconciliation statement was drawn up on 30 April 2017 in the books of Pikinini Traders: Bank reconciliation statement on 30 April 2017 Amount (R) R2 600 Details Balance as per bank statement Outstanding deposit Comection of incorrect entry on bank statement Outstanding cheques: No. R2 230 R3 100 R750 812 815 R920 Balance as per bank account R1 060 The bank statement received in 31 May is as follows: Bank statement for May 2017 Day Details 1 Balance Depoit Credit Balance R2 600 Dr R370 Dr R2 730 Cr Debit R2 230 R3 100 Error corrected RI 300 R1 430 Cr R18 580 Cr R18 545 Cr R22 645 Cr 2 Cheque 822 7 Deposit 12 Cheque book 15 Deposit 16 Cheque 824 19 Cheque 812 23 Cheque 823 24 Service fee 25 Deposit 26 Unpaid cheque (N. Andrews) 27 Deposit (Rent incorme) 28 Cheque 826 29 Cheque 827 31 Interest on overdraft Deposit R17 150 R35 R4 100 R1 550 R750 R21 095 Cr R20 345 Cr R18 145 Cr R18 090 Cr R2 200 R55 R8 300 R26 390 Cr R23 090 Cr R29 590 Cr R24 190 Cr R3 300 R6 500 R5 400 R7 400 R13 R16 790 Cr R16 777 Cr R1 000 R17 777 Cr The following is a summary of the deposits and cheque payments recorded in the cash receipts and cash payments journals of Pikinini Traders for May 2017: Cash receipts journal - May 2017 Cash payments journal May 2017 RI 300 R2 200 R1 550 R1 250 R4 500 822 6 Deposit 14 Deposit 24 Deposil 31 Deposit 1 Insurance 9 R Raymond 824 14 Water & electricity 825 19 K Palm 826 25 Wages & salaries 827 29 Inventory R17 150 R4 100 823 R8 300 R1 200 R7 400 RI8 200 R30 750 Additional information: a) The amount of R4 500 shown in the CPJ on 25 May for cheque 826 is correct. b) The unpaid cheque of R3 300 on the bank statement on 26 May was received from a debtor, N Andrews. c) The deposit of R6 500 on the bank statement on 27 May was for rent income deposited directly into the account of Pikinini Traders by the tenant. d) The deposit of R1 000 on the bank statement on 31 May is an error. The amount was deposited into the account of Picknick Traders, another client of the bank. Required: Use the information taken above to complete the following for May 2017: Identify any differences identified in the bank reconciliation process in the supplementary cashbook receipts and cashbook payments with columns for details and amounts. Begin with totals before any amendments. Open, post to, and balance the bank account in the general ledger. (6 marks) Compile the bank reconciliation statement as at 31 May 2017. For every amount entered in the bank reconciliation statement on 31 May 2017, indicate if it should be added/subtracted from the bank reconciliation and explain why the amount should be entered. 3.1. (6 marks) 3.2. 3.3 (7 marks) 3.4. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

31 Cash Balance as per Bank Statement 1777700 Add Deposits in transit 120000 Error by bank 90000 540...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started