Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following book and fair values were available for Westmont Company as of March 1. Book Value Fair Value Inventory $ 692,500 $ 643,750 Land

The following book and fair values were available for Westmont Company as of March 1.

| Book Value | Fair Value | ||||||

| Inventory | $ | 692,500 | $ | 643,750 | |||

| Land | 757,500 | 1,047,750 | |||||

| Buildings | 1,755,000 | 2,073,750 | |||||

| Customer relationships | 0 | 804,750 | |||||

| Accounts payable | (102,000 | ) | (102,000 | ) | |||

| Common stock | (2,000,000 | ) | |||||

| Additional paid-in capital | (500,000 | ) | |||||

| Retained earnings 1/1 | (434,500 | ) | |||||

| Revenues | (488,500 | ) | |||||

| Expenses | 320,000 | ||||||

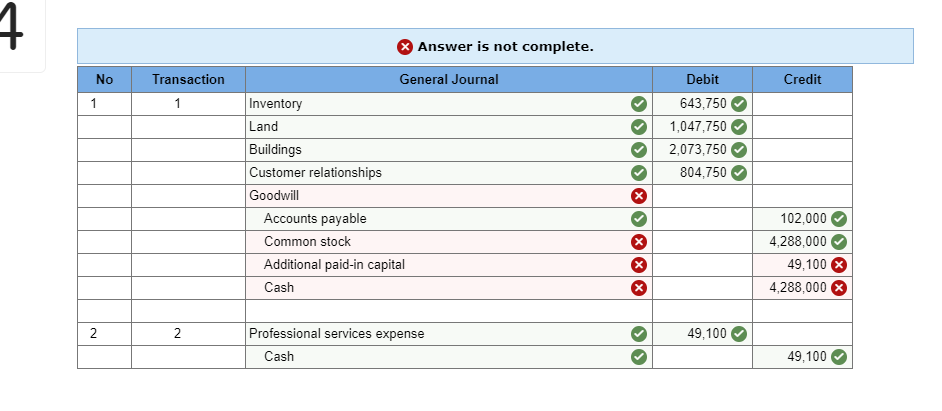

Arturo pays cash of $4,288,000 to acquire Westmont. No stock is issued and Arturo pays $49,100 for legal fees to complete the transaction.

Prepare Arturos journal entry to record its acquisition of Westmont. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started