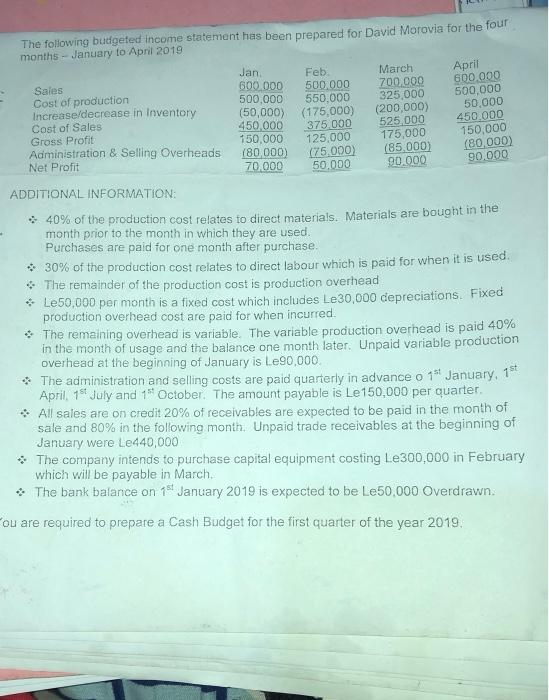

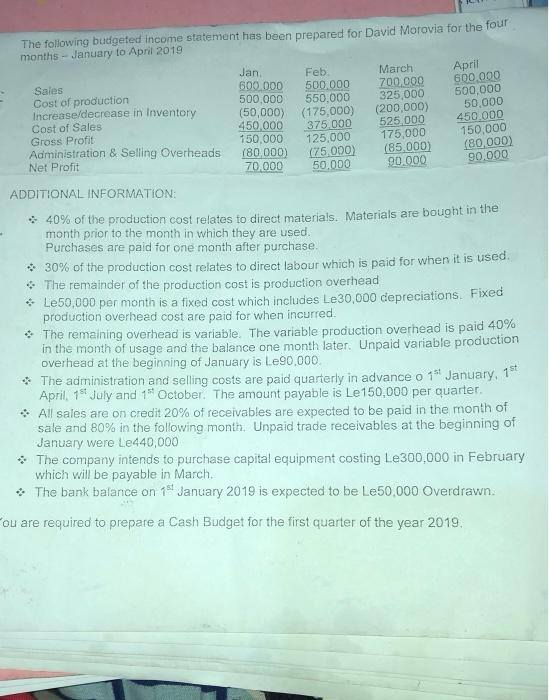

The following budgeted income statement has been prepared for David Moravia for the four months - January to April 2019 Sales Cost of production Increase/decrease in Inventory Cost of Sales Gross Profit Administration & Selling Overheads Net Profit Jan Feb 600.000 500.000 500.000 550.000 (50,000) (175.000) 450,000 375.000 150.000 125.000 (80.000) 175.000) 70.000 50.000 March 700.000 325,000 (200,000) 525.000 175,000 (85.000) 90.000 April 600.000 500.000 50.000 450.000 150,000 (80.000) 90.000 ADDITIONAL INFORMATION: 40% of the production cost relates to direct materials. Materials are bought in the month prior to the month in which they are used. Purchases are paid for one month after purchase. 30% of the production cost relates to direct labour which is paid for when it is used The remainder of the production cost is production overhead Le50,000 per month is a fixed cost which includes Le30,000 depreciations. Fixed production overhead cost are paid for when incurred. The remaining overhead is variable. The variable production overhead is paid 40% in the month of usage and the balance one month later. Unpaid variable production overhead at the beginning of January is Le90,000 The administration and selling costs are paid quarterly in advance o 15 January, 15+ April, 14 July and 15 October. The amount payable is Le 150,000 per quarter, All sales are on credit 20% of receivables are expected to be paid in the month of sale and 80% in the following month. Unpaid trade receivables at the beginning of January were Le440,000 The company intends to purchase capital equipment costing Le300,000 in February which will be payable in March The bank balance on 15 January 2019 is expected to be Le50,000 Overdrawn. ou are required to prepare a Cash Budget for the first quarter of the year 2019, The following budgeted income statement has been prepared for David Moravia for the four months - January to April 2019 Sales Cost of production Increase/decrease in Inventory Cost of Sales Gross Profit Administration & Selling Overheads Net Profit Jan Feb 600.000 500.000 500.000 550.000 (50,000) (175.000) 450,000 375.000 150.000 125.000 (80.000) 175.000) 70.000 50.000 March 700.000 325,000 (200,000) 525.000 175,000 (85.000) 90.000 April 600.000 500.000 50.000 450.000 150,000 (80.000) 90.000 ADDITIONAL INFORMATION: 40% of the production cost relates to direct materials. Materials are bought in the month prior to the month in which they are used. Purchases are paid for one month after purchase. 30% of the production cost relates to direct labour which is paid for when it is used The remainder of the production cost is production overhead Le50,000 per month is a fixed cost which includes Le30,000 depreciations. Fixed production overhead cost are paid for when incurred. The remaining overhead is variable. The variable production overhead is paid 40% in the month of usage and the balance one month later. Unpaid variable production overhead at the beginning of January is Le90,000 The administration and selling costs are paid quarterly in advance o 15 January, 15+ April, 14 July and 15 October. The amount payable is Le 150,000 per quarter, All sales are on credit 20% of receivables are expected to be paid in the month of sale and 80% in the following month. Unpaid trade receivables at the beginning of January were Le440,000 The company intends to purchase capital equipment costing Le300,000 in February which will be payable in March The bank balance on 15 January 2019 is expected to be Le50,000 Overdrawn. ou are required to prepare a Cash Budget for the first quarter of the year 2019