Answered step by step

Verified Expert Solution

Question

1 Approved Answer

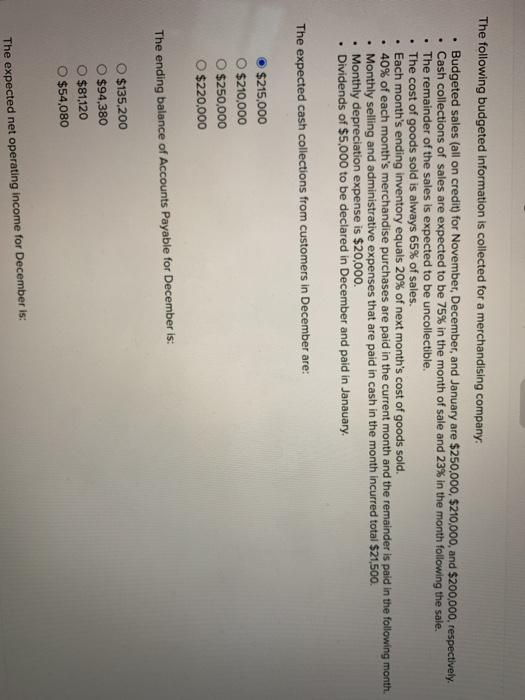

. The following budgeted information is collected for a merchandising company Budgeted sales (all on credit) for November December, and January are $250,000, $210,000 and

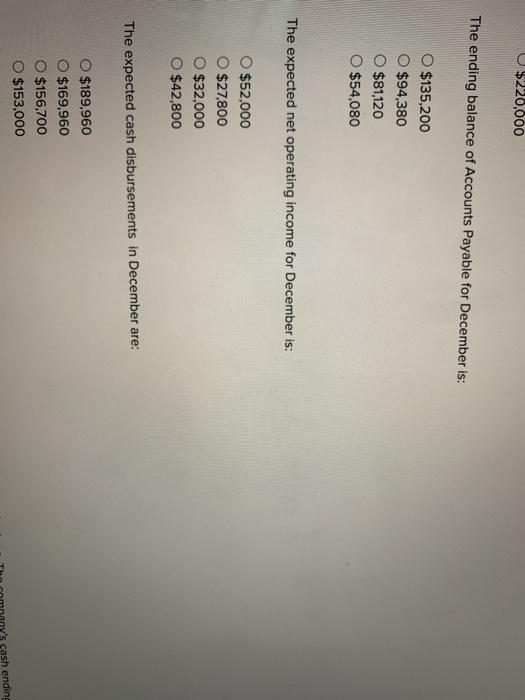

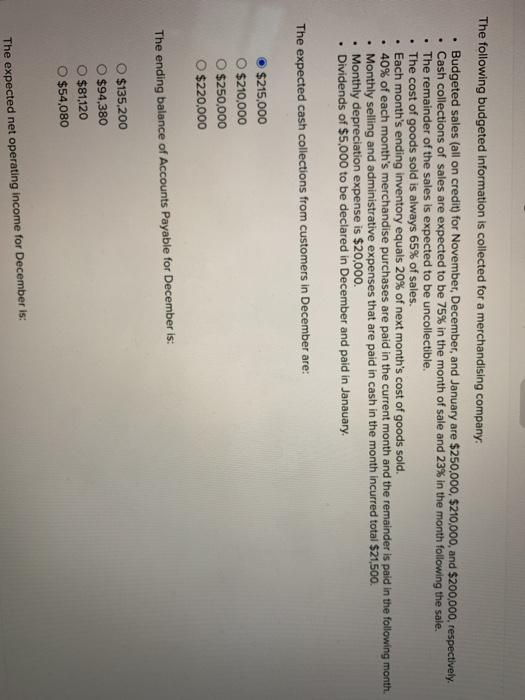

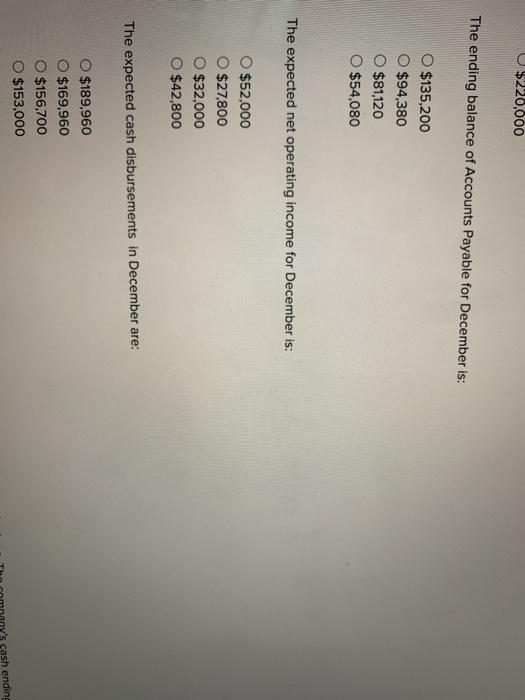

. The following budgeted information is collected for a merchandising company Budgeted sales (all on credit) for November December, and January are $250,000, $210,000 and $200,000, respectively Cash collections of sales are expected to be 75% in the month of sale and 23% in the month following the sale. . The remainder of the sales is expected to be uncollectible. The cost of goods sold is always 65% of sales. Each month's ending inventory equals 20% of next month's cost of goods sold. 40% of each month's merchandise purchases are paid in the current month and the remainder is paid in the following month. Monthly selling and administrative expenses that are paid in cash in the month incurred total $21,500. Monthly depreciation expense is $20,000 Dividends of $5,000 to be declared in December and paid in Janauary, The expected cash collections from customers in December are: $215,000 $210,000 $250,000 $220,000 The ending balance of Accounts Payable for December is: O $135,200 $94.380 O $81,120 O $54,080 The expected net operating income for December is: $220,000 The ending balance of Accounts Payable for December is: $135,200 $94,380 $81,120 $54,080 The expected net operating income for December is: $52,000 $27,800 $32,000 O $42,800 The expected cash disbursements in December are: $189,960 $169,960 O $156,700 O $153,000 cash ending

. The following budgeted information is collected for a merchandising company Budgeted sales (all on credit) for November December, and January are $250,000, $210,000 and $200,000, respectively Cash collections of sales are expected to be 75% in the month of sale and 23% in the month following the sale. . The remainder of the sales is expected to be uncollectible. The cost of goods sold is always 65% of sales. Each month's ending inventory equals 20% of next month's cost of goods sold. 40% of each month's merchandise purchases are paid in the current month and the remainder is paid in the following month. Monthly selling and administrative expenses that are paid in cash in the month incurred total $21,500. Monthly depreciation expense is $20,000 Dividends of $5,000 to be declared in December and paid in Janauary, The expected cash collections from customers in December are: $215,000 $210,000 $250,000 $220,000 The ending balance of Accounts Payable for December is: O $135,200 $94.380 O $81,120 O $54,080 The expected net operating income for December is: $220,000 The ending balance of Accounts Payable for December is: $135,200 $94,380 $81,120 $54,080 The expected net operating income for December is: $52,000 $27,800 $32,000 O $42,800 The expected cash disbursements in December are: $189,960 $169,960 O $156,700 O $153,000 cash ending

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started