Answered step by step

Verified Expert Solution

Question

1 Approved Answer

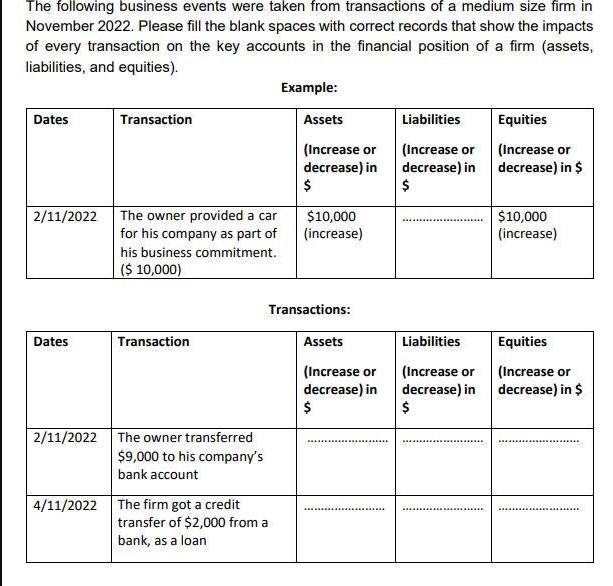

The following business events were taken from transactions of a medium size firm in November 2022. Please fill the blank spaces with correct records

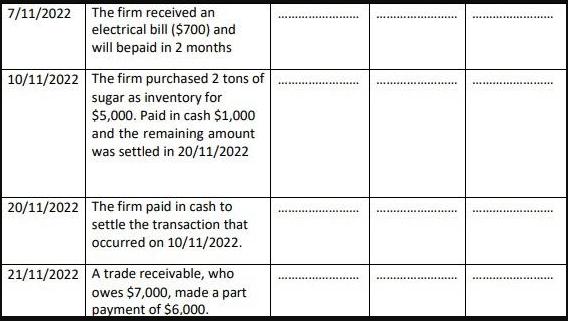

The following business events were taken from transactions of a medium size firm in November 2022. Please fill the blank spaces with correct records that show the impacts of every transaction on the key accounts in the financial position of a firm (assets, liabilities, and equities). Dates 2/11/2022 Dates Transaction The owner provided a car for his company as part of his business commitment. ($ 10,000) Transaction 2/11/2022 The owner transferred $9,000 to his company's bank account 4/11/2022 The firm got a credit Example: transfer of $2,000 from a bank, as a loan Assets (Increase or decrease) in $ $10,000 (increase) Transactions: Assets (Increase or decrease) in $ ****************** Liabilities (Increase or decrease) in $ Liabilities (Increase or decrease) in $ Equities (Increase or decrease) in $ $10,000 (increase) Equities (Increase or decrease) in $ 7/11/2022 The firm received an electrical bill ($700) and will bepaid in 2 months 10/11/2022 The firm purchased 2 tons of sugar as inventory for $5,000. Paid in cash $1,000 and the remaining amount was settled in 20/11/2022 20/11/2022 The firm paid in cash to settle the transaction that occurred on 10/11/2022. 21/11/2022 A trade receivable, who owes $7,000, made a part payment of $6,000.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The breakdown of the financial impact for each transaction are as follows Transactions Date Transac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started