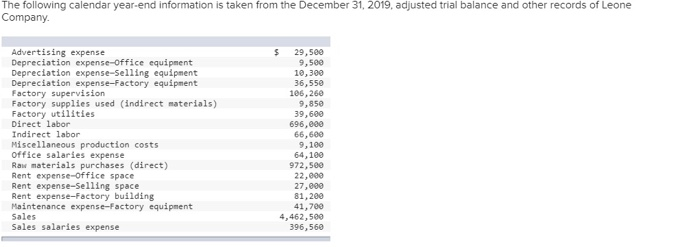

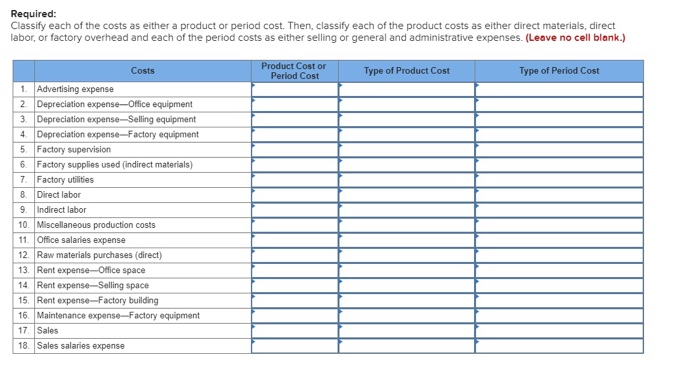

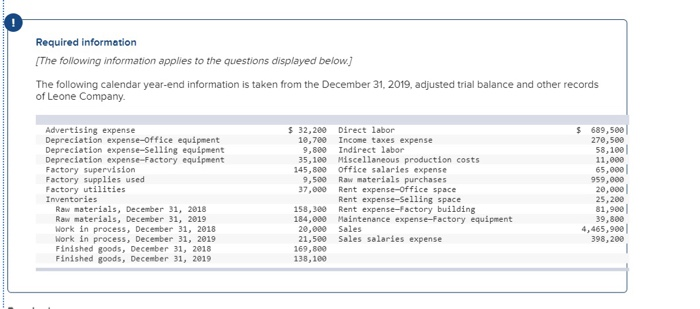

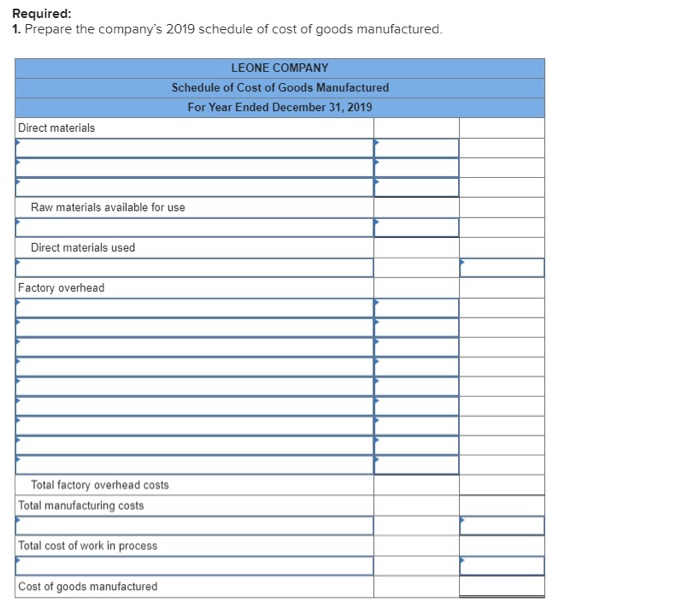

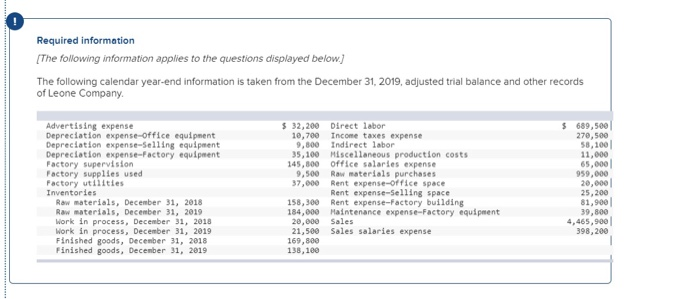

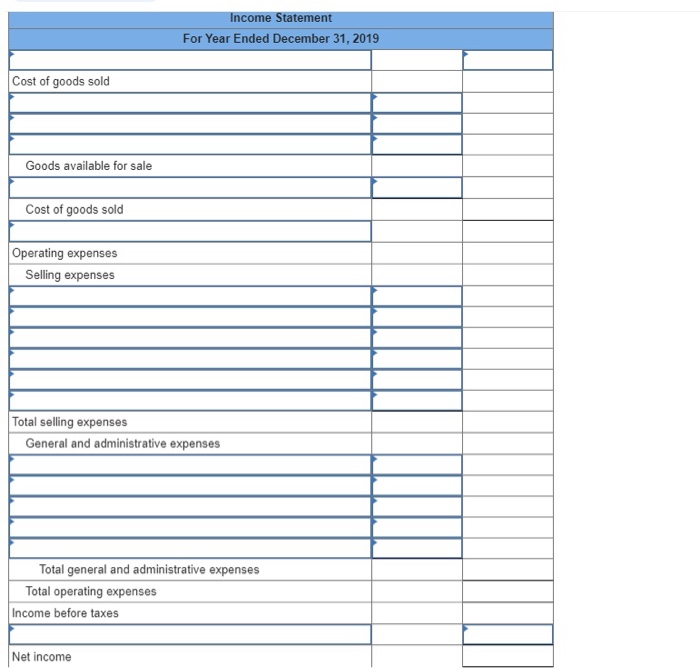

The following calendar year-end information is taken from the December 31, 2019, adjusted trial balance and other records of Leone Company $ Advertising expense Depreciation expense-Office equipment Depreciation expense-selling equipment Depreciation expense-Factory equipment Factory supervision Factory supplies used indirect materials) Factory utilities Direct labor Indirect labor Miscellaneous production costs Office salaries expense Raw materials purchases (direct) Rent expense-Office space Rent expense-selling space Rent expense-Factory building Maintenance expense-Factory equipment Sales Sales salaries expense 29,50 9,500 10.300 36.550 106,260 9.850 39,600 696.000 66,600 9.100 64,100 972,500 22,000 27,000 81,200 41,700 4,462,500 396,560 Required: Classify each of the costs as either a product or period cost. Then, classify each of the product costs as either direct materials, direct labor, or factory overhead and each of the period costs as either selling or general and administrative expenses. (Leave no cell blank.) Costs Product Cost or Period Cost Type of Product Cost Type of Period Cost 1. Advertising expense 2 Depreciation expense-Office equipment 3. Depreciation expense-Selling equipment 4. Depreciation expense-Factory equipment 5 Factory supervision 6 Factory supplies used indirect materials) 7. Factory utilities 8. Direct labor 9 indirect labor 10. Miscellaneous production costs 11. Office salaries expense 12. Raw materials purchases (direct) 13. Rent expense-Office space 14. Rent expense-Selling space 15 Rent expense-Factory building 16. Maintenance expense-Factory equipment 17 Sales 18 Sales salaries expense Required information The following information applies to the questions displayed below.) The following calendar year-end information is taken from the December 31, 2019, adjusted trial balance and other records of Leone Company $ Advertising expense Depreciation expense-office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Factory supervision Factory supplies used Factory utilities Inventories Raw materials, December 31, 2018 Raw materials, December 31, 2019 Work in process, December 31, 2018 Work in process, December 31, 2019 Finished goods, December 31, 2018 Finished goods, December 31, 2019 $32.209 Direct labor 10.709 Income taxes expense 9,809 Indirect labor 35,169 Miscellaneous production costs 145.800 office salaries expense 9.500 Raw materials purchases 37,000 Rent expense-Office space Rent expense-Selling space 158,300 Rent expense-Factory building 184,000 Maintenance expense-Factory equipment 20.000 Sales 21,500 Sales salaries expense 169,800 138.100 689.500 270,500 58,100 11.000 65.000 999,000 20.000 25. 200 81,900 39.800 4,465,9001 398,200 Required: 1. Prepare the company's 2019 schedule of cost of goods manufactured. LEONE COMPANY Schedule of Cost of Goods Manufactured For Year Ended December 31, 2019 Direct materials Raw materials available for use Direct materials used Factory overhead Total factory overhead costs Total manufacturing costs Total cost of work in process Cost of goods manufactured Required information The following information applies to the questions displayed below.] The following calendar year-end information is taken from the December 31, 2019, adjusted trial balance and other records of Leone Company Advertising expense Depreciation expense-office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Factory supervision Factory supplies used Factory utilities Inventories Raw materials, December 31, 2018 Raw materials, December 31, 2019 Work in process, December 31, 2018 Work in process, December 31, 2019 Finished goods, December 31, 2018 Finished goods, December 31, 2019 $ 32,200 Direct labor 10,700 Income taxes expense 9.800 Indirect labor 35,100 Miscellaneous production costs 145,000 office salaries expense 9.500 Raw materials purchases 37,000 Rent expense-office space Rent expense-selling space 158,300 Rent expense-Factory building 184,000 Maintenance expense-Factory equipment 20,000 Sales 21.500 Sales salaries expense 169,800 138,100 689.500 270.500 58,100 11,000 65,000 959.000 20,000 25,200 81,900 39,800 4,465,900 398,200 Income Statement For Year Ended December 31, 2019 Cost of goods sold Goods available for sale Cost of goods sold Operating expenses Selling expenses Total selling expenses General and administrative expenses Total general and administrative expenses Total operating expenses Income before taxes Net income