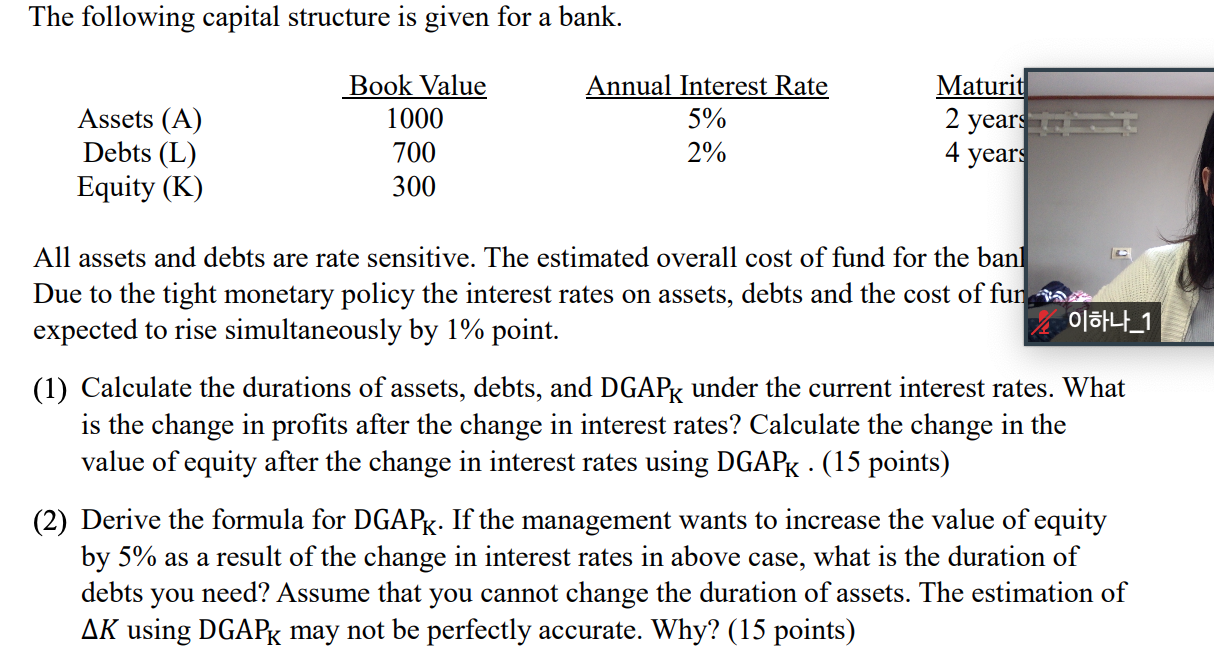

The following capital structure is given for a bank. Assets (A) Debts (L) Equity (K) Book Value 1000 700 300 Annual Interest Rate 5% 2% Maturit 2 years 4 years All assets and debts are rate sensitive. The estimated overall cost of fund for the band Due to the tight monetary policy the interest rates on assets, debts and the cost of fun ia expected to rise simultaneously by 1% point. 1 (1) Calculate the durations of assets, debts, and DGAPk under the current interest rates. What is the change in profits after the change in interest rates? Calculate the change in the value of equity after the change in interest es using DGAPK - (15 points) (2) Derive the formula for DGAPK. If the management wants to increase the value of equity by 5% as a result of the change in interest rates in above case, what is the duration of debts you need? Assume that you cannot change the duration of assets. The estimation of AK using DGAP, may not be perfectly accurate. Why? (15 points) The following capital structure is given for a bank. Assets (A) Debts (L) Equity (K) Book Value 1000 700 300 Annual Interest Rate 5% 2% Maturity 2 years 4 years All assets and debts are rate sensitive. The estimated overall cost of fund for the bank is 3%. Due to the tight monetary policy the interest rates on assets, debts and the cost of fund are expected to rise simultaneously by 1% point. (1) Calculate the durations of assets, debts, and DGAPk under the current interest rates. What is the change in profits after the change in interest rates Calculate the change in the value of equity after the change in interest rates using DGAPK (15 points) (2) Derive the formula for DGAPK. If the management wants to increase the value of equity by 5% as a result of the change in interest rates in above case, what is the duration of debts you need? Assume that you cannot change the duration of assets. The estimation of AK using DGAPK may not be perfectly accurate. Why? (15 points) The following capital structure is given for a bank. Assets (A) Debts (L) Equity (K) Book Value 1000 700 300 Annual Interest Rate 5% 2% Maturit 2 years 4 years All assets and debts are rate sensitive. The estimated overall cost of fund for the band Due to the tight monetary policy the interest rates on assets, debts and the cost of fun ia expected to rise simultaneously by 1% point. 1 (1) Calculate the durations of assets, debts, and DGAPk under the current interest rates. What is the change in profits after the change in interest rates? Calculate the change in the value of equity after the change in interest es using DGAPK - (15 points) (2) Derive the formula for DGAPK. If the management wants to increase the value of equity by 5% as a result of the change in interest rates in above case, what is the duration of debts you need? Assume that you cannot change the duration of assets. The estimation of AK using DGAP, may not be perfectly accurate. Why? (15 points) The following capital structure is given for a bank. Assets (A) Debts (L) Equity (K) Book Value 1000 700 300 Annual Interest Rate 5% 2% Maturity 2 years 4 years All assets and debts are rate sensitive. The estimated overall cost of fund for the bank is 3%. Due to the tight monetary policy the interest rates on assets, debts and the cost of fund are expected to rise simultaneously by 1% point. (1) Calculate the durations of assets, debts, and DGAPk under the current interest rates. What is the change in profits after the change in interest rates Calculate the change in the value of equity after the change in interest rates using DGAPK (15 points) (2) Derive the formula for DGAPK. If the management wants to increase the value of equity by 5% as a result of the change in interest rates in above case, what is the duration of debts you need? Assume that you cannot change the duration of assets. The estimation of AK using DGAPK may not be perfectly accurate. Why? (15 points)