Answered step by step

Verified Expert Solution

Question

1 Approved Answer

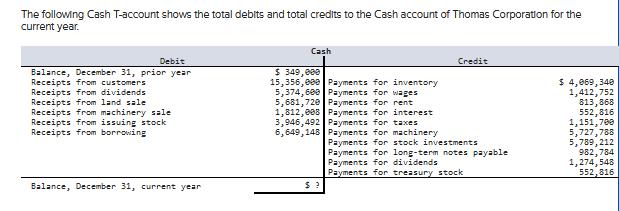

The following Cash T-account shows the total debits and total credits to the Cash account of Thomas Corporation for the current year. Debit Balance,

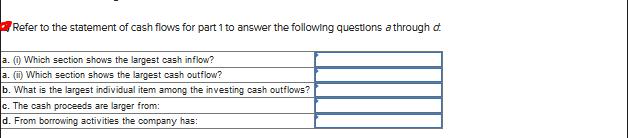

The following Cash T-account shows the total debits and total credits to the Cash account of Thomas Corporation for the current year. Debit Balance, December 31, prior year Receipts from customers Receipts from dividends Receipts from land sale Receipts from machinery sale Receipts from issuing stock Receipts from borrowing Balance, December 31, current year Cash $ 349,000 15,356,000 Payments for inventory 5,374,600 Payments for wages 5,681,720 Payments for rent 1,812,808 Payments for interest 3,946,492 Payments for taxes 6,649,148 Payments for machinery $? Credit Payments for stock investments Payments for long-term notes payable. Payments for dividends Payments for treasury stock $ 4,069,340 1,412,752 813,868 552,816 1,151,700 5,727,788 5,789,212 982,784 1,274,548 552,816 Refer to the statement of cash flows for part 1 to answer the following questions a through d a. (1) Which section shows the largest cash inflow? a. (ii) Which section shows the largest cash outflow? b. What is the largest individual item among the investing cash outflows? c. The cash proceeds are larger from: d. From borrowing activities the company has:

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a 1 Which section shows the largest cash inflow The financing section shows the largest cash inflow ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started