Question

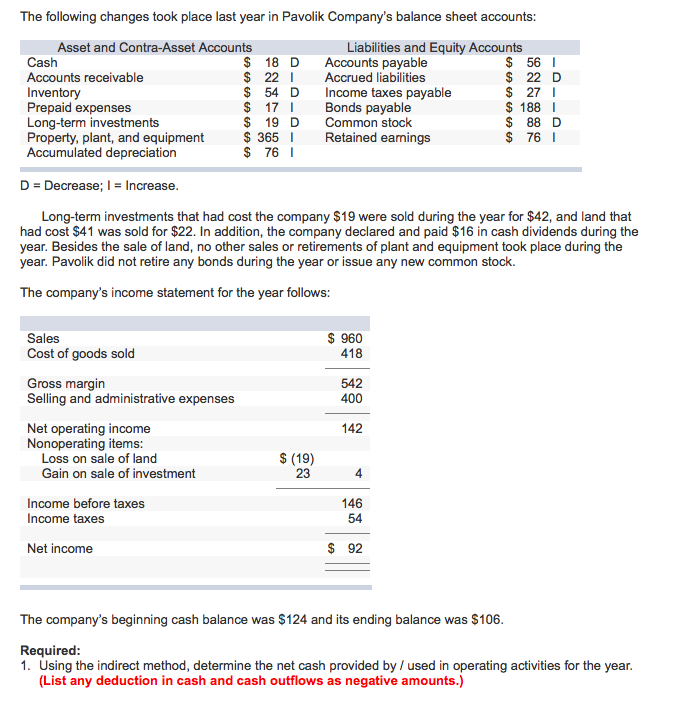

The following changes took place last year in Pavolik Companys balance sheet accounts: Long-term investments that had cost the company $19 were sold during the

The following changes took place last year in Pavolik Companys balance sheet accounts:

Long-term investments that had cost the company $19 were sold during the year for $42, and land that had cost $41 was sold for $22. In addition, the company declared and paid $16 in cash dividends during the year. Besides the sale of land, no other sales or retirements of plant and equipment took place during the year. Pavolik did not retire any bonds during the year or issue any new common stock.

The companys income statement for the year follows:

The companys beginning cash balance was $124 and its ending balance was $106.

Required:

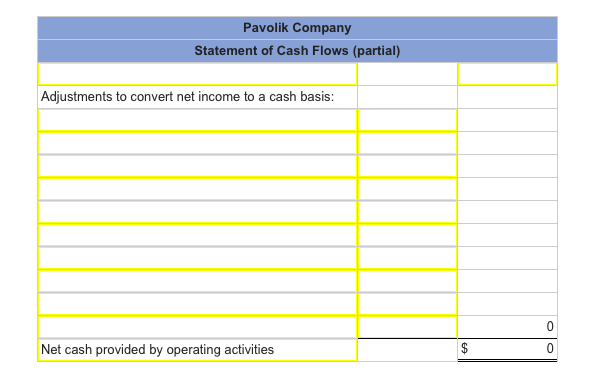

1. Using the indirect method, determine the net cash provided by / used in operating activities for the year. (List any deduction in cash and cash outflows as negative amounts.)

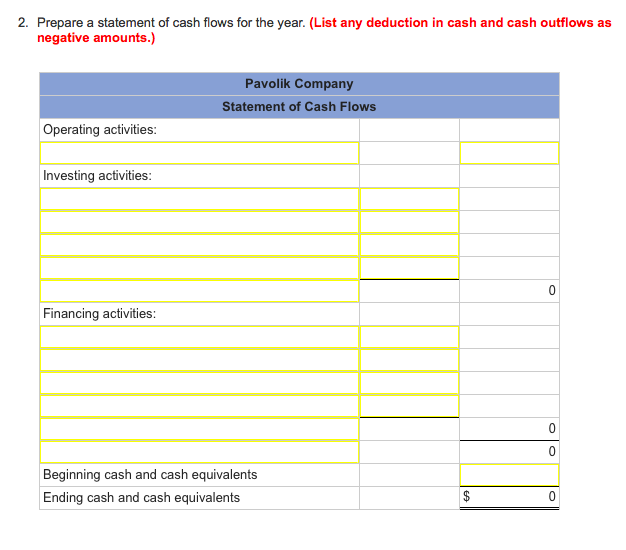

2. Prepare a statement of cash flows for the year. (List any deduction in cash and cash outflows as negative amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started