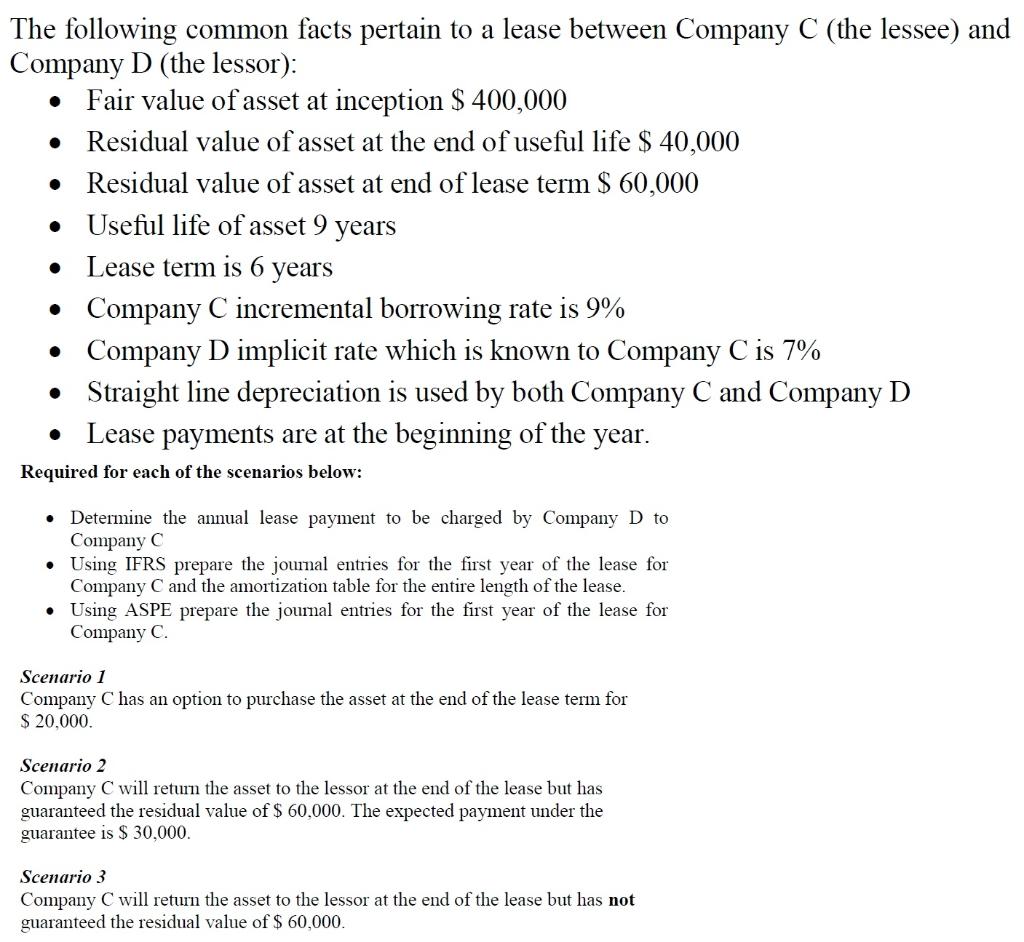

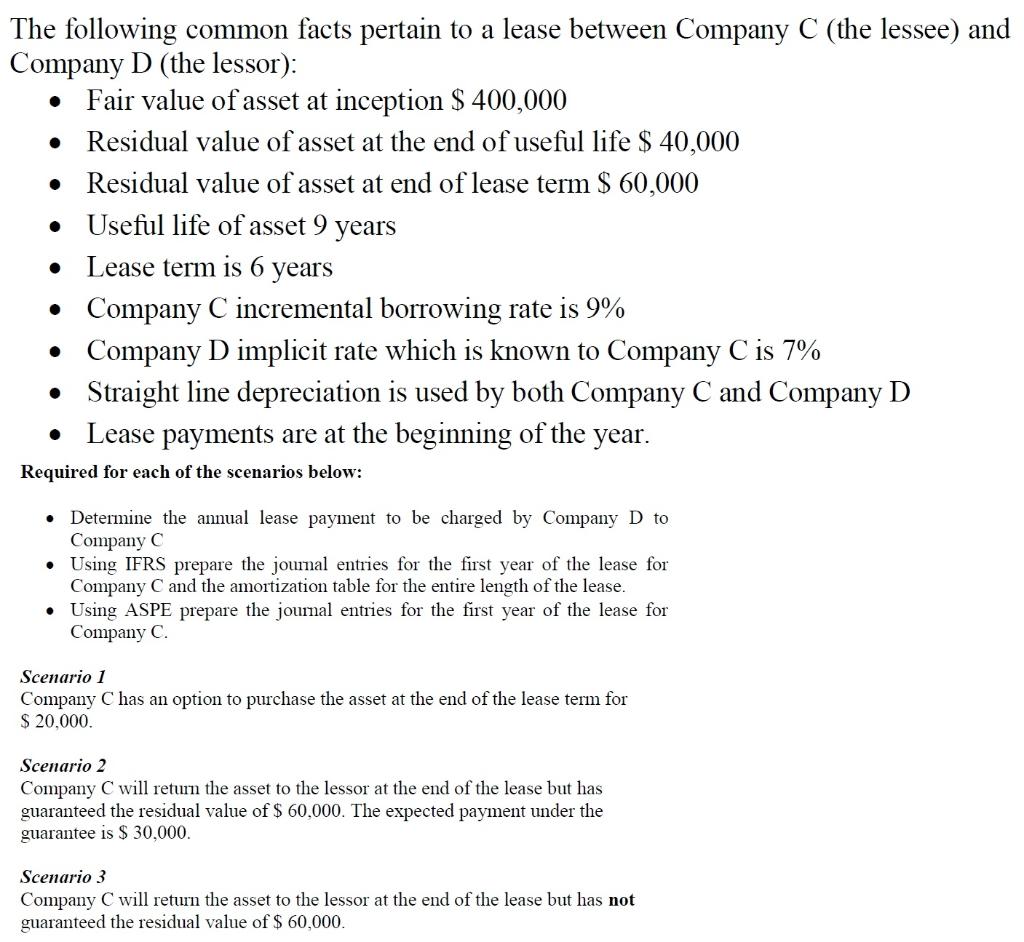

The following common facts pertain to a lease between Company C (the lessee) and Company D (the lessor): Fair value of asset at inception $ 400,000 Residual value of asset at the end of useful life $ 40,000 Residual value of asset at end of lease term $ 60,000 Useful life of asset 9 years Lease term is 6 years Company C incremental borrowing rate is 9% Company D implicit rate which is known to Company C is 7% Straight line depreciation is used by both Company C and Company D Lease payments are at the beginning of the year. . Required for each of the scenarios below: . Determine the annual lease payment to be charged by Company D to Company C Using IFRS prepare the journal entries for the first year of the lease for Company C and the amortization table for the entire length of the lease. Using ASPE prepare the journal entries for the first year of the lease for Company C. Scenario 1 Company C has an option to purchase the asset at the end of the lease term for $ 20,000. Scenario 2 Company C will return the asset to the lessor at the end of the lease but has guaranteed the residual value of $ 60,000. The expected payment under the guarantee is $ 30,000. Scenario 3 Company C will return the asset to the lessor at the end of the lease but has not guaranteed the residual value of $ 60,000. The following common facts pertain to a lease between Company C (the lessee) and Company D (the lessor): Fair value of asset at inception $ 400,000 Residual value of asset at the end of useful life $ 40,000 Residual value of asset at end of lease term $ 60,000 Useful life of asset 9 years Lease term is 6 years Company C incremental borrowing rate is 9% Company D implicit rate which is known to Company C is 7% Straight line depreciation is used by both Company C and Company D Lease payments are at the beginning of the year. . Required for each of the scenarios below: . Determine the annual lease payment to be charged by Company D to Company C Using IFRS prepare the journal entries for the first year of the lease for Company C and the amortization table for the entire length of the lease. Using ASPE prepare the journal entries for the first year of the lease for Company C. Scenario 1 Company C has an option to purchase the asset at the end of the lease term for $ 20,000. Scenario 2 Company C will return the asset to the lessor at the end of the lease but has guaranteed the residual value of $ 60,000. The expected payment under the guarantee is $ 30,000. Scenario 3 Company C will return the asset to the lessor at the end of the lease but has not guaranteed the residual value of $ 60,000