Answered step by step

Verified Expert Solution

Question

1 Approved Answer

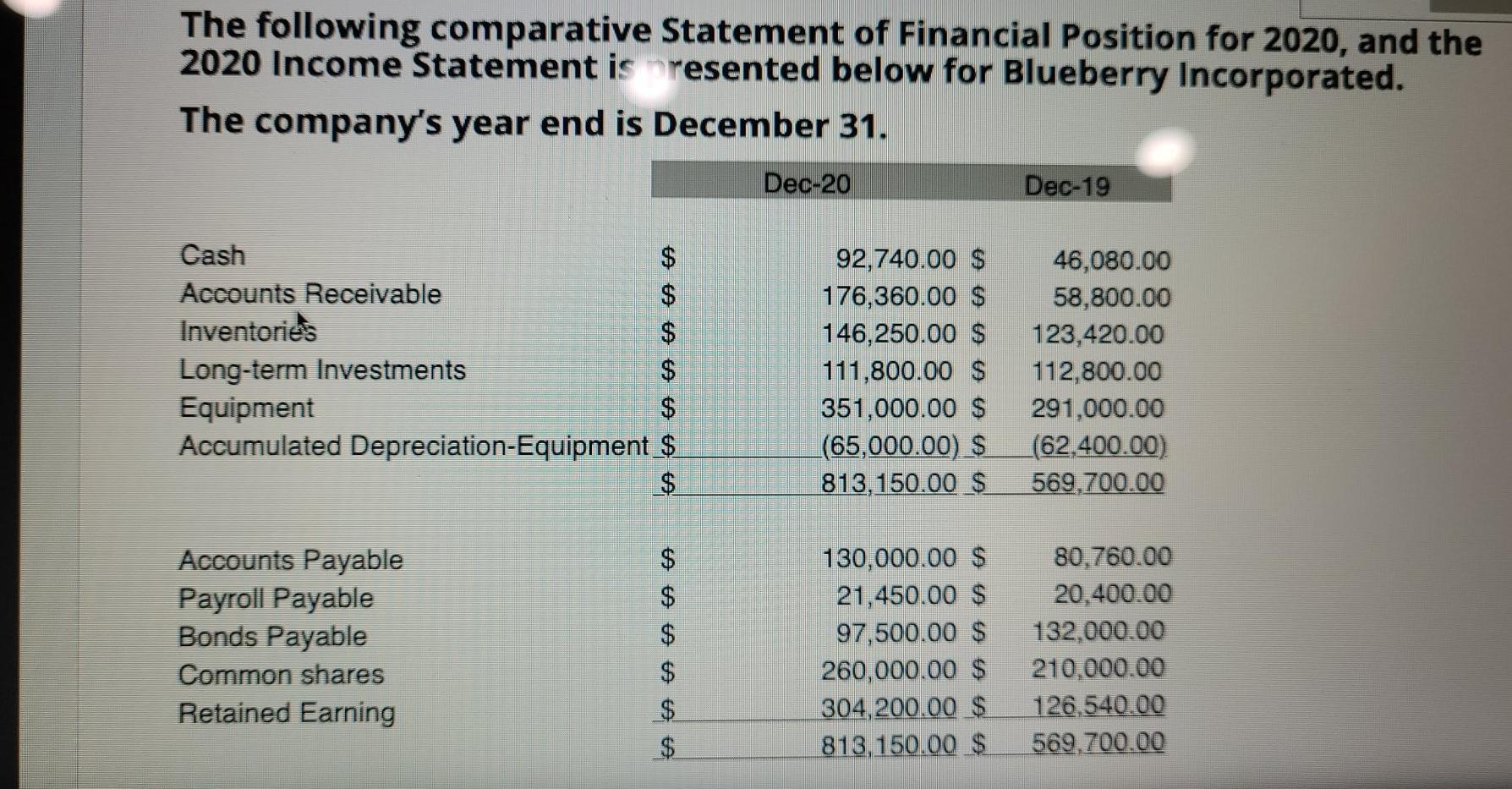

The following comparative Statement of Financial Position for 2020, and the 2020 Income Statement is resented below for Blueberry Incorporated. The company's year end is

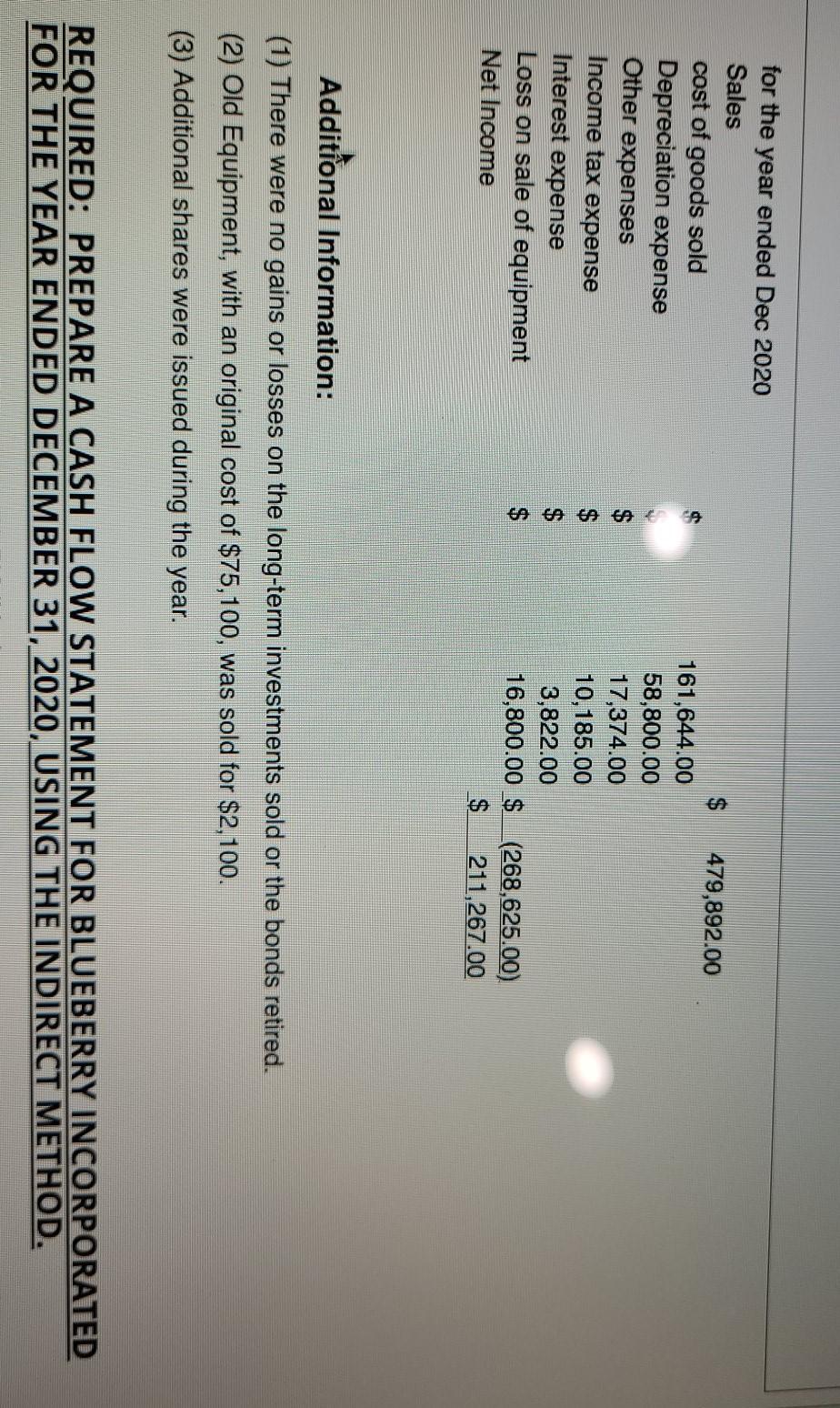

The following comparative Statement of Financial Position for 2020, and the 2020 Income Statement is resented below for Blueberry Incorporated. The company's year end is December 31. Dec-20 Dec-19 Cash $ Accounts Receivable $ Inventories Long-term Investments $ Equipment $ Accumulated Depreciation Equipment_$ 92,740.00 $ 176,360.00 $ 146,250.00 $ 111,800.00 $ 351,000.00 $ _(65,000.00 $ 813,150.00 $ 46,080.00 58,800.00 123,420.00 112,800.00 291,000.00 _(62.400.00) 569,700.00 Accounts Payable Payroll Payable Bonds Payable Common shares Retained Earning 00000 130,000.00 $ 21,450.00 $ 97,500.00 $ 260,000.00 $ 304,200.00 $ 813,150.00 $ 80,760.00 20,400.00 132,000.00 210,000.00 126,540.00 569.700.00 for the year ended Dec 2020 Sales cost of goods sold Depreciation expense Other expenses Income tax expense Interest expense Loss on sale of equipment Net Income EA GA GA GA & 479,892.00 161,644.00 58,800.00 17,374.00 10,185.00 3,822.00 16,800.00 $ (268,625.00) $ 211,267.00 Additional Information: (1) There were no gains or losses on the long-term investments sold or the bonds retired. (2) Old Equipment, with an original cost of $75,100, was sold for $2,100. (3) Additional shares were issued during the year. REQUIRED: PREPARE A CASH FLOW STATEMENT FOR BLUEBERRY INCORPORATED FOR THE YEAR ENDED DECEMBER 31, 2020, USING THE INDIRECT METHOD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started