Answered step by step

Verified Expert Solution

Question

1 Approved Answer

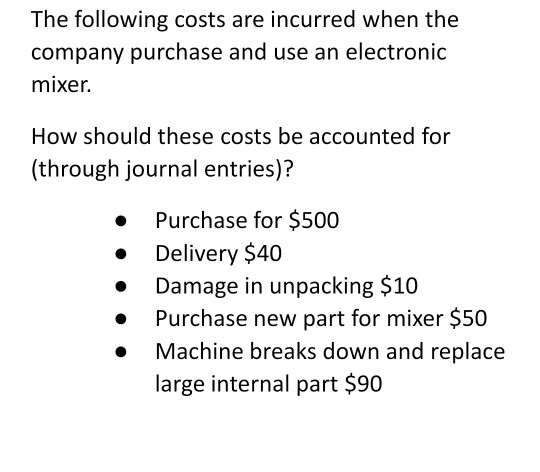

The following costs are incurred when the company purchase and use an electronic mixer. How should these costs be accounted for (through journal entries)? Purchase

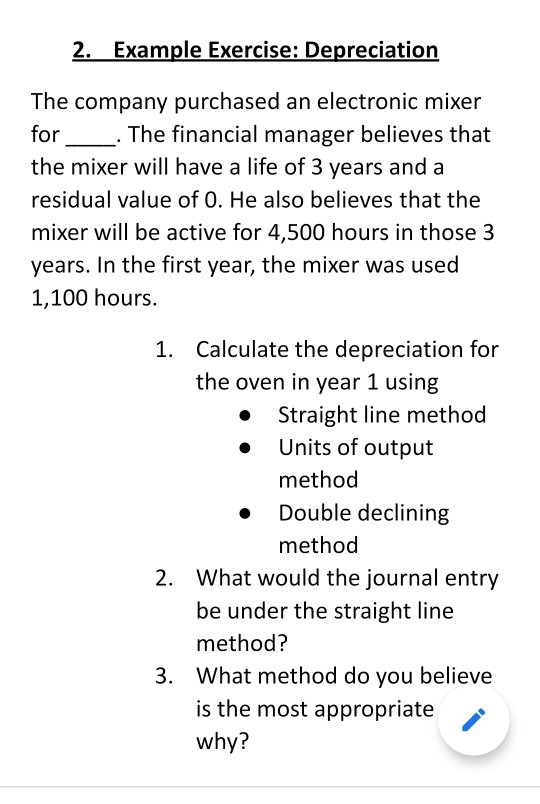

The following costs are incurred when the company purchase and use an electronic mixer. How should these costs be accounted for (through journal entries)? Purchase for $500 Delivery $40 Damage in unpacking $10 Purchase new part for mixer $50 Machine breaks down and replace large internal part $90 2. Example Exercise: Depreciation The company purchased an electronic mixer for . The financial manager believes that the mixer will have a life of 3 years and a residual value of 0. He also believes that the mixer will be active for 4,500 hours in those 3 years. In the first year, the mixer was used 1,100 hours. 1. Calculate the depreciation for the oven in year 1 using Straight line method Units of output method Double declining method 2. What would the journal entry be under the straight line method? 3. What method do you believe is the most appropriate why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started