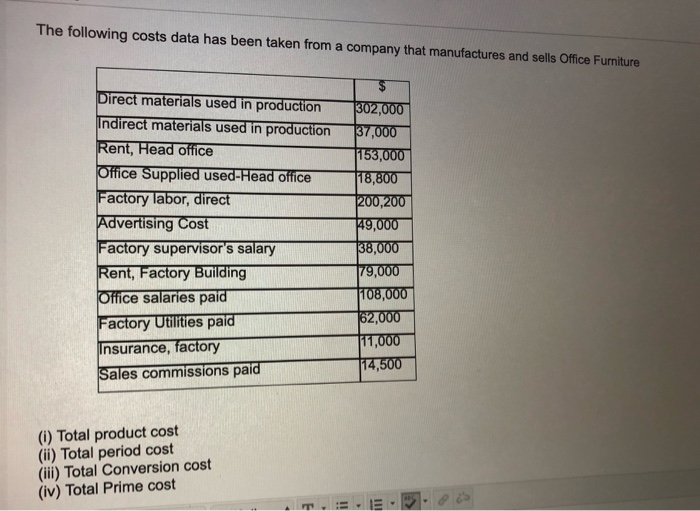

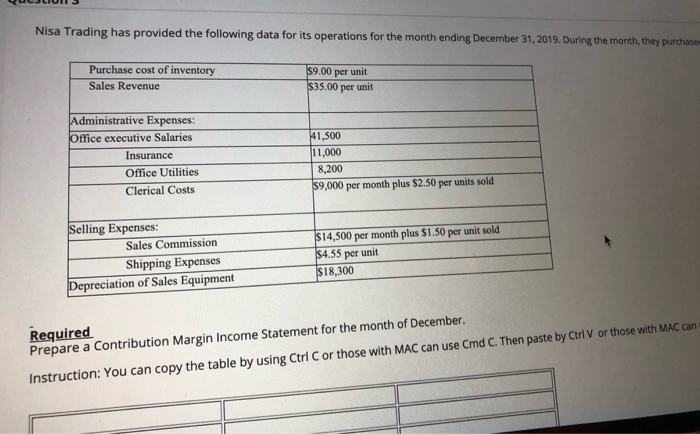

The following costs data has been taken from a company that manufactures and sells Office Furniture Direct materials used in production Indirect materials used in production Rent, Head office Office Supplied used-Head Office Factory labor, direct Advertising Cost Factory supervisor's salary Rent, Factory Building Office salaries paid Factory Utilities paid Insurance, factory Sales commissions paid 302,000 137,000 153,000 118,800 200,200 149,000 38,000 179,000 108,000 162,000 11,000 14,500 (i) Total product cost (ii) Total period cost (iii) Total Conversion cost (iv) Total Prime cost Nisa Trading has provided the following data for its operations for the month ending December 31, 2019. During the month, they purchase Purchase cost of inventory Sales Revenue $9.00 per unit $35.00 per unit Administrative Expenses: Office executive Salaries Insurance Office Utilities Clerical Costs 41,500 11,000 8,200 $9,000 per month plus $2.50 per units sold Selling Expenses: Sales Commission Shipping Expenses Depreciation of Sales Equipment $14,500 per month plus $1.50 per unit sold $4.55 per unit $18,300 Required Prepare a Contribution Margin Income Statement for the month of December Instruction: You can copy the table by using Ctrl C or those with MAC can use Cmd C. Then paste by Ctrl V or those with MAC can The following costs data has been taken from a company that manufactures and sells Office Furniture Direct materials used in production Indirect materials used in production Rent, Head office Office Supplied used-Head Office Factory labor, direct Advertising Cost Factory supervisor's salary Rent, Factory Building Office salaries paid Factory Utilities paid Insurance, factory Sales commissions paid 302,000 137,000 153,000 118,800 200,200 149,000 38,000 179,000 108,000 162,000 11,000 14,500 (i) Total product cost (ii) Total period cost (iii) Total Conversion cost (iv) Total Prime cost Nisa Trading has provided the following data for its operations for the month ending December 31, 2019. During the month, they purchase Purchase cost of inventory Sales Revenue $9.00 per unit $35.00 per unit Administrative Expenses: Office executive Salaries Insurance Office Utilities Clerical Costs 41,500 11,000 8,200 $9,000 per month plus $2.50 per units sold Selling Expenses: Sales Commission Shipping Expenses Depreciation of Sales Equipment $14,500 per month plus $1.50 per unit sold $4.55 per unit $18,300 Required Prepare a Contribution Margin Income Statement for the month of December Instruction: You can copy the table by using Ctrl C or those with MAC can use Cmd C. Then paste by Ctrl V or those with MAC can