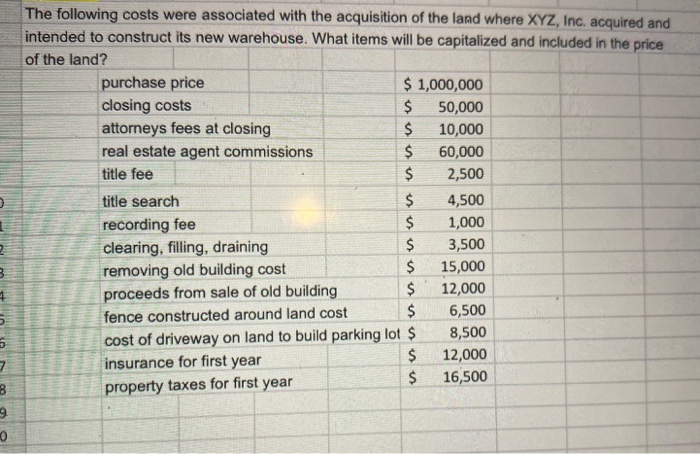

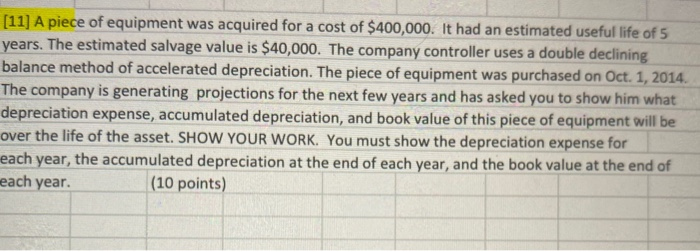

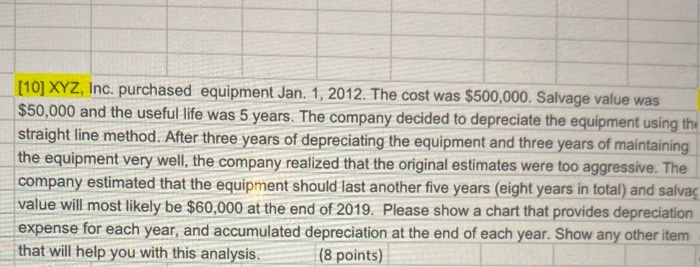

The following costs were associated with the acquisition of the land where XYZ, Inc. acquired and intended to construct its new warehouse. What items will be capitalized and included in the price of the land? purchase price $ 1,000,000 closing costs $ 50,000 attorneys fees at closing $ 10,000 real estate agent commissions $ 60,000 title fee $ 2,500 title search $ 4,500 recording fee $ 1,000 clearing, filling, draining $ 3,500 removing old building cost $ 15,000 proceeds from sale of old building $ 12,000 fence constructed around land cost $ 6,500 cost of driveway on land to build parking lot $ 8,500 insurance for first year $ 12,000 $ property taxes for first year 16,500 2 m 4 in US 7 8 9 0 [11] A piece of equipment was acquired for a cost of $400,000. It had an estimated useful life of 5 years. The estimated salvage value is $40,000. The company controller uses a double declining balance method of accelerated depreciation. The piece of equipment was purchased on Oct. 1, 2014 The company is generating projections for the next few years and has asked you to show him what depreciation expense, accumulated depreciation, and book value of this piece of equipment will be over the life of the asset. SHOW YOUR WORK. You must show the depreciation expense for each year, the accumulated depreciation at the end of each year, and the book value at the end of each year. (10 points) [10] XYZ, Inc. purchased equipment Jan. 1, 2012. The cost was $500,000. Salvage value was $50,000 and the useful life was 5 years. The company decided to depreciate the equipment using the straight line method. After three years of depreciating the equipment and three years of maintaining the equipment very well, the company realized that the original estimates were too aggressive. The company estimated that the equipment should last another five years (eight years in total) and salva value will most likely be $60,000 at the end of 2019. Please show a chart that provides depreciation expense for each year, and accumulated depreciation at the end of each year. Show any other item that will help you with this analysis. (8 points)