Question

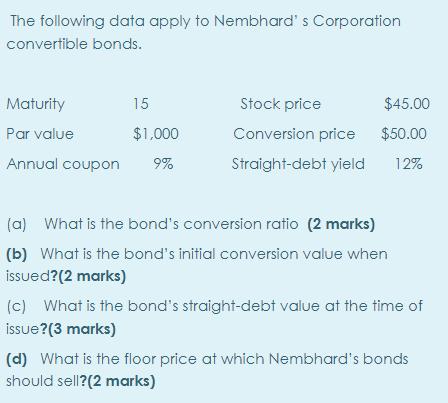

The following data apply to Nembhard's Corporation convertible bonds. Maturity 15 Par value $1,000 Annual coupon 9% $45.00 Stock price Conversion price $50.00 Straight-debt

The following data apply to Nembhard's Corporation convertible bonds. Maturity 15 Par value $1,000 Annual coupon 9% $45.00 Stock price Conversion price $50.00 Straight-debt yield 12% (a) What is the bond's conversion ratio (2 marks) (b) What is the bond's initial conversion value when issued? (2 marks) (c) What is the bond's straight-debt value at the time of issue? (3 marks) (d) What is the floor price at which Nembhard's bonds should sell? (2 marks)

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a The bonds conversion ratio is calculated by dividing the par value of the bond by the conversion p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis Using Financial Accounting Information

Authors: Charles H Gibson

12th Edition

1439080607, 978-1439080603

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App