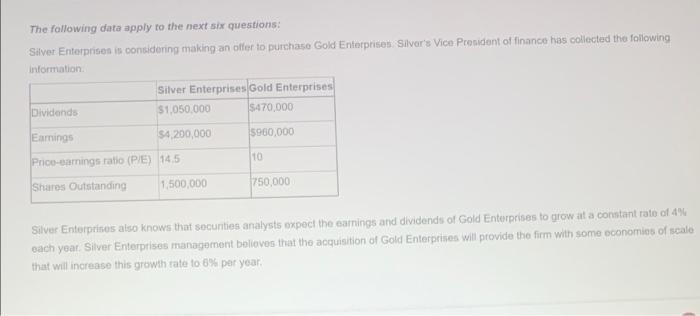

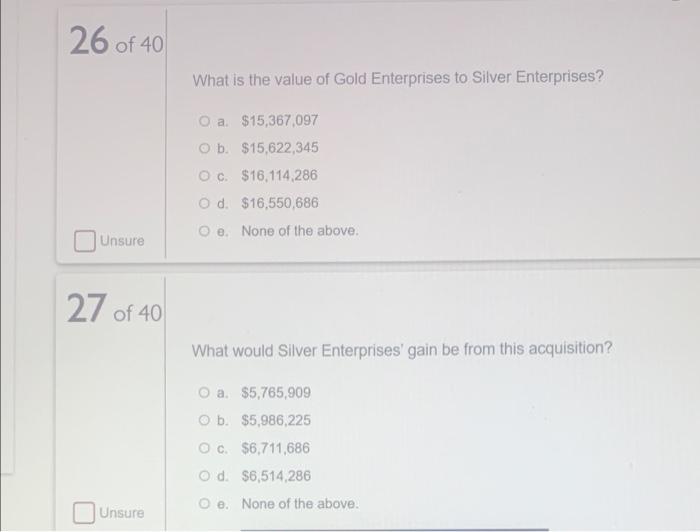

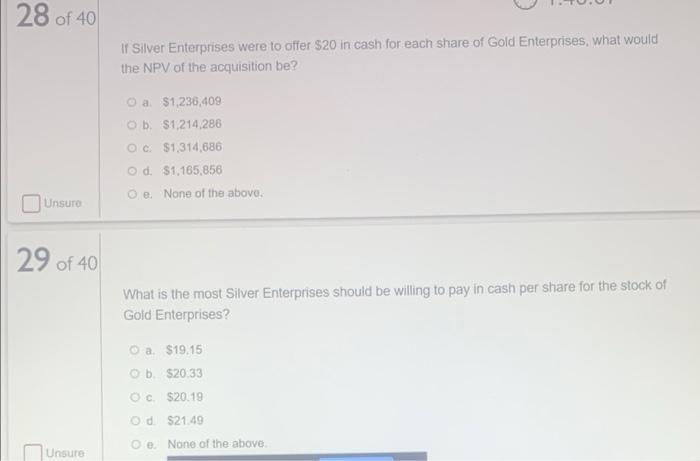

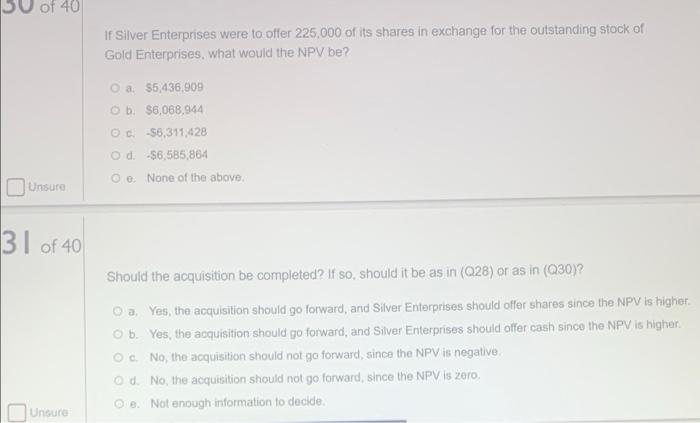

The following data apply to the next six questions: Silver Enterprisen is considering making an offer to purchase Gold Enterprises Silver's Vice Prendent of finance has collected the following information Silver Enterprises Gold Enterprises Dividends $1,050.000 $470.000 Earnings $4,200,000 5900,000 10 Price-samnings ratio (PE) 14.5 Sharos Outstanding 1,500,000 750.000 Silver Enterprises also knows that securities analysts expect the earnings and dividends of Gold Enterprises to grow at a constant rate of 4% each year. Silver Enterprises management boloves that the acquisition of Gold Enterprises will provide the firm with some economics of scale that will increase this growth rate to 6% per year 26 of 40 What is the value of Gold Enterprises to Silver Enterprises? O a $15,367,097 O b. $15,622,345 Oc. $16,114,286 Od $16,550,686 Oe. None of the above. Unsure 27 of 40 What would Silver Enterprises' gain be from this acquisition? O a $5,765,909 O b. $5,986,225 Oc. $6,711,686 Od $6,514,286 e. None of the above. Unsure 28 of 40 If Silver Enterprises were to offer $20 in cash for each share of Gold Enterprises, what would the NPV of the acquisition be? O a $1,236,409 Ob $1,214,286 OC $1,314,686 Od $1.165,856 O e None of the above. Unsurd 29 of 40 What is the most Silver Enterprises should be willing to pay in cash per share for the stock of Gold Enterprises? O a $19.15 Ob $20:33 OC S20.19 Od $21.49 Oe. None of the above Unsure U of 40 If Silver Enterprises were to offer 225,000 of its shares in exchange for the outstanding stock of Gold Enterprises, what would the NPV be? a $5,436,909 Ob: $6,068,944 OC -56,311,428 Od: $6,585,864 0 None of the above Unsure 31 of 40 Should the acquisition be completed? If so, should it be as in (Q28) or as in (Q30)? Da Yes, the acquisition should go forward, and Silver Enterprises should offer shares since the NPV is higher Ob. Yes, the acquisition should go forward, and Silver Enterprises should offer cash since the NPV is higher OoNothe acquisition should not go forward, since the NPV is negative, Od No, the acquisition should not go forward, since the NPV is zero. Oe. Not enough information to decide Unsure