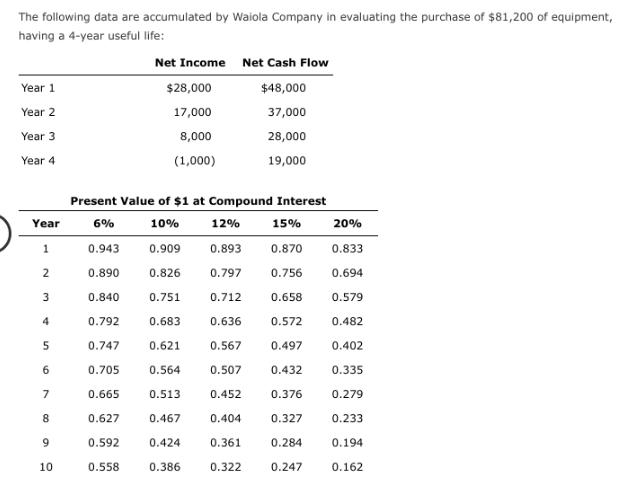

The following data are accumulated by Waiola Company in evaluating the purchase of $81,200 of equipment, having a 4-year useful life: Net Income Net

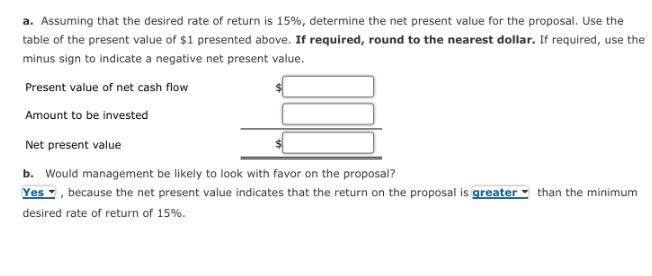

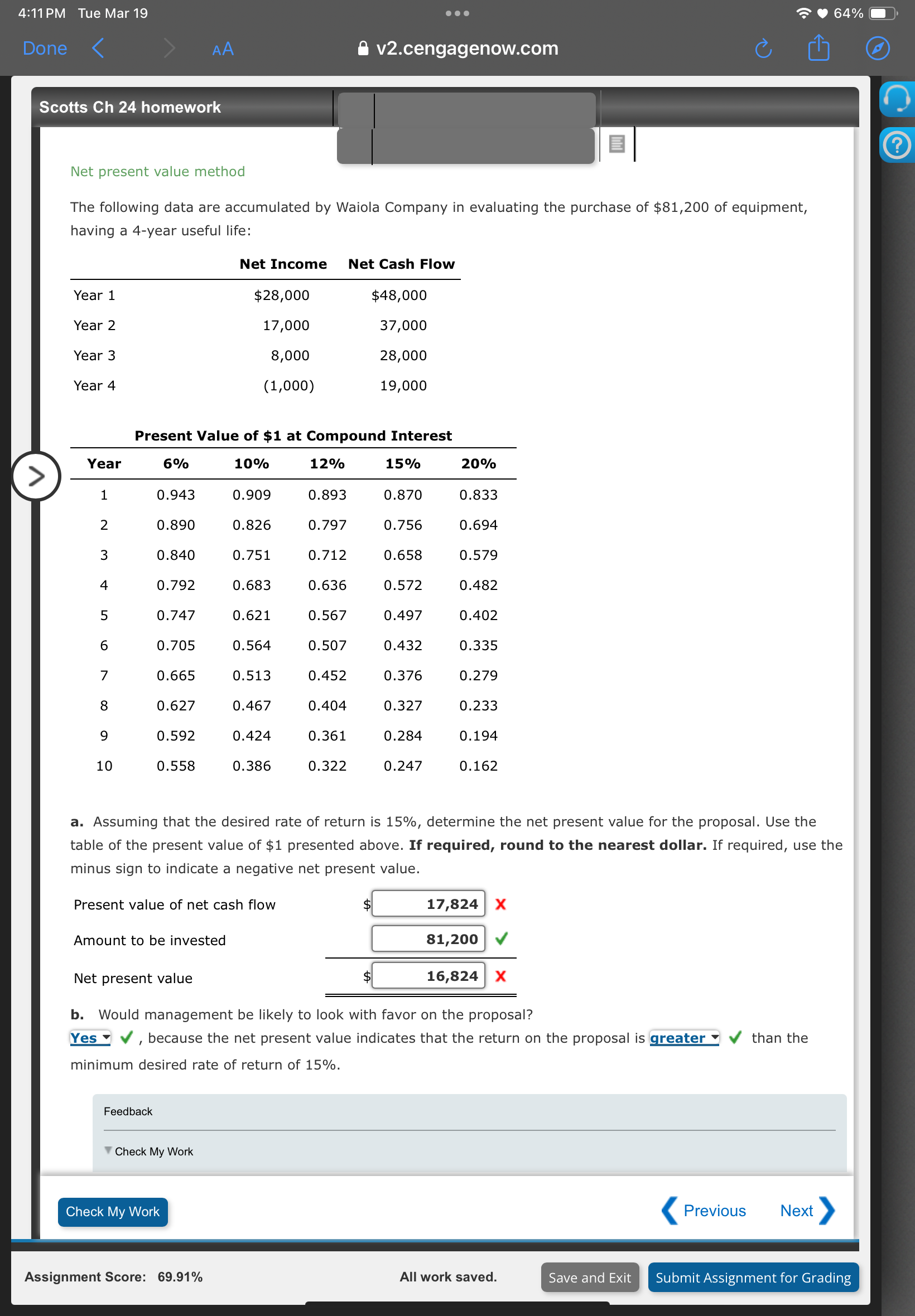

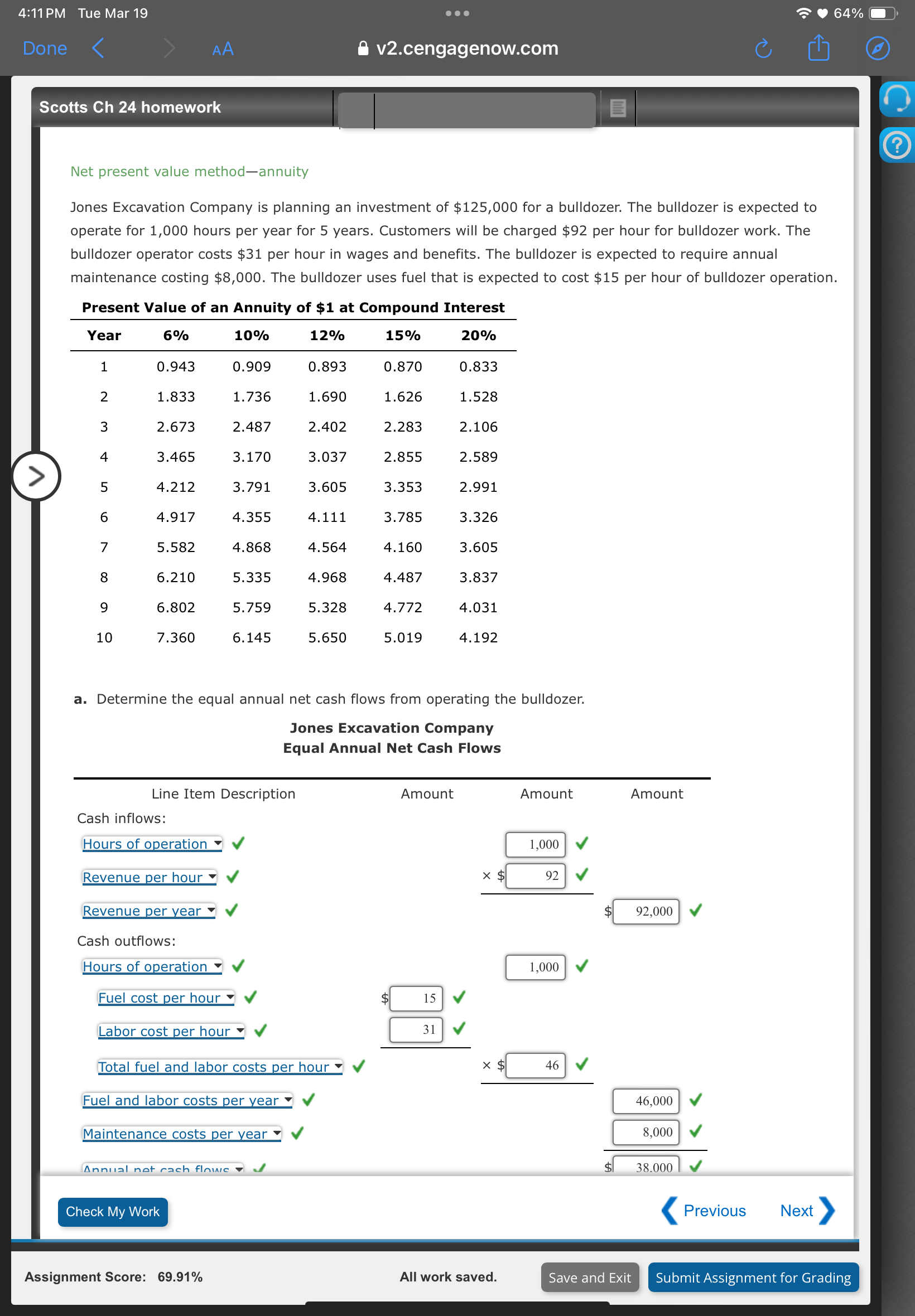

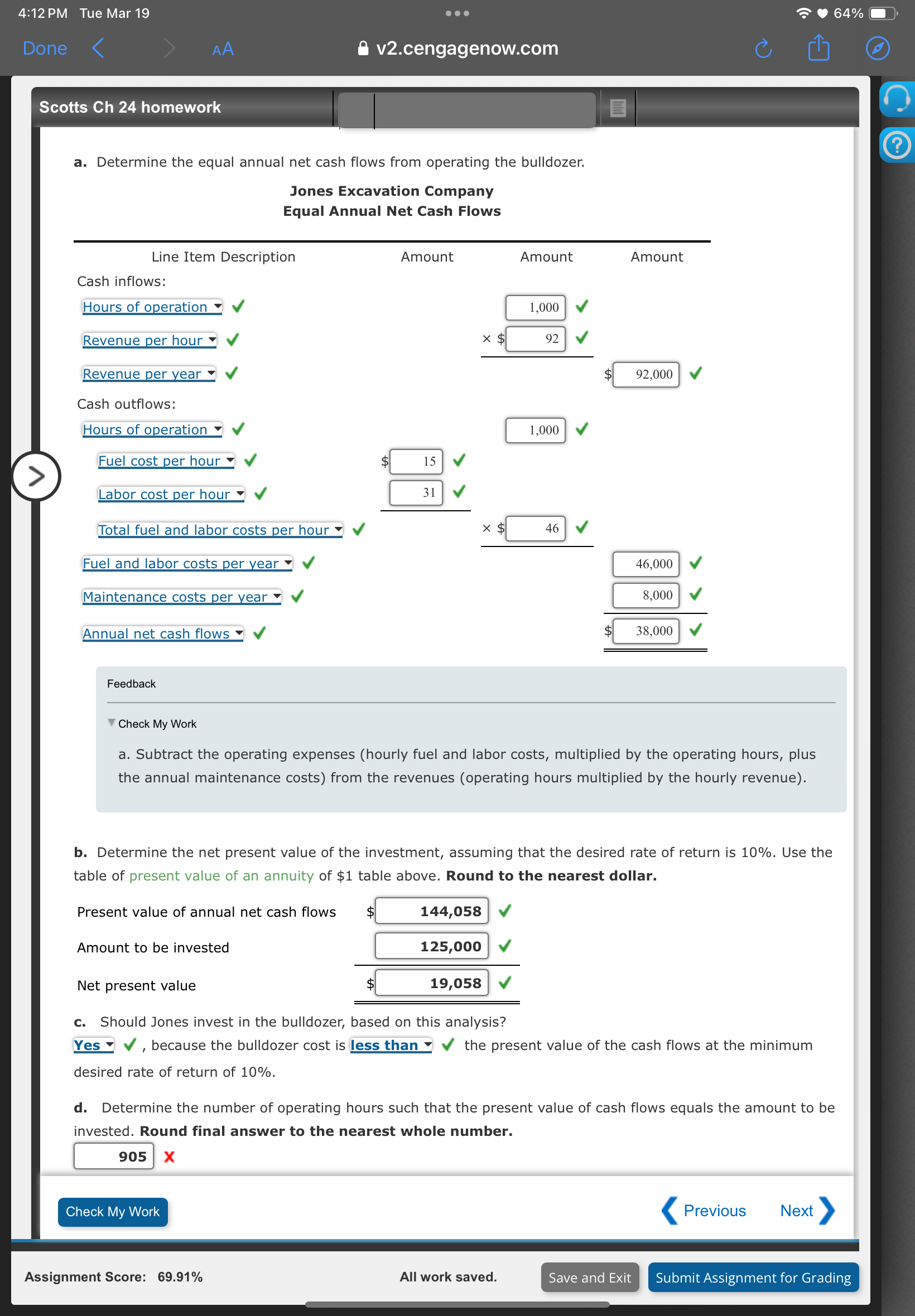

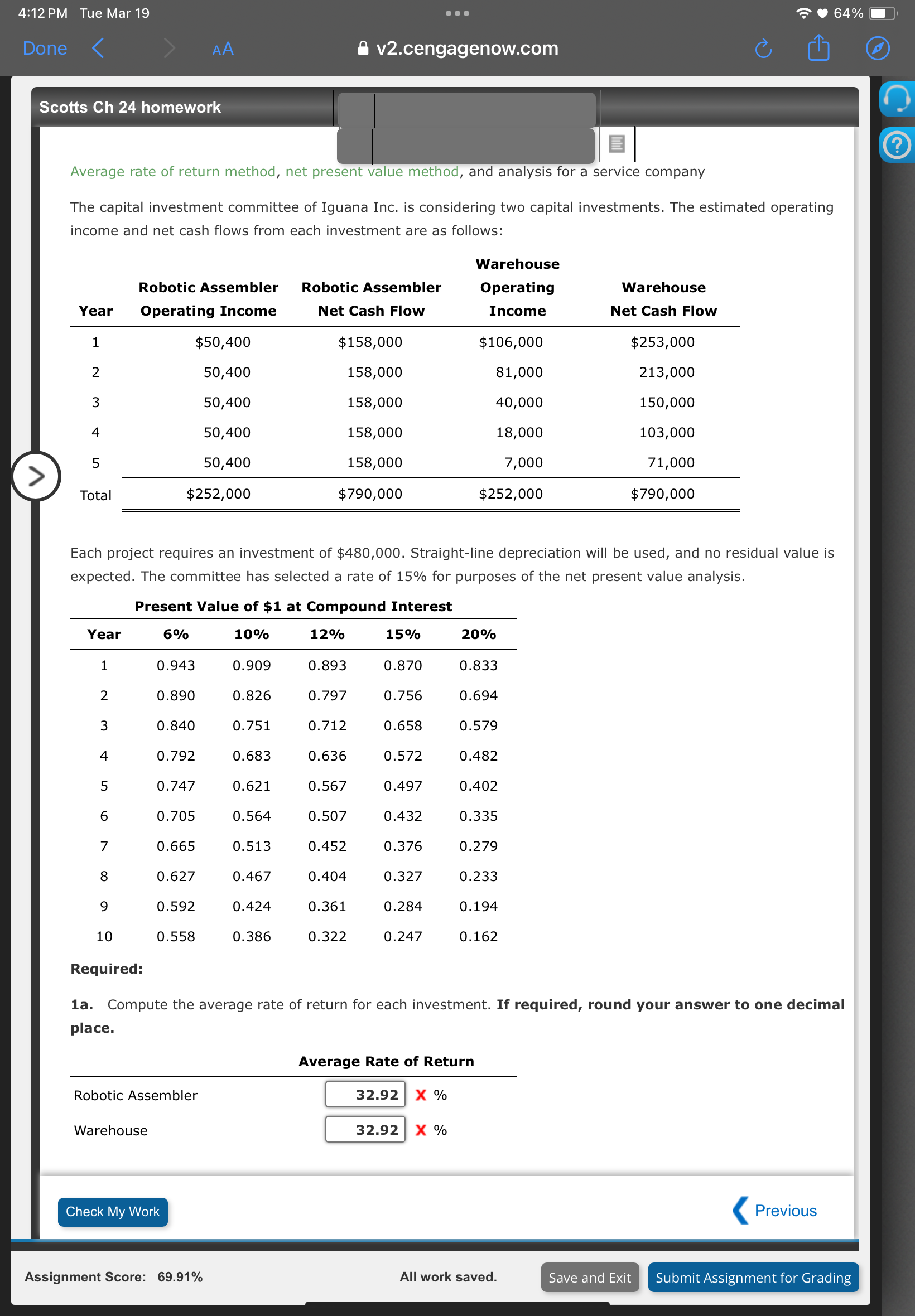

The following data are accumulated by Waiola Company in evaluating the purchase of $81,200 of equipment, having a 4-year useful life: Net Income Net Cash Flow Year 1 $28,000 $48,000 Year 2 17,000 37,000 Year 3 8,000 28,000 Year 4 (1,000) 19,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 10 0.558 0.386 0.322 0.247 0.162 a. Assuming that the desired rate of return is 15%, determine the net present value for the proposal. Use the table of the present value of $1 presented above. If required, round to the nearest dollar. If required, use the minus sign to indicate a negative net present value. Present value of net cash flow Amount to be invested Net present value b. Would management be likely to look with favor on the proposal? Yes, because the net present value indicates that the return on the proposal is greater than the minimum desired rate of return of 15%. 4:11 PM Tue Mar 19 Done AA v2.cengagenow.com Scotts Ch 24 homework Net present value method The following data are accumulated by Waiola Company in evaluating the purchase of $81,200 of equipment, having a 4-year useful life: Net Income Net Cash Flow Year 1 Year 2 Year 3 Year 4 $28,000 $48,000 17,000 37,000 8,000 28,000 (1,000) 19,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 64% a. Assuming that the desired rate of return is 15%, determine the net present value for the proposal. Use the table of the present value of $1 presented above. If required, round to the nearest dollar. If required, use the minus sign to indicate a negative net present value. Present value of net cash flow Amount to be invested Net present value $ $ 17,824 X 81,200 16,824 X b. Would management be likely to look with favor on the proposal? Yes ' because the net present value indicates that the return on the proposal is greater minimum desired rate of return of 15%. than the Feedback Check My Work Check My Work Previous Next Assignment Score: 69.91% All work saved. Save and Exit Submit Assignment for Grading ? 4:11 PM Tue Mar 19 Done AA v2.cengagenow.com Scotts Ch 24 homework < Net present value method-annuity Jones Excavation Company is planning an investment of $125,000 for a bulldozer. The bulldozer is expected to operate for 1,000 hours per year for 5 years. Customers will be charged $92 per hour for bulldozer work. The bulldozer operator costs $31 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $8,000. The bulldozer uses fuel that is expected to cost $15 per hour of bulldozer operation. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine the equal annual net cash flows from operating the bulldozer. Jones Excavation Company Equal Annual Net Cash Flows Line Item Description Cash inflows: Hours of operation Revenue per hour Revenue per year Cash outflows: Hours of operation Fuel cost per hour Labor cost per hour Total fuel and labor costs per hour Fuel and labor costs per year Maintenance costs per year Annual net cash flows J Check My Work Amount Amount Amount 1,000 $ 92 1,000 $ 15 31 $ 46 92,000 46,000 8,000 $ 38.000 Previous Next 64% Assignment Score: 69.91% All work saved. Save and Exit Submit Assignment for Grading ? 4:12 PM Tue Mar 19 Done AA Scotts Ch 24 homework v2.cengagenow.com a. Determine the equal annual net cash flows from operating the bulldozer. Jones Excavation Company Equal Annual Net Cash Flows Line Item Description Cash inflows: Hours of operation Revenue per hour Revenue per year Cash outflows: Hours of operation Fuel cost per hour Labor cost per hour Total fuel and labor costs per hour Fuel and labor costs per year Maintenance costs per year Annual net cash flows Feedback Amount Amount Amount 1,000 $ 92 1,000 $ 15 31 $ 46 92,000 46,000 8,000 38,000 64% Check My Work a. Subtract the operating expenses (hourly fuel and labor costs, multiplied by the operating hours, plus the annual maintenance costs) from the revenues (operating hours multiplied by the hourly revenue). b. Determine the net present value of the investment, assuming that the desired rate of return is 10%. Use the table of present value of an annuity of $1 table above. Round to the nearest dollar. Present value of annual net cash flows $ Amount to be invested 144,058 125,000 19,058 Net present value C. Should Jones invest in the bulldozer, based on this analysis? ' Yes because the bulldozer cost is less than the present value of the cash flows at the minimum desired rate of return of 10%. d. Determine the number of operating hours such that the present value of cash flows equals the amount to be invested. Round final answer to the nearest whole number. 905 X Check My Work Previous Next Assignment Score: 69.91% All work saved. Save and Exit Submit Assignment for Grading ? 4:12 PM Tue Mar 19 Done AA v2.cengagenow.com Scotts Ch 24 homework 64% Average rate of return method, net present value method, and analysis for a service company The capital investment committee of Iguana Inc. is considering two capital investments. The estimated operating income and net cash flows from each investment are as follows: Robotic Assembler Robotic Assembler Year Operating Income Net Cash Flow Warehouse Operating Income Warehouse Net Cash Flow 1 $50,400 $158,000 $106,000 $253,000 2 50,400 158,000 81,000 213,000 3 50,400 158,000 40,000 150,000 4 50,400 158,000 18,000 103,000 5 50,400 158,000 7,000 71,000 > Total $252,000 $790,000 $252,000 $790,000 Each project requires an investment of $480,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 15% for purposes of the net present value analysis. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Required: 1a. Compute the average rate of return for each investment. If required, round your answer to one decimal place. Robotic Assembler Warehouse Check My Work Average Rate of Return 32.92 X % 32.92 X % Previous Assignment Score: 69.91% All work saved. Save and Exit Submit Assignment for Grading ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started