Answered step by step

Verified Expert Solution

Question

1 Approved Answer

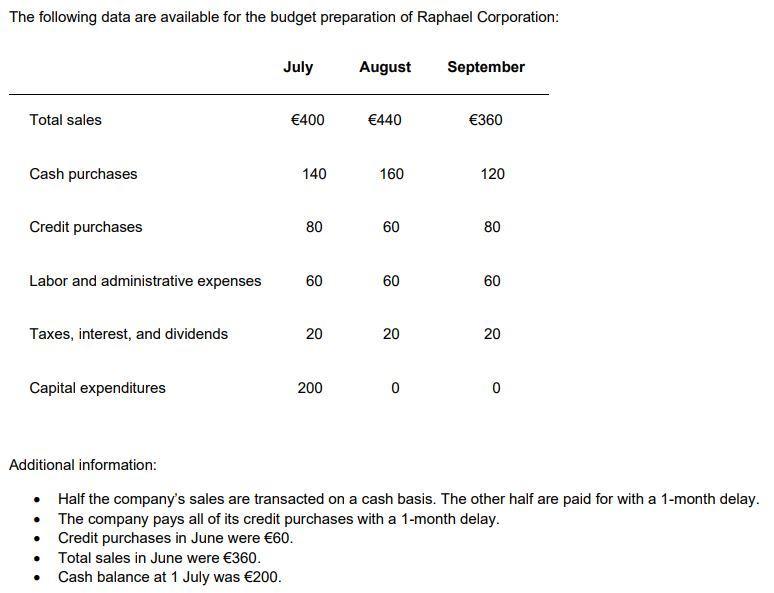

The following data are available for the budget preparation of Raphael Corporation: Total sales July August September 400 440 360 Cash purchases 140 160

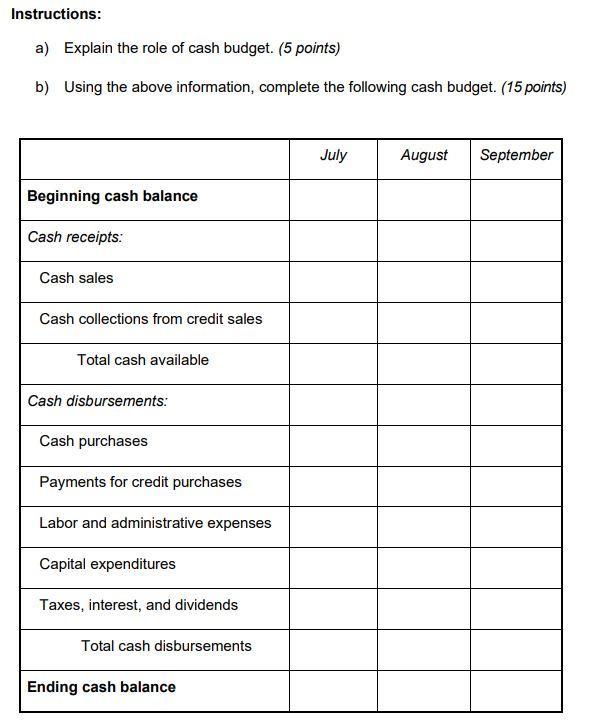

The following data are available for the budget preparation of Raphael Corporation: Total sales July August September 400 440 360 Cash purchases 140 160 120 Credit purchases Labor and administrative expenses Taxes, interest, and dividends Capital expenditures 80 60 60 60 60 00 80 60 60 60 60 20 20 20 20 20 20 200 0 0 Additional information: Half the company's sales are transacted on a cash basis. The other half are paid for with a 1-month delay. The company pays all of its credit purchases with a 1-month delay. Credit purchases in June were 60. Total sales in June were 360. . Cash balance at 1 July was 200. Instructions: a) Explain the role of cash budget. (5 points) b) Using the above information, complete the following cash budget. (15 points) July August September Beginning cash balance Cash receipts: Cash sales Cash collections from credit sales Total cash available Cash disbursements: Cash purchases Payments for credit purchases Labor and administrative expenses Capital expenditures Taxes, interest, and dividends Total cash disbursements Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The cash budget is an important financial tool used by businesses to forecast and manage their cash flows over a specific period usually on a monthl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started