Question

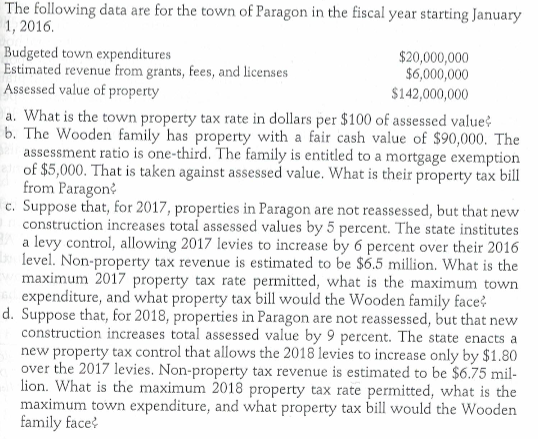

The following data are for the town of Paragon in the fiscal year starting January 1, 2016. Budgeted town expenditures $20,000,000 Estimated revenue from grants,

The following data are for the town of Paragon in the fiscal year starting January 1, 2016.

Budgeted town expenditures $20,000,000

Estimated revenue from grants, fees and licenses $6,000,000

Assessed value of property $142,000,000

a. what is the town property tax rate in dollars per $100 of assessed value?

b. the wooden family has property with a fair cash value of $90,000. The assessment ratio is one-third. The family entitled to a mortgage exemption of $5,000. That is taken against assessed value. What is their property tax bill from Paragon?

c. suppose that, for 2017, properties in paragon are not reassessed, but that new construction increases total assessed values by 5 percent. the state institutes a levy control, allowing 2017 levies to increase by 6 percent over their 2016 level. non-property tax revenue is estimated to be $6.5 million.

1)what is the maximum 2017 property tax rate permitted

2) what is the maximum town expenditure

3)what property tax bill would the wooden family face?

d. suppose that, for 2018, properties in paragon are not reassed, but that new construction increases total assessed value by 9 percent. the state enacts a new property tax control that allows the 2018 levies to increase only by $1.80 over the 2017 levies. non-property tax revenue is estimated to be $6.75 million.

1)What is the maximum 2018 property tax rate permitted.

2)what is the maximum town expenditure

3)what property tax bill would the wooden family face?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started