Answered step by step

Verified Expert Solution

Question

1 Approved Answer

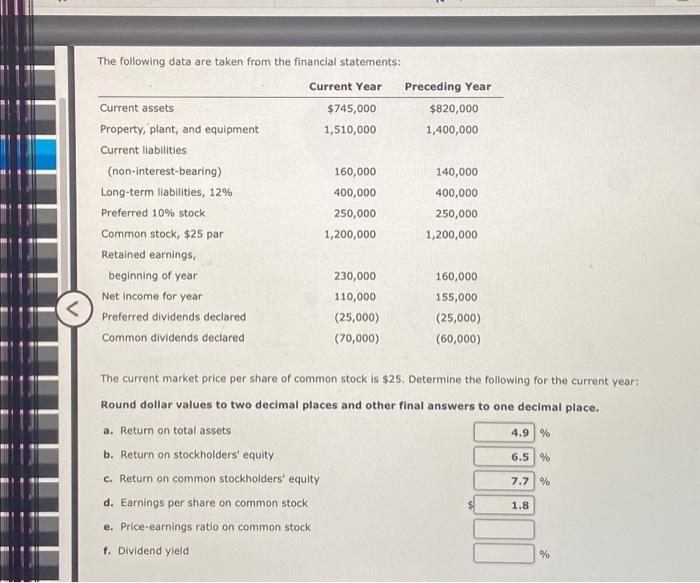

The following data are taken from the financial statements: Current assets Property, plant, and equipment Current liabilities (non-interest-bearing) Long-term liabilities, 12% Preferred 10% stock Common

The following data are taken from the financial statements: Current assets Property, plant, and equipment Current liabilities (non-interest-bearing) Long-term liabilities, 12% Preferred 10% stock Common stock, $25 par Retained earnings, beginning of year Net income for year Preferred dividends declared Common dividends declared Current Year a. Return on total assets $745,000 1,510,000 b. Return on stockholders' equity c. Return on common stockholders' equity d. Earnings per share on common stock e. Price-earnings ratio on common stock f. Dividend yield 160,000 400,000 250,000 1,200,000 230,000 110,000 (25,000) (70,000) Preceding Year $820,000 1,400,000 140,000 400,000 250,000 1,200,000 The current market price per share of common stock is $25. Determine the following for the current year: Round dollar values to two decimal places and other final answers to one decimal place. 160,000 155,000 (25,000) (60,000) 4.9 % 6.5 % 7.7 % 1.8 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started