Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company releases its latest quarterly earnings report. The report details extremely negative developments for the firm that will adversely impacts its cash flows

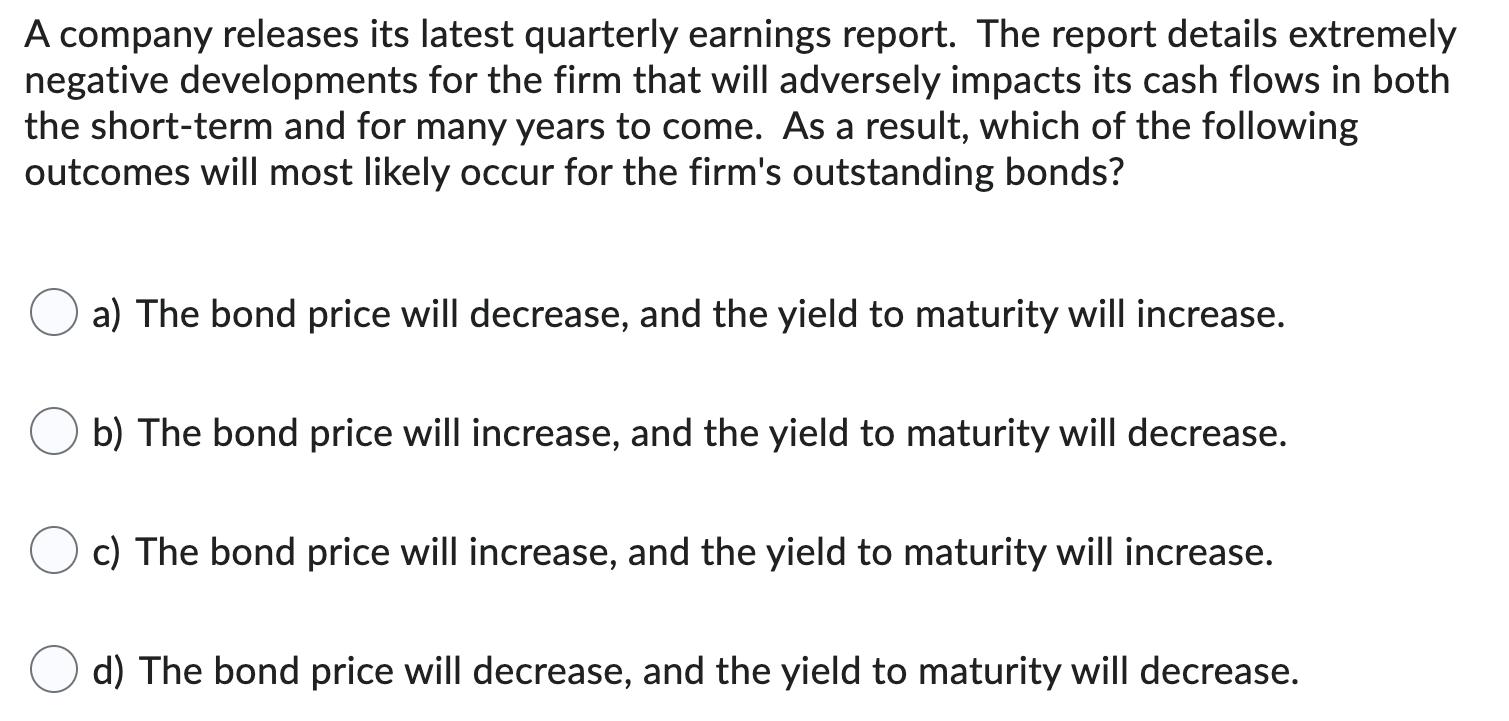

A company releases its latest quarterly earnings report. The report details extremely negative developments for the firm that will adversely impacts its cash flows in both the short-term and for many years to come. As a result, which of the following outcomes will most likely occur for the firm's outstanding bonds? a) The bond price will decrease, and the yield to maturity will increase. b) The bond price will increase, and the yield to maturity will decrease. c) The bond price will increase, and the yield to maturity will increase. d) The bond price will decrease, and the yield to maturity will decrease.

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer b the bond price will increase and the yield to maturity will decrease While exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started