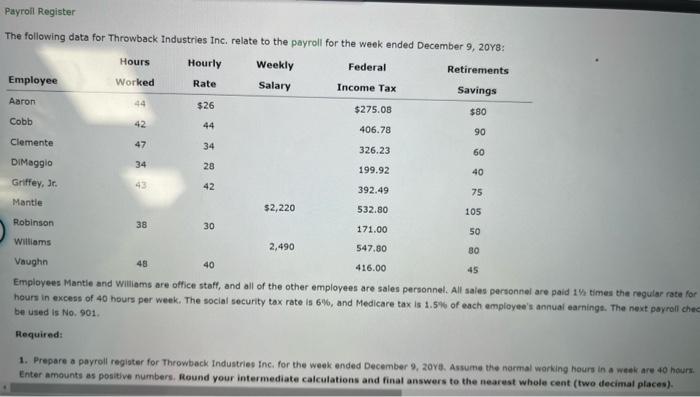

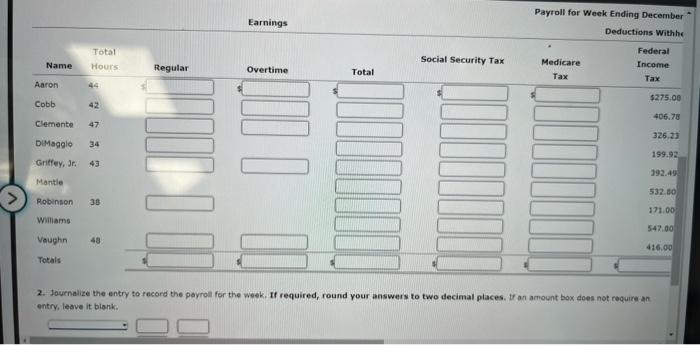

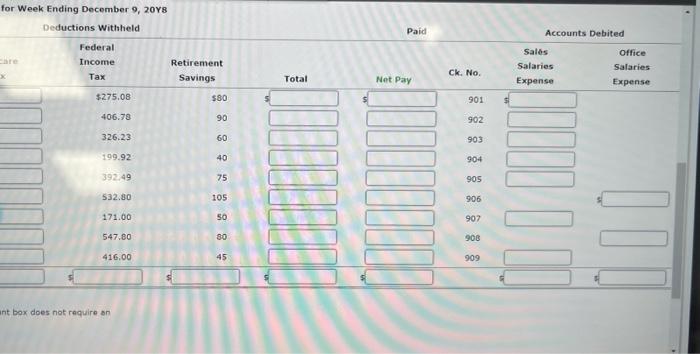

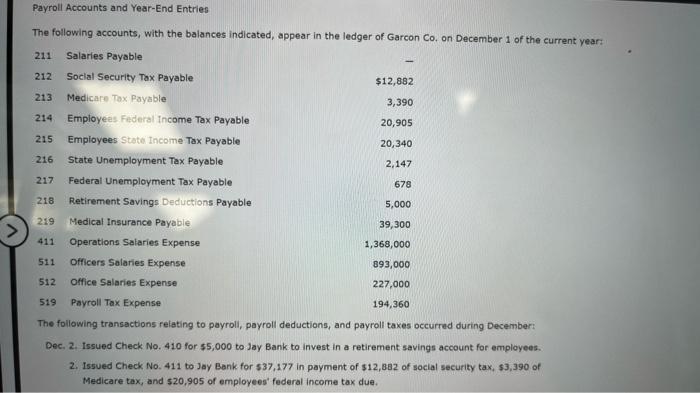

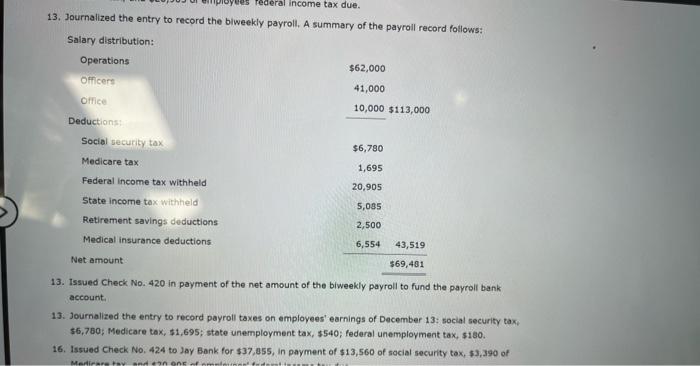

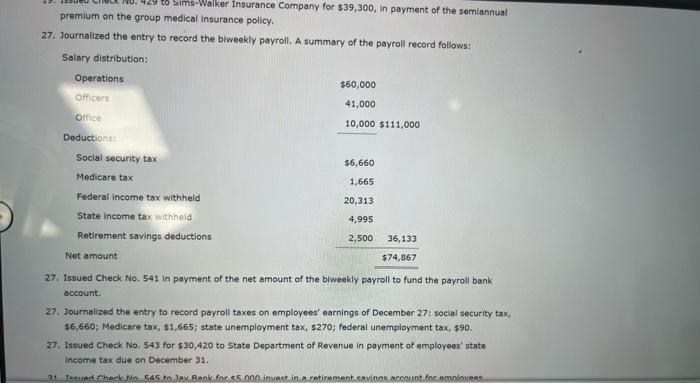

The following data for Throwback Industries Inc, relate to the payroll for the week ended December 9, 20Y8: Employees Mantie and Wiliams are office staff, and all of the other employees are sales personnel. All saies personnel are paid 1 be times the regular rate for hours in excess of 40 hours per week. The social security tax rate is 6%, and Medicare tax is 1.5% of each employee's annual earnings. The next payrell chen be used is No, 901 . Required: 1. Prepare a payroll regioter for Throwback Industries Inc. for the week ended December 9, zoya. Assume the normal working hours in a waek are 40 hours. Enter amounts as positive numbers. Round your intermediate calculations and final answers to the nearest whole cent (two decimal places). Payroll for Week Ending December * 2. Journalize the entry to fecord the payroll for the week, If required, round your answers to two decimal places. If an amount box does not require an entry, leave it blenk. for Week Ending December 9,20Y8 int box does not require on Payroll Accounts and Year-End Entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co, on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2. Issued Check No. 410 for $5,000 to Jay Bank to invest in a retirement savings account for employees. 2. Issued Check No. 411 to Jay Bank for $37,177 in payment of $12,882 of social security tax, $3,390 of Medicare tax, and $20,905 of employees' federal income tax due. 13. Journalized the entry to record the blweekly payroll. A summary of the payroll record follows: Salary distribution: 13. Issued Check No. 420 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 13. Journalized the entry to record payroll taxes on employees' earnings of December 13: social security tax, \$6,780; Medicare tax, $1,695; state unemployment tax, $540; federal unemployment tax, $180. 16. Issued Check No, 424 to Jay Bank for $37,855, in payment of $13,560 of social security tox, $3,390 of premlum on the group medical insurance policy. 27. Joumalized the entry to record the bheekly payroll. A summary of the payroll record foliows: 27. Lssued check No. 541 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 27. Joumalized the entry to record payroll taxes on employees' earnings of December 27: social security tax, $6,660; Medicare tax, \$1,665; state unemployment tax, $270; federal unemployment tax, $90. 27. Issued Check No, 543 for $30,420 to 5 tate Department of Revenue in payment of employees' state income tax due on December 31 . The following data for Throwback Industries Inc, relate to the payroll for the week ended December 9, 20Y8: Employees Mantie and Wiliams are office staff, and all of the other employees are sales personnel. All saies personnel are paid 1 be times the regular rate for hours in excess of 40 hours per week. The social security tax rate is 6%, and Medicare tax is 1.5% of each employee's annual earnings. The next payrell chen be used is No, 901 . Required: 1. Prepare a payroll regioter for Throwback Industries Inc. for the week ended December 9, zoya. Assume the normal working hours in a waek are 40 hours. Enter amounts as positive numbers. Round your intermediate calculations and final answers to the nearest whole cent (two decimal places). Payroll for Week Ending December * 2. Journalize the entry to fecord the payroll for the week, If required, round your answers to two decimal places. If an amount box does not require an entry, leave it blenk. for Week Ending December 9,20Y8 int box does not require on Payroll Accounts and Year-End Entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co, on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2. Issued Check No. 410 for $5,000 to Jay Bank to invest in a retirement savings account for employees. 2. Issued Check No. 411 to Jay Bank for $37,177 in payment of $12,882 of social security tax, $3,390 of Medicare tax, and $20,905 of employees' federal income tax due. 13. Journalized the entry to record the blweekly payroll. A summary of the payroll record follows: Salary distribution: 13. Issued Check No. 420 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 13. Journalized the entry to record payroll taxes on employees' earnings of December 13: social security tax, \$6,780; Medicare tax, $1,695; state unemployment tax, $540; federal unemployment tax, $180. 16. Issued Check No, 424 to Jay Bank for $37,855, in payment of $13,560 of social security tox, $3,390 of premlum on the group medical insurance policy. 27. Joumalized the entry to record the bheekly payroll. A summary of the payroll record foliows: 27. Lssued check No. 541 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 27. Joumalized the entry to record payroll taxes on employees' earnings of December 27: social security tax, $6,660; Medicare tax, \$1,665; state unemployment tax, $270; federal unemployment tax, $90. 27. Issued Check No, 543 for $30,420 to 5 tate Department of Revenue in payment of employees' state income tax due on December 31