Question

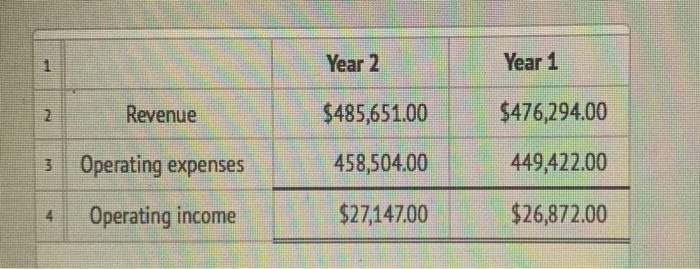

The following data (in millions) are taken from the financial statements of Walmart Stores, Inc.: 1 Year 2 Year 1 2 Revenue $485,651.00 $476,294.00 3

The following data (in millions) are taken from the financial statements of Walmart Stores, Inc.:

| 1 |

| Year 2 | Year 1 |

| 2 | Revenue | $485,651.00 | $476,294.00 |

| 3 | Operating expenses | 458,504.00 | 449,422.00 |

| 4 | Operating income | $27,147.00 | $26,872.00 |

| a. | For Walmart, determine the amount of change in millions and the percent of change from Year 1 to Year 2 for: Rounded to one decimal place. For those boxes in which you must enter subtractive or negative numbers use a minus sign. |

| 1. Revenue | |

| 2. Operating expenses | |

| 3. Operating income | |

| b. | Comment on the results of your horizontal analysis in requirement (A). |

| c. | Compare and comment on the two-year change in operating results between Target and Walmart. |

a. For Target, determine the amount of change in millions and the percent of change from Year 1 to Year 2. Rounded to one decimal place. For those boxes in which you must enter subtractive or negative numbers use a minus sign.

| Amount of Change in Millions | Percent of Change | ||

| 1. | Revenue | $ | % |

| 2. | Operating expenses | $ | % |

| 3. | Operating income | $ | % |

b. What conclusions can you draw from your analysis of the revenue and total operating expenses?

The revenues and the operating expenses increased between the two years and the operating income also increased.

The revenues and the operating expenses decreased between the two years and the operating income also decreased.

The revenues decreased and the operating expenses increased between the two years and the operating income decreased.

The revenues increased and the operating expenses decreased between the two years and the operating income increased.

c. When the revenues grow faster than the operating expenses:

There is an increase in the operating income.

There is a decrease in dividends.

There is a decrease in the operating income.

There is an increase in the current liabilities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started