Answered step by step

Verified Expert Solution

Question

1 Approved Answer

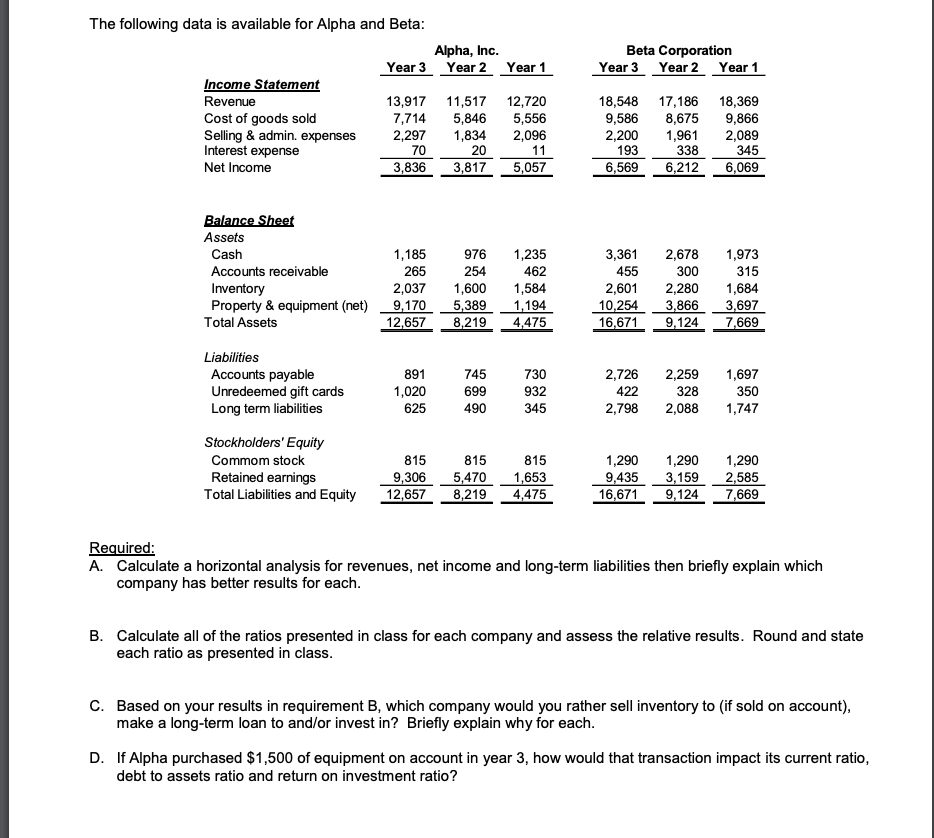

The following data is available for Alpha and Beta: Alpha, Inc. Year 3 Year 2 Year 1 Beta Corporation Year 3 Year 2 Year

The following data is available for Alpha and Beta: Alpha, Inc. Year 3 Year 2 Year 1 Beta Corporation Year 3 Year 2 Year 1 Income Statement Revenue 13,917 11,517 12,720 18,548 17,186 18,369 Cost of goods sold 7,714 5,846 5,556 9,586 8,675 9,866 Selling & admin. expenses 2,297 1,834 2,096 2,200 1,961 2,089 Interest expense 70 20 11 193 338 345 Net Income 3,836 3,817 5,057 6,569 6,212 6,069 Balance Sheet Assets Cash 1,185 976 1,235 3,361 2,678 1,973 Accounts receivable 265 254 462 455 300 315 Inventory 2,037 1,600 1,584 2,601 2,280 1,684 Property & equipment (net) 9,170 5,389 1,194 10,254 3,866 3,697 Total Assets 12,657 8,219 4,475 16,671 9,124 7,669 Liabilities Accounts payable 891 745 730 2,726 2,259 1,697 Unredeemed gift cards 1,020 699 932 422 328 350 Long term liabilities 625 490 345 2,798 2,088 1,747 Stockholders' Equity Commom stock 815 815 815 1,290 1,290 1,290 Retained earnings Total Liabilities and Equity 9,306 12,657 5,470 1,653 8,219 4,475 9,435 3,159 2,585 16,671 9,124 7,669 Required: A. Calculate a horizontal analysis for revenues, net income and long-term liabilities then briefly explain which company has better results for each. B. Calculate all of the ratios presented in class for each company and assess the relative results. Round and state each ratio as presented in class. C. Based on your results in requirement B, which company would you rather sell inventory to (if sold on account), make a long-term loan to and/or invest in? Briefly explain why for each. D. If Alpha purchased $1,500 of equipment on account in year 3, how would that transaction impact its current ratio, debt to assets ratio and return on investment ratio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started