Answered step by step

Verified Expert Solution

Question

1 Approved Answer

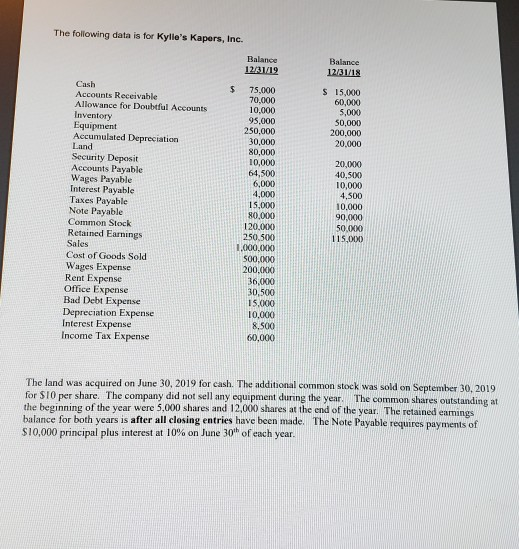

The following data is for Kylie's Kapers, Inc. Balance 1281/19 Balance 12/31/18 $ $ 15,000 60,000 5,000 50.000 200.000 20.000 Cash Accounts Receivable Allowance for

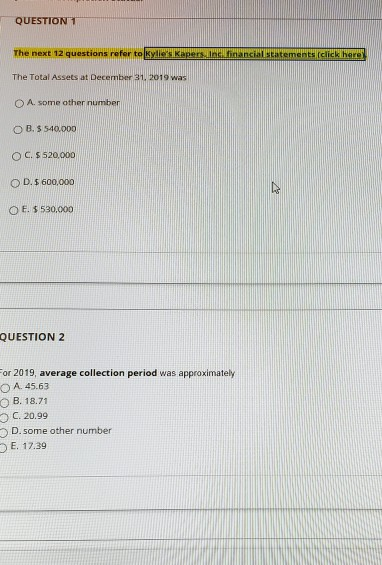

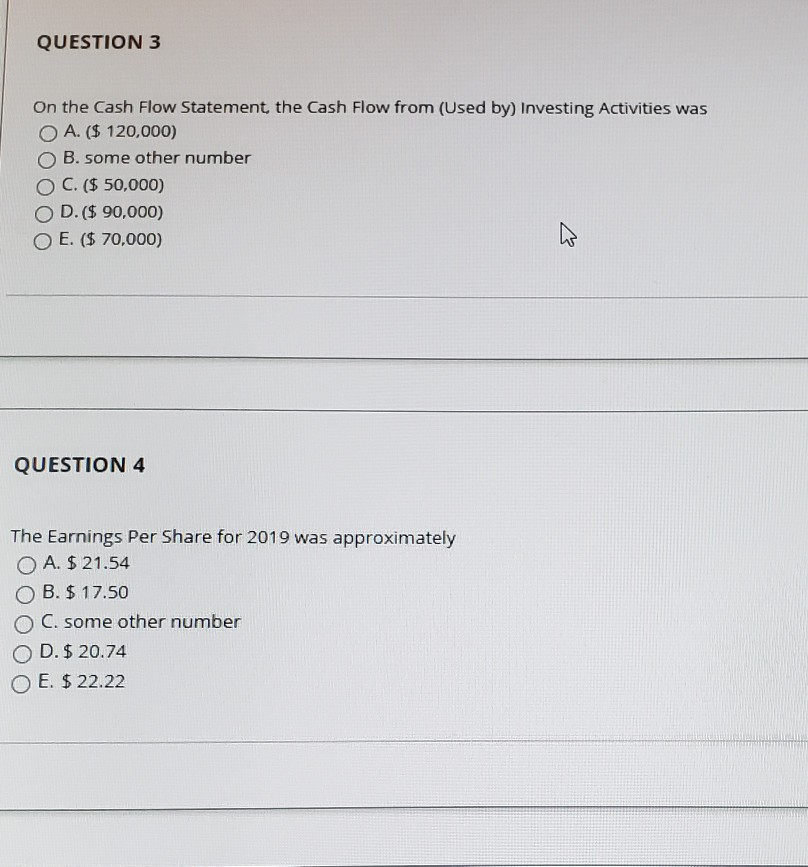

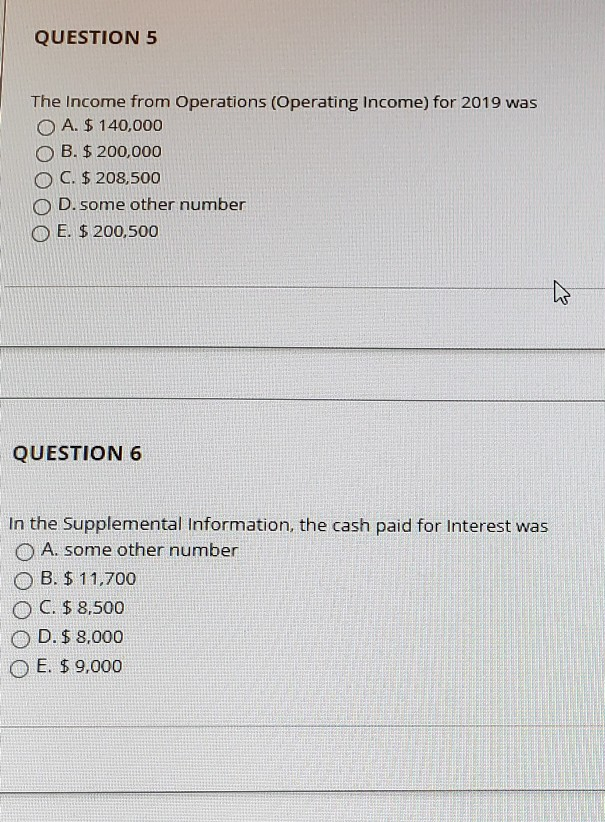

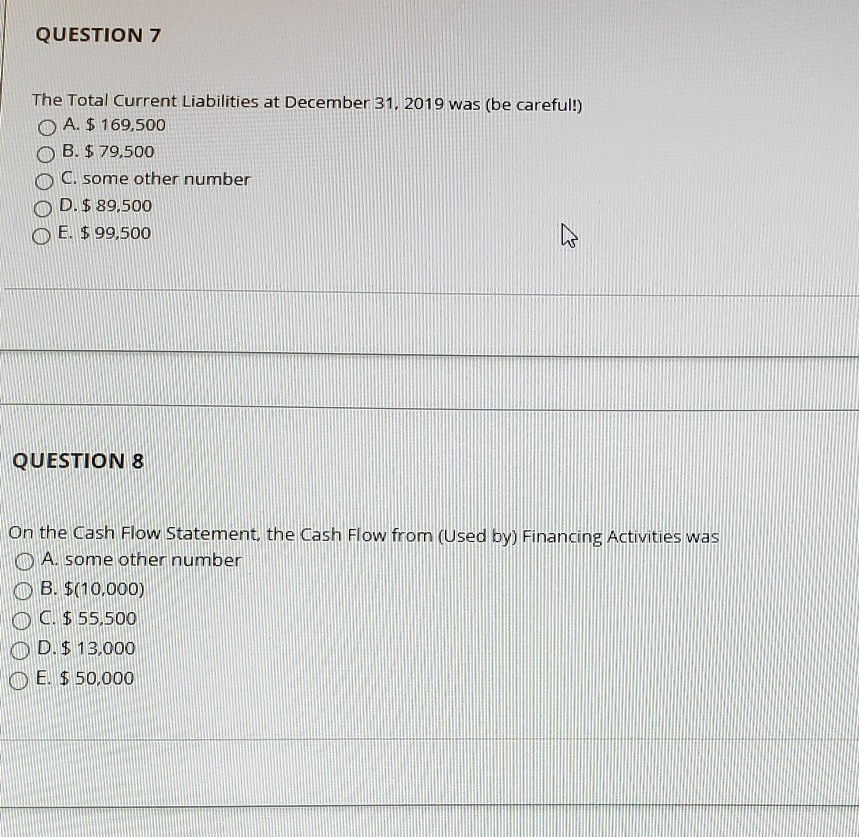

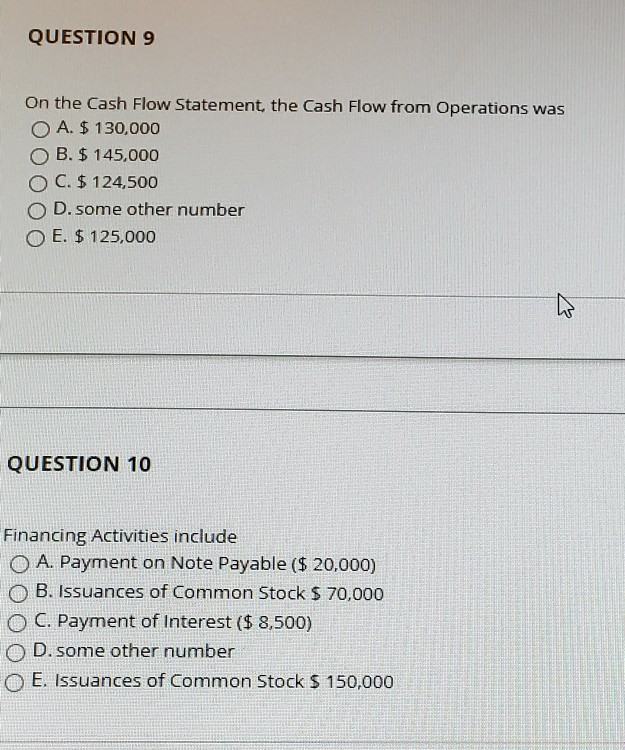

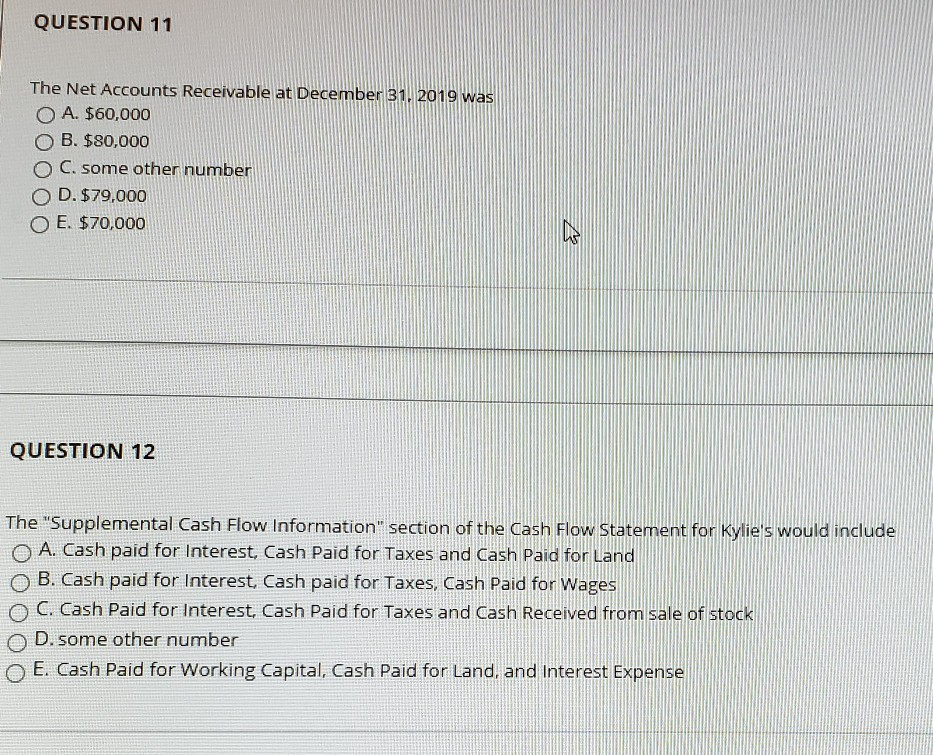

The following data is for Kylie's Kapers, Inc. Balance 1281/19 Balance 12/31/18 $ $ 15,000 60,000 5,000 50.000 200.000 20.000 Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Equipment Accumulated Depreciation Land Security Deposit Accounts Payable Wages Payable Interest Payable Taxes Payable Note Payable Common Stock Retained Earnings Sales Cost of Goods Sold Wages Expense Rent Expense Office Expense Bad Debt Expense Depreciation Expense Interest Expense Income Tax Expense 75,000 70,000 10,000 95.000 250.000 30.000 80,000 10,000 64,500 6,000 4,000 15,000 80,000 120.000 250.500 1.000.XK) 500.X 200.000 36.000 30,500 15.000 10.000 8.500 60,000 20,0XXO 40,500 10,000 4,500 10.000 90,000 50.000 115.000 The land was acquired on June 30, 2019 for cash. The additional common stock was sold on September 30, 2019 for $10 per share. The company did not sell any equipment during the year. The common shares outstanding at the beginning of the year were 5,000 shares and 12,000 shares at the end of the year. The retained earnings balance for both years is after all closing entries have been made. The Note Payable requires payments of $10,000 principal plus interest at 10% on June 30th of each year. QUESTION 1 The next 12 questions refer to Kepercanciascatements click here The Total Assets at December 31, 2019 was A. some other number OB. 540.000 OC. $520.000 D. $ 600,000 O E. $530,000 QUESTION 2 For 2019, average collection period was approximately OA. 45.63 B. 18.71 C. 20.99 D. some other number E. 17.39 QUESTION 3 On the Cash Flow Statement the Cash Flow from (Used by) Investing Activities was O A. ($ 120,000) B. some other number C. ($ 50,000) O D.($ 90,000) E. ($ 70,000) QUESTION 4 The Earnings Per Share for 2019 was approximately O A. $21.54 B. $ 17.50 C. some other number D. $ 20.74 O E. $ 22.22 QUESTION 5 The Income from Operations (Operating Income) for 2019 was O A. $ 140,000 B. $ 200,000 O C. $ 208,500 OD. some other number O E. $ 200,500 QUESTION 6 In the Supplemental Information, the cash paid for Interest was O A. some other number B. $ 11,700 O C. $ 8,500 OD. $ 8,000 O E. $9,000 QUESTION 7 The Total Current Liabilities at December 31, 2019 was (be careful!) O A. $ 169,500 B. $ 79,500 O C. some other number D. $ 89.500 O E. $ 99,500 2 QUESTION 8 On the Cash Flow Statement, the Cash Flow from (Used by) Financing Activities was O A. some other number O B. $(10,000) O C. $ 55,500 OD. $ 13,000 O E. $ 50,000 QUESTION 9 On the Cash Flow Statement, the Cash Flow from Operations was O A. $ 130,000 B. $ 145,000 C. $ 124,500 OD. some other number E. $ 125,000 QUESTION 10 Financing Activities include O A. Payment on Note Payable ($ 20,000) O B. Issuances of Common Stock $ 70,000 O C. Payment of Interest ($ 8,500) O D. some other number O E. Issuances of Common Stock $ 150,000 QUESTION 11 The Net Accounts Receivable at December 31. 2019 was O A. $60,000 OB. $80,000 C. some other number O D. $79.000 O E. $70,000 QUESTION 12 The "Supplemental Cash Flow Information" section of the Cash Flow Statement for Kylie's would include O A. Cash paid for Interest, Cash Paid for Taxes and Cash Paid for Land B. Cash paid for Interest, Cash paid for Taxes, Cash Paid for Wages O C. Cash Paid for Interest, Cash Paid for Taxes and Cash Received from sale of stock OD. some other number O E. Cash Paid for Working Capital, Cash Paid for Land, and Interest Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started